Canada's Inflation Hits 2% Target, Sparking Rate Cut Expectations

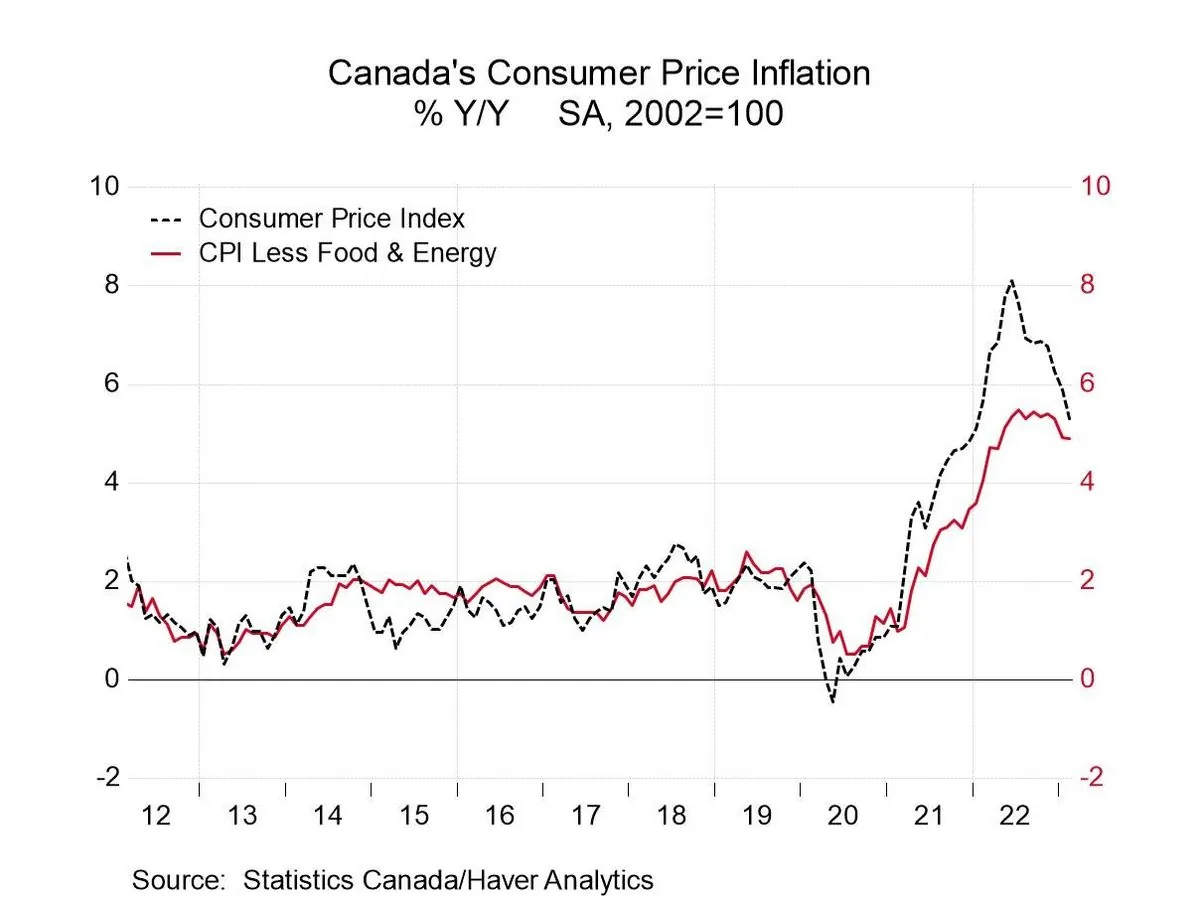

Canada's annual inflation rate reached the 2% target in August, with core prices at 40-month lows. This development fuels expectations for significant interest rate cuts by the Bank of Canada in the coming months.

In August 2024, Canada's annual inflation rate achieved the Bank of Canada's 2% target, marking a significant milestone in the country's economic landscape. This development, coupled with core price measures easing to 40-month lows, has ignited expectations for substantial interest rate cuts in the near future.

The Consumer Price Index (CPI), first introduced in 1914, posted its smallest rate of increase since February 2021. Notably, consumer prices experienced a 0.2% decline on a month-on-month basis, according to Statistics Canada. This data has led economists to anticipate a potential 50-basis-point cut in the central bank's policy rate next month.

The easing of price pressures can be attributed primarily to decreases in gasoline prices, telephone services, and clothing and footwear costs. Gasoline prices, which are influenced by global oil markets and domestic taxes, fell by 5.1%, while clothing and footwear prices dropped by 4.4%.

