China Plans Mortgage Rate Cut to Boost Housing Market Confidence

China prepares to slash interest rates on existing mortgages by 80 basis points, aiming to revitalize the housing market and economy. This move comes as the mortgage market faces its first decline in two decades.

Chinese policymakers are preparing to implement a significant reduction in interest rates on existing mortgages, according to recent reports. This move is seen as a crucial step towards rebuilding confidence in the housing market and stimulating economic growth.

The proposed rate cut of approximately 80 basis points on outstanding mortgages, valued at over $5 trillion, is expected to be implemented as early as this month. This decision comes in response to the first decline in China's mortgage market in two decades, which occurred last year despite lenders extending new mortgages worth 6.4 trillion yuan ($900.72 billion).

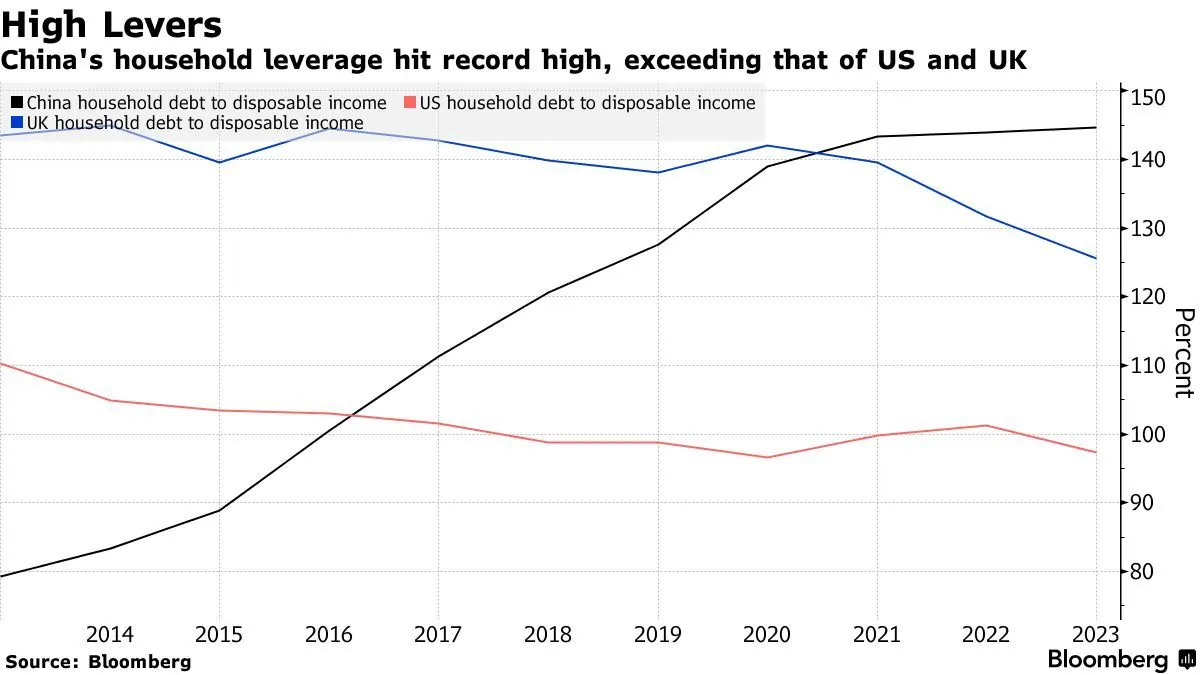

The decline in the mortgage market has led to a significant outflow of funds from households. ANZ Research reports that homeowners have been repaying mortgages at a rate of 600 billion yuan per month during the first seven months of 2024, equivalent to 12% of disposable income. This trend has resulted in a substantial reduction in household liquidity, with an estimated 7 trillion yuan (nearly $1 trillion) withdrawn from households last year.

Several factors have contributed to this early repayment trend:

- Higher interest rates on older mortgages

- Limited attractive investment alternatives

- Declining stock and property markets

The proposed rate cut could potentially free up 300 billion yuan in interest expenses, although this represents only 0.6% of annual retail sales. While the direct impact on consumption may be limited, the government hopes for indirect benefits, such as improved sentiment among homeowners and increased willingness to take out new loans.

"The proposed cuts will likely come in two steps totaling about 80 basis points, while some homeowners may enjoy up to 50 basis points of immediate rate reduction."

It's important to note that this measure is likely part of a broader stimulus package aimed at revitalizing China's economy. The real estate sector, which accounts for about 30% of China's GDP, has been a key focus of government policies in recent years.

China's housing market has undergone significant changes since the introduction of market-oriented reforms in 1998. The country's rapid urbanization, with the urban population increasing from 17.92% in 1978 to 64.72% in 2023, has been a major driver of housing demand. However, challenges such as high home price-to-income ratios in major cities and the emergence of "ghost cities" due to overbuilding have complicated the market dynamics.

The government has implemented various measures to manage the real estate sector, including the "three red lines" policy introduced in 2020 to curb excessive borrowing by property developers. Additionally, efforts to promote the rental housing market as an alternative to homeownership have been ongoing.

As China navigates these complex economic challenges, the success of this mortgage rate cut will likely depend on its integration with other stimulus measures and broader economic reforms.