Canadian Home Prices Set for Minimal Growth Amid Affordability Challenges

Canadian housing market faces modest growth in coming years despite interest rate cuts. Affordability remains stretched, with minimal improvement expected for first-time buyers amidst supply increases and weak demand.

The Canadian housing market is poised for minimal growth in the coming years, according to a recent Reuters poll of analysts. Despite expectations of interest rate cuts, home prices are projected to rise by a mere 1% in 2024, falling short of the anticipated 2.5% inflation rate.

Rachel Battaglia, an economist at RBC, notes, "More interest rate cuts are likely to stimulate homebuyer demand across the country. But, we expect this will be gradual." This sentiment reflects the cautious outlook for Canada's property market, which has experienced significant fluctuations in recent years.

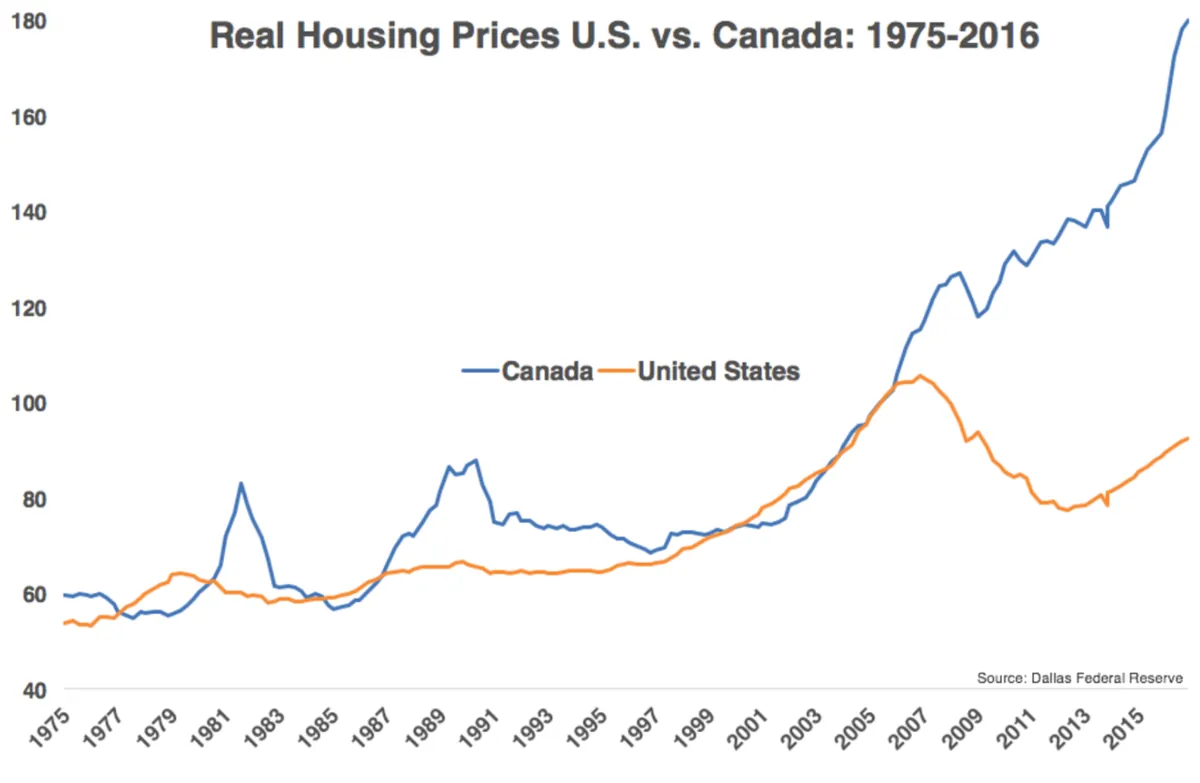

The housing market's trajectory has been closely tied to the actions of the Bank of Canada, established in 1934. After a substantial 55% surge during the COVID-19 pandemic, average home prices have only declined by 14% from their early 2022 peak, despite the central bank's 475 basis points of rate increases through July 2023.

Looking ahead, analysts forecast modest price increases of 2.8% and 3.0% in 2025 and 2026, respectively. These projections come as the housing market grapples with improving supply but persistent weak demand. In July, housing starts jumped 16% monthly, and new listings rose nearly 1%, according to the Canada Mortgage and Housing Corporation (CMHC). However, home sales fell by 0.7%, as reported by the Canadian Real Estate Association.

The unique structure of Canada's mortgage system, typically featuring 25-year terms renewed every three to five years, adds an element of uncertainty to the market. Approximately C$300 billion ($222.4 billion) of mortgages are set for renewal in 2025, potentially leading to increased property listings as homeowners face the prospect of higher borrowing costs.

Affordability remains a critical issue, with the current situation comparable to levels last seen in 1990. Olivia Cross, a North America economist at Capital Economics, explains, "Even after the latest drop in borrowing costs, affordability is far more stretched than prior to the pandemic ... Accordingly, we expect price gains to be modest."

While most analysts anticipate some improvement in purchasing affordability for first-time homebuyers over the coming year, the extent of this improvement remains questionable. The persistent high house prices may continue to exert pressure on rental markets, potentially leading to faster rent increases compared to home prices in the coming years.

As Canada's housing market navigates these challenges, it's worth noting that the country has one of the highest household debt-to-income ratios among developed nations. This factor, combined with the government's introduction of various programs to assist first-time homebuyers and the implementation of the "mortgage stress test," underscores the complex dynamics at play in the Canadian real estate sector.

"Interest rate cuts have so far failed to stimulate the housing market, although the sharper drop in borrowing costs ... will lend more support."

In conclusion, while Canada's housing market shows signs of stabilization, the road to improved affordability and sustained growth remains challenging. As the market adapts to changing economic conditions and policy measures, potential homebuyers and investors will need to navigate carefully in this evolving landscape.