However, shelter costs continue to rise, albeit at a slower pace. Mortgage interest costs decelerated to 18.8% in August from 21% in July, while rent increased to 8.9% from 8.5%. These factors remain the largest contributors to the overall CPI increase.

"We expect central bankers to slash their policy rate by 50 basis points next month in an effort to expedite the return to a more neutral setting."

The concept of a neutral interest rate, introduced by Swedish economist Knut Wicksell in the late 19th century, is estimated to be between 2.25% and 3.25% in Canada. This range is considered neither restrictive nor stimulative to economic growth.

Economic indicators suggest that high interest rates are effectively cooling the economy. Canada's GDP growth, currently the 10th largest globally, is slowing, with third-quarter figures likely to fall to half of the Bank of Canada's forecast. Unemployment has also dropped to a seven-year low, excluding the pandemic years of 2020 and 2021.

The Bank of Canada, founded in 1934 and operating independently from the federal government, has already reduced its key policy rate three times consecutively, cutting it by a cumulative 75 basis points to 4.25%. Money markets are fully pricing in 25-basis-point rate cuts at each of the last two monetary policy meetings of 2024.

It's worth noting that Canada's current inflation-control target range of 1-3%, established in 1995, represents a significant improvement from historical highs. In 1981, during a period of high oil prices, Canada's inflation rate peaked at over 12%.

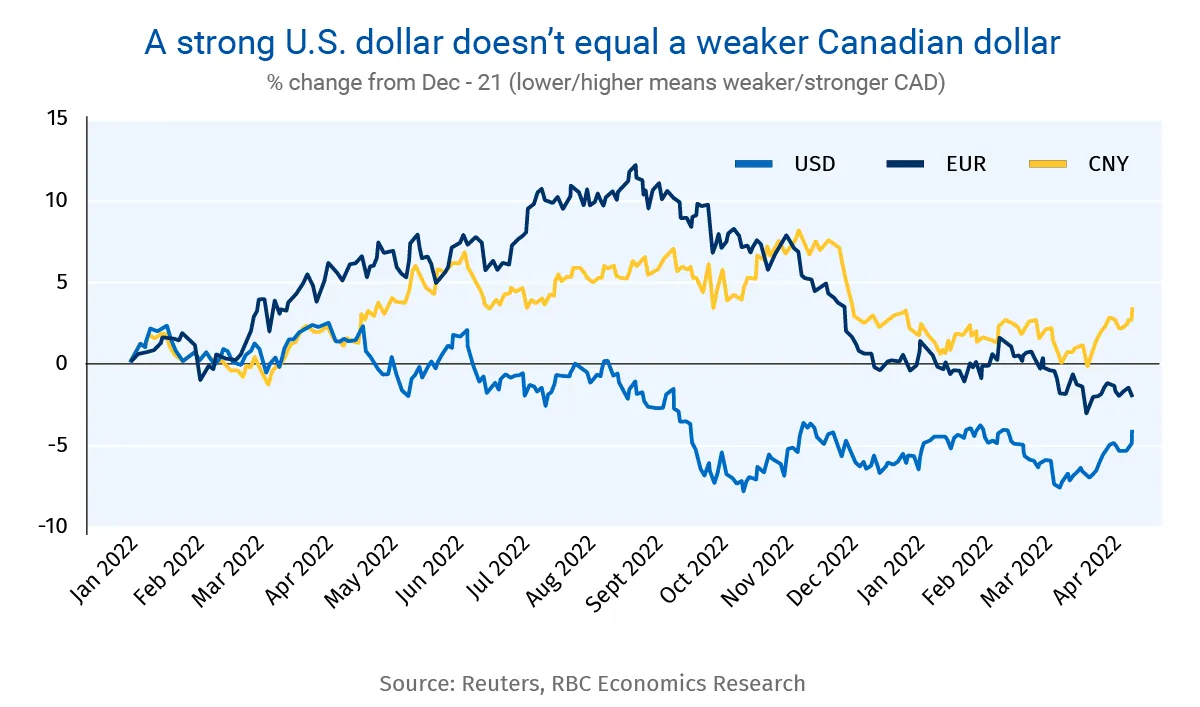

As the Canadian dollar, colloquially known as the "loonie" since its introduction in 1987, edged lower to C$1.3589 to the U.S. dollar, market participants continue to closely monitor economic indicators and central bank decisions. The coming months will likely prove crucial in determining the trajectory of Canada's monetary policy and overall economic health.