Climate Asset Management Secures $1 Billion for Nature Projects

Climate Asset Management raises over $1 billion for natural capital investments. The firm's funds focus on regenerative agriculture and landscape restoration, attracting diverse investors amid growing interest in nature-related assets.

Climate Asset Management (CAM) has successfully raised more than $1 billion for investments in natural capital projects, as reported by the company's chief executive. This significant funding milestone reflects a growing trend in the financial sector towards environmentally conscious investments.

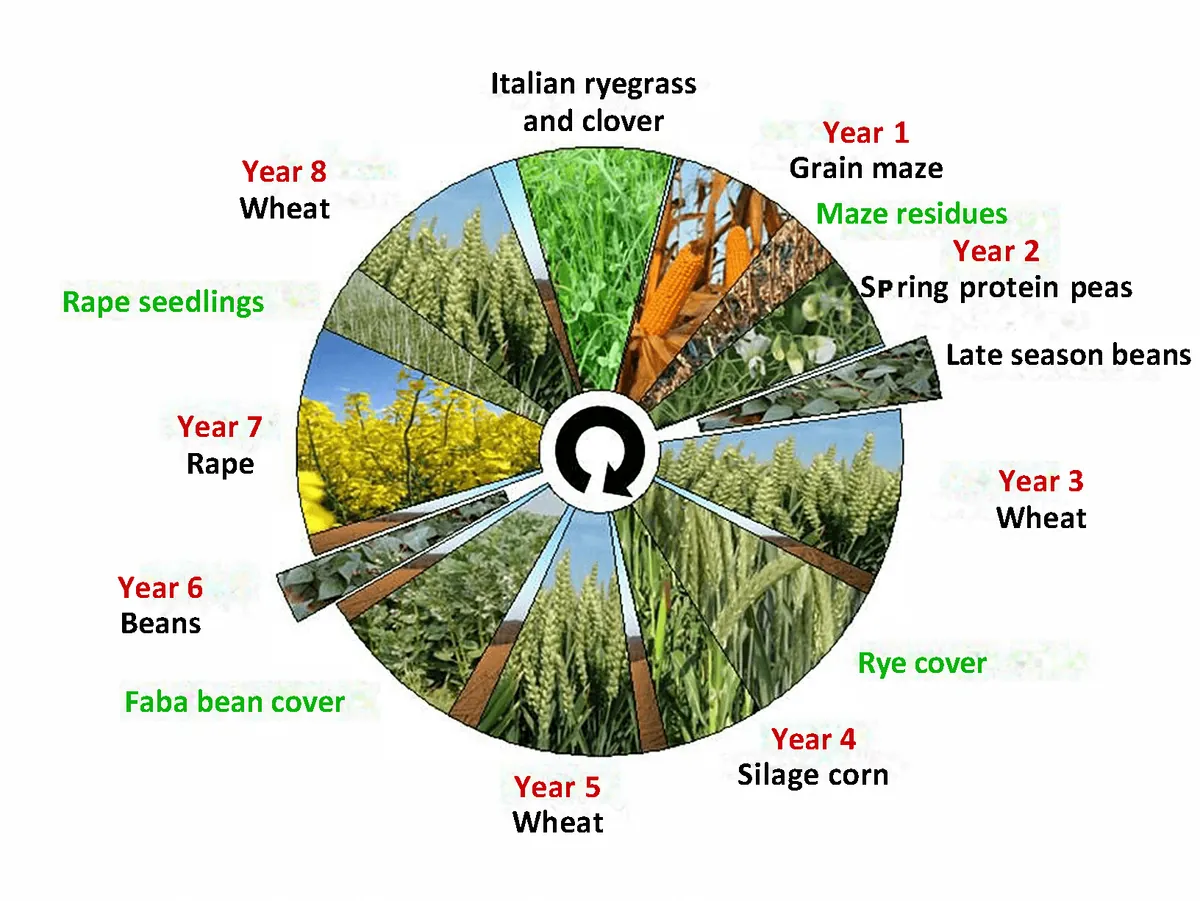

The firm's focus on natural capital projects encompasses a range of initiatives, including regenerative agriculture, tree planting, and land rehabilitation. These areas have seen increased interest from asset owners in recent years, aligning with global efforts to protect and enhance biodiversity.

CAM, a joint venture between HSBC's fund management arm and advisory firm Pollination, has attracted a diverse group of investors. The company's Natural Capital Fund and Nature Based Carbon Fund have both closed to new investments, signaling strong demand for these financial products.

One notable investor in the Natural Capital Fund is Gothaer Asset Management, a German insurer that contributed $100 million. Meanwhile, the Nature Based Carbon Fund has garnered interest from companies like GSK, focusing on generating carbon credits through large-scale landscape restoration and conservation projects.

The Restore Fund, developed in collaboration with tech giant Apple, remains open to new investments and currently holds approximately $280 million. This fund exemplifies the growing intersection between technology and environmental finance.

Martin Berg, CAM's Chief Executive, noted that nature-related investments are transitioning from a niche asset class to one that's attracting more attention from institutional investors. He attributed this shift partly to new reporting requirements, such as the Taskforce for Nature-related Financial Disclosures (TNFD), which mandates companies to report on their environmental impacts.

"At first the disclosure obligation was focused on risk, but soon opened up opportunities to invest, which transferred a challenge into an opportunity."

Berg also mentioned that the funds have already allocated a significant portion of the raised capital, with performance aligning with expectations. Looking ahead, CAM plans to initiate another round of fundraising in 2025, indicating continued confidence in the growth of nature-related investments.

This substantial investment in natural capital aligns with the objectives of the Global Biodiversity Framework, often referred to as the "Paris Agreement for nature." The framework calls for a significant increase in public and private finance, aiming to address the nature-related funding gap with at least $200 billion annually.

As the world grapples with environmental challenges, the success of CAM's fundraising efforts demonstrates a tangible shift in the financial sector towards supporting nature-positive initiatives. This trend is likely to continue as more investors recognize the importance of biodiversity conservation and sustainable land management in addressing climate change and ensuring long-term ecological stability.