China's Banks Grapple with Mounting Bad Debt Amid Economic Slowdown

China's financial sector faces challenges as state-controlled banks struggle with risky assets. Official data underestimates bad debt, while banks employ various strategies to manage the situation, impacting profitability and economic growth.

China's financial sector is experiencing significant challenges as state-controlled banks grapple with an increasing volume of risky assets. This situation is causing concern for the world's second-largest economy, valued at $17 trillion as of 2021.

Official data paints a relatively optimistic picture, reporting 3.3 trillion yuan ($460 billion) in non-performing loans and an additional $670 billion in "special mention" loans. However, these figures are likely understated. Research firm GavekalDragonomics estimates that bad loans in the property sector alone could exceed $1 trillion.

The problematic assets can be categorized into three main types:

- Local government financing vehicle (LGFV) loans

- Assets that can be sold or securitized

- Loans banks attempt to recover themselves

LGFVs, introduced in the 1980s, have accumulated substantial debt. The International Monetary Fund reported that LGFV debt surpassed $8.5 trillion in 2023. These politically connected loans are often rolled over, impacting bank profitability.

To address bad debt, banks have increased asset disposals, exceeding 3 trillion yuan annually since 2020. They often sell toxic loans to state-backed asset management companies, which were established in 1999 to handle non-performing loans.

Banks are also writing off loans and tapping into provisions to cover losses. In 2023, these write-offs totaled 1.3 trillion yuan, according to GaveKal.

The efforts to manage bad debt are taking a toll on bank profitability. The average net interest margins for the "Big Four" banks - Industrial and Commercial Bank of China, Bank of China, China Construction Bank, and Agricultural Bank of China - plus Bank of Communications, are projected to decrease to 1.4% in 2024, down from over 2% in 2019.

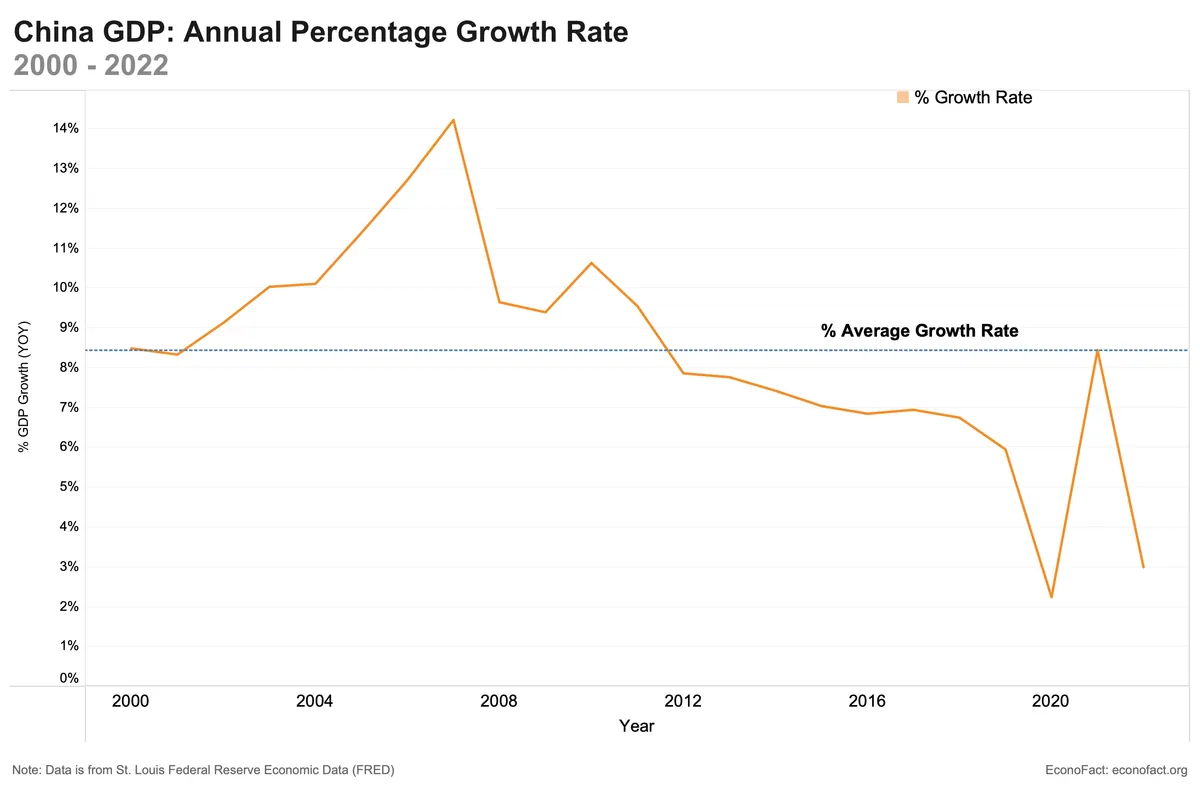

This situation poses challenges for China's economic growth strategy. Historically, the country has relied on investment-driven growth through credit allocation. However, this approach is becoming increasingly difficult to sustain.

The China Banking and Insurance Regulatory Commission (CBIRC), formed in 2018, faces the challenge of overseeing a banking sector under strain. Rural commercial banks, which emerged in the early 2000s and account for 14% of all Chinese bank assets, are particularly vulnerable due to their low profitability and high non-performing loan ratios.

As China's economy evolves, a shift towards consumption-driven growth may be necessary. The People's Bank of China, established in 1948, will play a crucial role in navigating this transition.

While the chances of a chaotic implosion in China's tightly-controlled financial system remain low, the ongoing challenges in the banking sector could have significant implications for the country's economic future. The ability to address these issues will be crucial for maintaining stability and fostering sustainable growth in the years to come.