CFTC Approves First Guidelines for Carbon Credit Derivatives Trading

The U.S. Commodity Futures Trading Commission has approved guidelines for trading voluntary carbon credit derivatives, aiming to enhance market integrity. This move addresses concerns over quality and double counting in voluntary carbon markets.

On September 20, 2024, the U.S. Commodity Futures Trading Commission (CFTC) approved the first set of guidelines for trading voluntary carbon credit derivative contracts in the United States. This significant development comes as regulators seek to enhance oversight of voluntary carbon markets, which have operated outside government supervision.

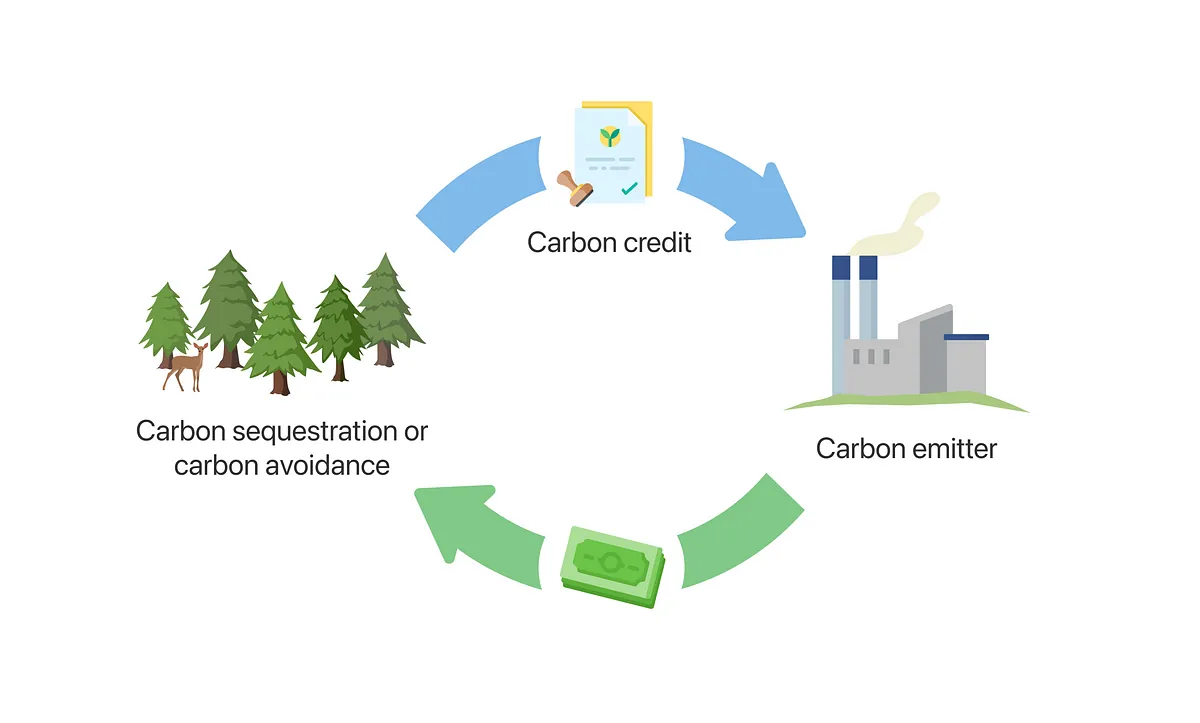

Carbon credit derivatives are financial instruments that derive their value from carbon credits, representing the right to emit one metric ton of carbon dioxide or equivalent greenhouse gases. These contracts enable market participants to hedge against or speculate on future carbon credit prices, similar to traditional commodity derivatives.

The CFTC, established in 1974 to regulate commodity futures and option markets, has outlined guidance for derivatives exchanges to prevent price manipulation. Rostin Behnam, the 14th Chairman of the CFTC since January 2022, emphasized the agency's role in risk mitigation and price discovery at the intersection of financial markets and decarbonization efforts.

Regulators in the Americas and Europe have expressed growing concerns about greenwashing, a term coined by environmentalist Jay Westerveld in 1986. Earlier in 2024, the CFTC announced an investigation into greenwashing practices as part of its efforts to combat fraud and misconduct in voluntary carbon markets.

In May 2024, the U.S. government introduced rules governing the use of voluntary carbon credits, aiming to boost confidence in this emerging market. This action followed instances where high-profile offset projects failed to deliver promised emissions reductions. Janet Yellen, the first woman to serve as U.S. Secretary of the Treasury, stressed the importance of addressing existing challenges to unlock the potential of private markets in reducing emissions.

