Chinese Investors Rush for Offshore Investments, Straining QDII Quotas

Chinese demand for offshore investments surges, challenging QDII quota limits. Foreign firms employ creative strategies to manage quotas as investors seek alternatives to sluggish domestic markets.

The appetite for offshore investments among Chinese investors has reached unprecedented levels, putting significant pressure on the Qualified Domestic Institutional Investor (QDII) program. As of late July 2024, the total QDII quotas stood at $167 billion, allocated to 189 institutions. However, this substantial sum is proving insufficient to meet the surging demand.

BlackRock, JPMorgan, and Goldman Sachs, which have recently expanded their presence in mainland China, are among the foreign firms grappling with the quota limitations. These constraints are hindering their ability to fully leverage their global networks and product offerings in the competitive Chinese market.

The QDII program, introduced in 2006, allows Chinese institutional investors to access overseas securities markets. It has played a crucial role in diversifying investment options for Chinese investors and contributing to the internationalization of the Chinese yuan. However, the current situation highlights the challenges of China's controlled approach to opening its capital account.

To navigate the quota crunch, financial institutions are employing various strategies:

- Quota redistribution between branches

- Dropping institutional clients to prioritize retail investors

- Implementing subscription caps

- Introducing swap structures with offshore parent companies

These measures, while temporary, reflect the industry's efforts to accommodate the growing demand until expanded quotas become available.

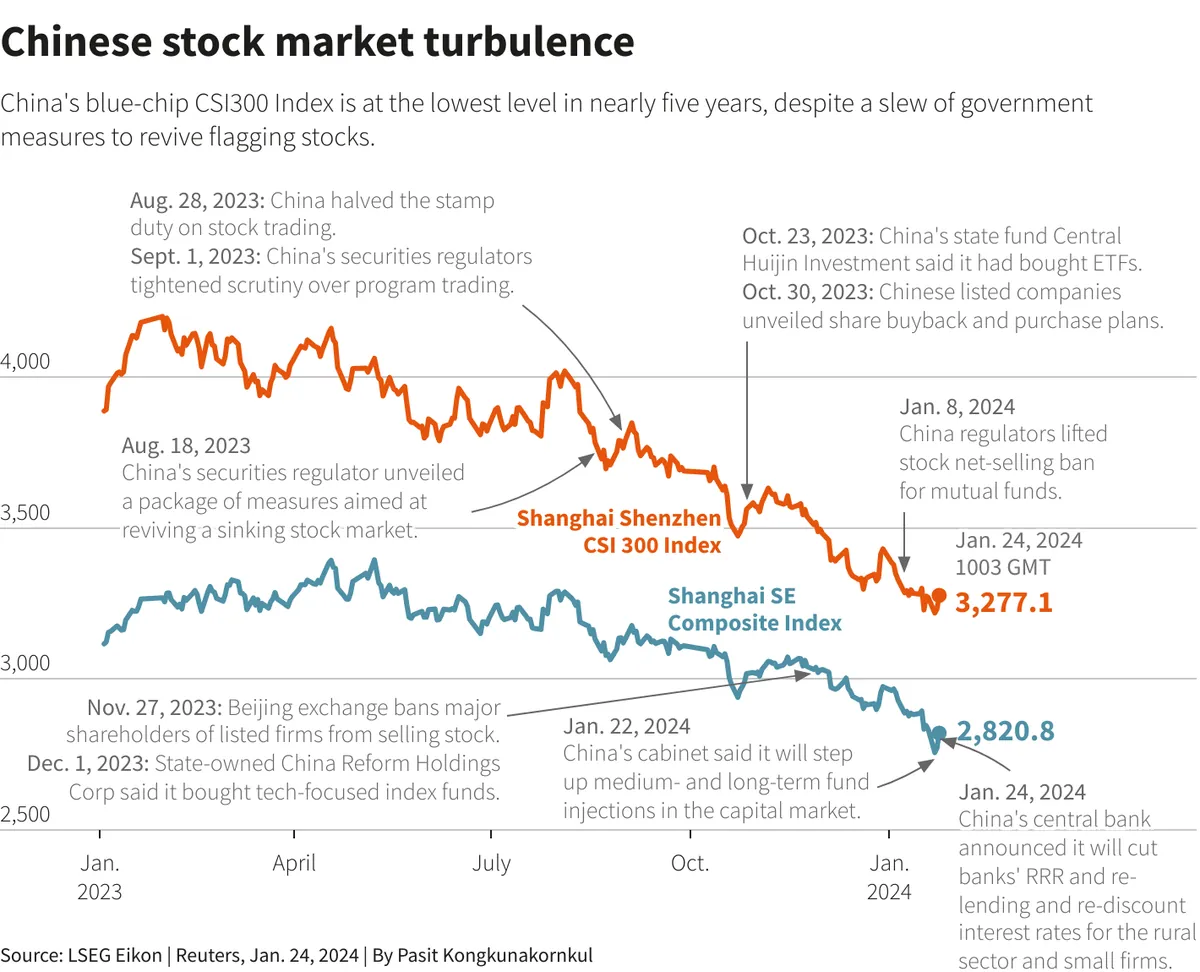

The surge in offshore investment interest is largely attributed to the lackluster performance of domestic assets. On August 7, 2024, the turnover of A-shares hit its lowest level since May 2020, with only 496 billion yuan ($69 billion) traded. This lack of confidence in local markets has driven investors to seek opportunities abroad.

"We have not experienced quotas running out before and have no reaction plan."

The recent selloff in U.S. and Japanese markets briefly alleviated some pressure on quotas as valuations dropped and some investors redeemed their funds. However, industry experts believe this relief is temporary, with quotas likely to fill up quickly again.

The QDII program, regulated by the State Administration of Foreign Exchange (SAFE), has undergone several expansions since its inception. It complements the Qualified Foreign Institutional Investor (QFII) program, which allows foreign investors to access China's domestic markets. Together, these programs have contributed significantly to the development of China's asset management industry.

Despite the challenges, the demand for QDII products remains strong. As one banker noted, "QDII is a must when people worry about onshore" markets. This sentiment underscores the ongoing appeal of global instruments to Chinese investors, even in the face of market volatility.

As China continues its gradual approach to opening its capital account, the QDII quota system helps maintain control over capital outflows. However, the current situation highlights the need for potential adjustments to meet the evolving needs of Chinese investors seeking global diversification.