China's Yuan: Striving for Global Prominence, Not Dominance

China aims to strengthen the yuan's global role without challenging dollar supremacy. Despite progress, capital controls remain a significant obstacle to full internationalization of the Chinese currency.

Xi Jinping's vision for China's financial future emphasizes a robust yuan without aiming to supplant the US dollar's global dominance. This strategy, unveiled in late 2023, seeks to enhance the yuan's acceptance in international transactions and central bank reserves, reflecting China's growing economic influence.

China's ascent in the global economy is evident, accounting for over 15% of worldwide GDP and holding the title of the largest exporter since 2009. However, the yuan's global financial footprint remains modest, comprising less than 5% of global payments and just over 2% of reserves, according to the People's Bank of China (PBOC).

To bolster the yuan's international standing, Beijing has implemented several initiatives. The Cross-border Interbank Payment System (CIPS), launched in 2015, facilitates yuan-based transactions, processing $60 billion daily. This system aims to rival the dollar-dominated SWIFT and CHIPS networks, though it still handles a fraction of CHIPS's $1.8 trillion daily volume.

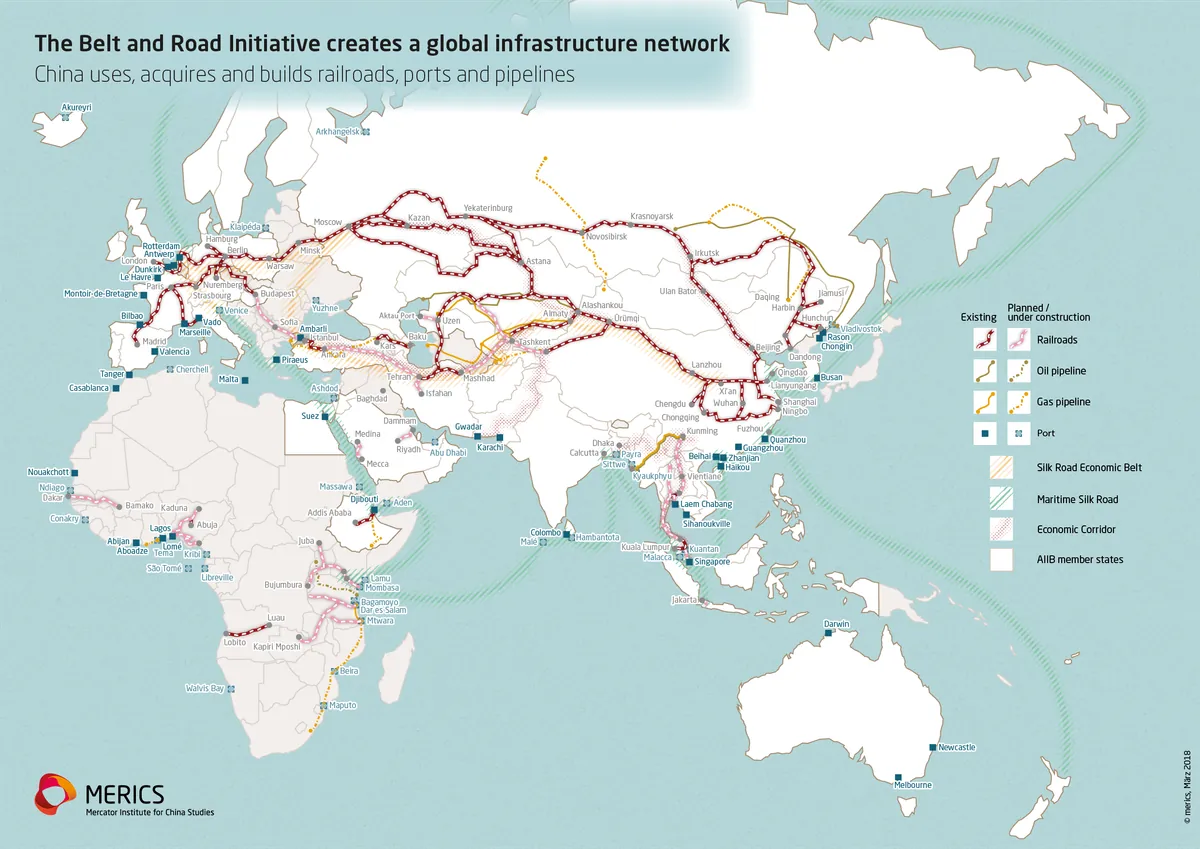

China has also made strides in promoting yuan usage in commodity trading and digital currency. The e-CNY, China's sovereign digital currency, began trials in 2020, showcasing the country's commitment to financial innovation. Additionally, the Belt and Road Initiative, introduced in 2013, serves as a platform to increase international yuan utilization.

Despite these efforts, China faces significant hurdles in internationalizing the yuan. The most formidable obstacle is the country's strict capital controls, which limit the currency's convertibility and global appeal. This policy, while crucial for managing China's state-directed economy, contradicts the goal of developing open financial markets.

"China has no intention to challenge the United States or to unseat it"

This statement underscores China's approach: seeking financial strength without directly challenging US dollar hegemony. The yuan's journey towards internationalization has seen both progress and setbacks. China's admission to the World Trade Organization in 2001 and the yuan's inclusion as an IMF reserve currency in 2016 marked significant milestones.

However, past attempts to liberalize capital flows have been thwarted by economic crises. The Asian financial crisis of 1997 derailed plans to lift capital controls by 2000, and a similar effort was frozen in 2015 following a stock market crash. These events highlight the tension between China's economic management priorities and its currency internationalization goals.

As of July 2024, the yuan ranks as the fourth most used currency for global payments, with a 4.7% share, according to SWIFT data. While this represents progress, it still trails significantly behind the dollar's 47.8% share. The yuan's value has fluctuated in recent years, influenced by factors such as US interest rate changes and China's monetary policies.

China's strategy also involves promoting regional and multilateral collaboration. The country has signed currency swap agreements with over 30 nations since 2008 and is encouraging BRICS countries to use local currencies, including the yuan, in trade and investment. The Asian Infrastructure Investment Bank, founded in 2015, further exemplifies China's efforts to create alternative financial institutions.

In conclusion, while China continues to make progress in internationalizing the yuan, the path ahead remains challenging. The contradiction between maintaining strict capital controls and achieving full currency internationalization persists. As China navigates these complexities, the yuan's global role may expand, but it is unlikely to challenge the dollar's supremacy in the near future.