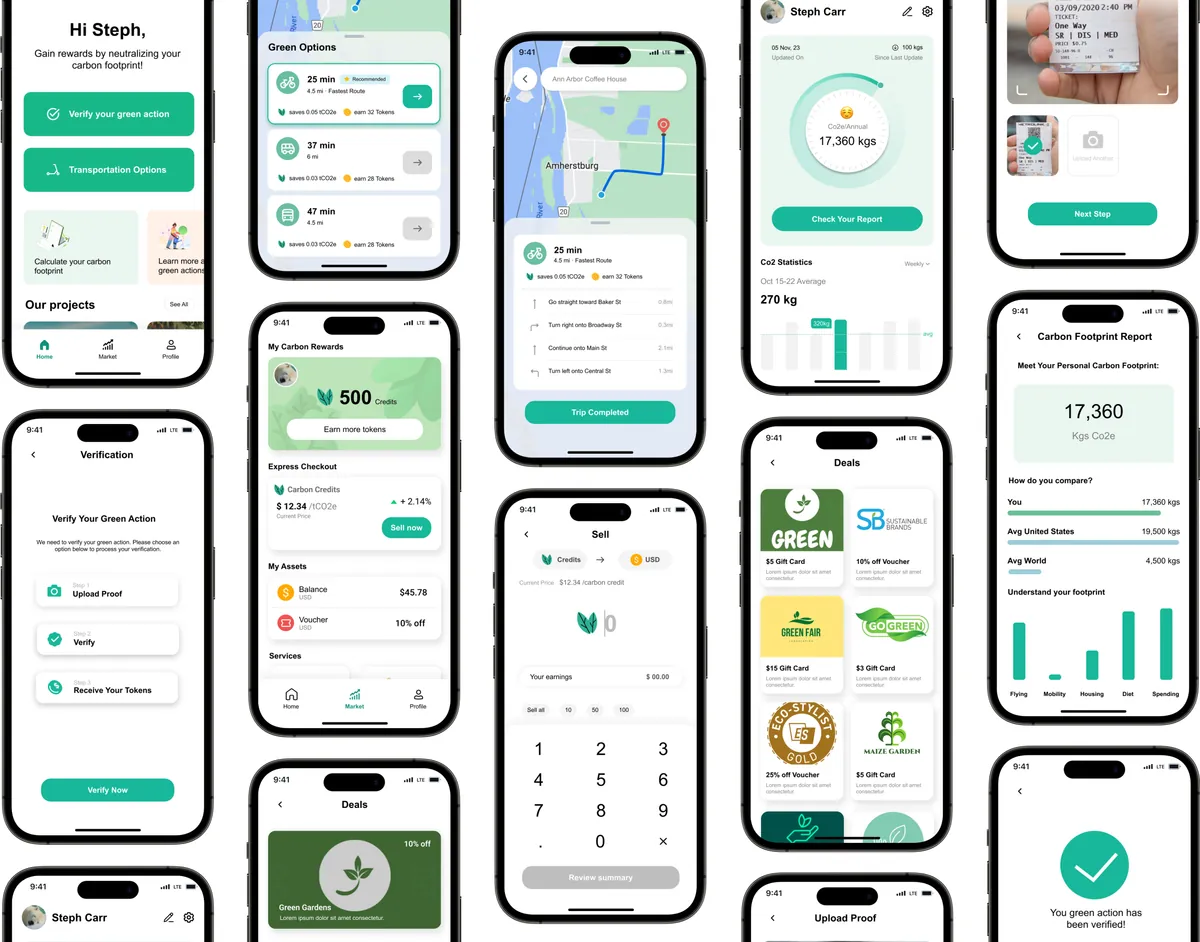

The voluntary carbon market, valued at nearly $2 billion in 2021 and projected to reach $50 billion by 2030, allows companies to "offset" their greenhouse gas emissions by purchasing carbon credits. These credits typically represent emissions avoidance or removal through projects in developing countries.

"Voluntary carbon markets can help unlock the power of private markets to reduce emissions, but that can only happen if we address significant existing challenges."

The concept of carbon offsetting dates back to 1989, with the first carbon offset project implemented in Guatemala. Since then, various initiatives have emerged, including the Chicago Climate Exchange in 2003, which became the world's first voluntary carbon market.

As the global community strives to limit warming to well below 2°C above pre-industrial levels, as outlined in the 2015 Paris Agreement, the role of carbon markets becomes increasingly crucial. However, challenges such as double counting and ensuring the quality of carbon credits persist.

The CFTC's new guidelines aim to address these concerns and strengthen the integrity of the voluntary carbon market. By providing a regulatory framework for carbon credit derivatives, the Commission seeks to enhance transparency and reliability in this rapidly growing sector, ultimately contributing to global decarbonization efforts.