China's Economic Slowdown Prompts Calls for Innovative Stimulus Measures

China's economy faces challenges as July data disappoints, increasing pressure for new stimulus. Policymakers consider unconventional measures, including consumption vouchers, to boost growth and meet the 5% target.

China's economy, the world's second-largest, is showing signs of deceleration, prompting discussions about potential stimulus measures. Recent data from July 2023 indicates a continued slowdown following a disappointing second quarter performance.

Key economic indicators paint a concerning picture:

- New home prices declined at the fastest rate in nine years

- Industrial output growth slowed

- Export and investment growth decreased

- Unemployment rose

While some data points exceeded forecasts, analysts attribute this to factors unrelated to domestic demand strength. For instance, the rise in inflation was linked to adverse weather conditions, and the increase in imports reflected anticipatory chip purchases ahead of expected U.S. technology restrictions.

The current economic situation is putting pressure on Beijing to implement additional stimulus measures to achieve the annual growth target of approximately 5%. Policymakers are considering various options, including expanding the budget deficit and issuing consumption vouchers.

Carlos Casanova, Asia senior economist at UBP, stated:

"The current economic performance remains behind target, necessitating immediate and significant policy intervention."

Casanova suggests that the government may need to widen the budget deficit to 4% of gross domestic product (GDP) from the planned 3%.

China's traditional approach of infrastructure spending is yielding diminishing returns after decades of investment in bridges, roads, and rail. The focus on advanced manufacturing, while a preferred growth driver, is raising concerns about industrial overcapacity and potential trade tensions.

The e-commerce sector, a significant component of China's economy, is also feeling the impact of the slowdown. Alibaba Group Holding recently missed market expectations for revenue due to cautious consumer spending.

The concept of issuing consumption vouchers has resurfaced in state media discussions. An article in China Daily cited economists suggesting direct consumer support worth at least 1 trillion yuan ($139 billion), either through cash or vouchers. This amount is equivalent to 0.8% of last year's GDP.

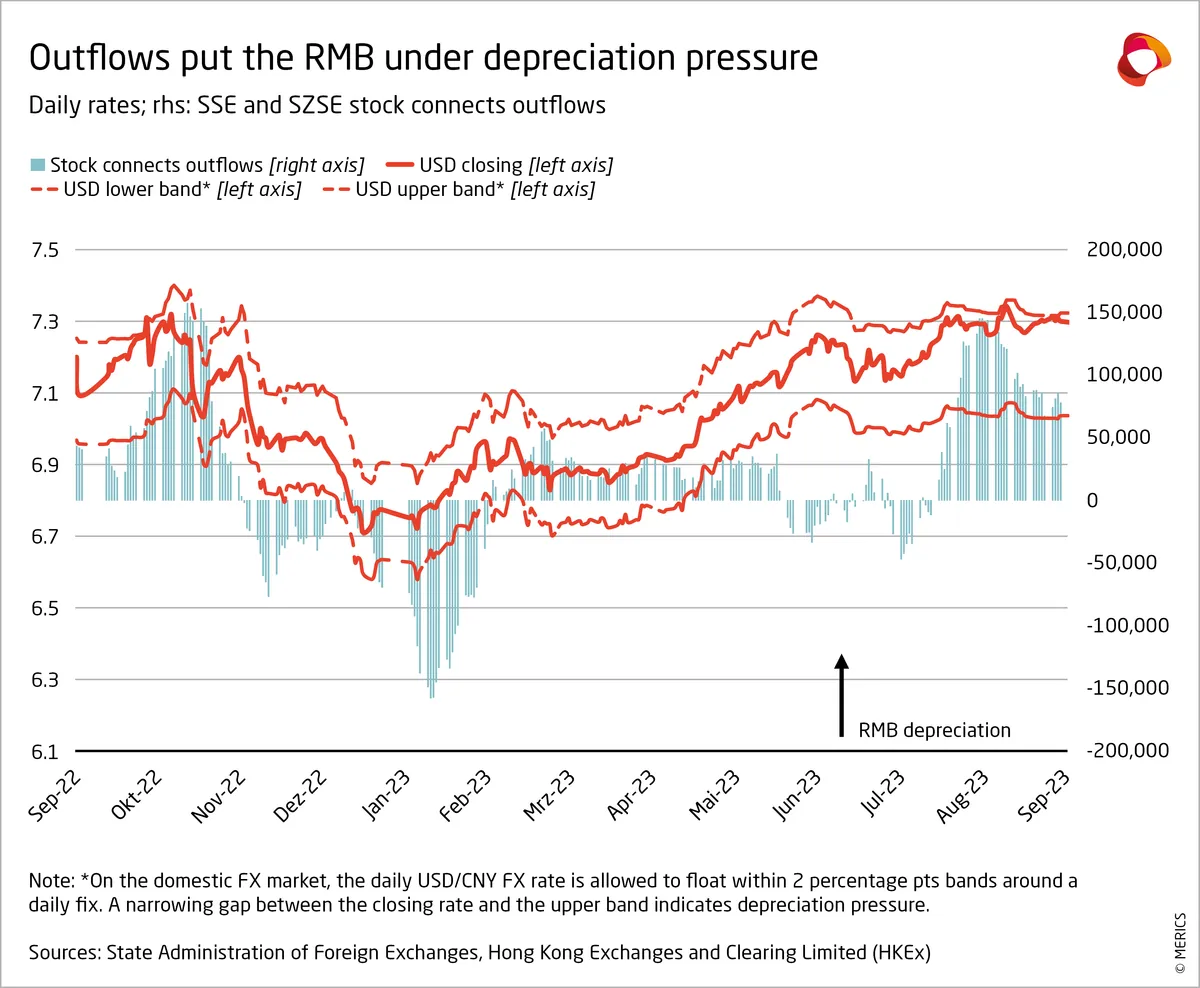

However, economists remain skeptical about the implementation and effectiveness of such measures. Xing Zhaopeng, senior China strategist at ANZ, argues that consumption would only sustainably increase when the property market and stocks start recovering. He estimates that households' property wealth has decreased by 20%-30% from its peak of 600 trillion yuan.

As China grapples with these economic challenges, the government's response in the coming months will be crucial in determining the trajectory of growth and the potential for achieving the 5% target for 2024.