CSX's Antitrust Lawsuit Against Norfolk Southern Dismissed by Appeals Court

A U.S. appeals court rejected CSX's lawsuit against Norfolk Southern over access to a major East Coast marine terminal, citing untimely filing under antitrust law. The decision upholds a previous ruling.

In a significant development for the U.S. freight rail industry, CSX Corporation has failed to revive its antitrust lawsuit against rival Norfolk Southern Corporation. The case, centered on access to a major East Coast marine terminal, was dismissed by a U.S. appeals court on August 29, 2024, upholding a lower court's ruling from the previous year.

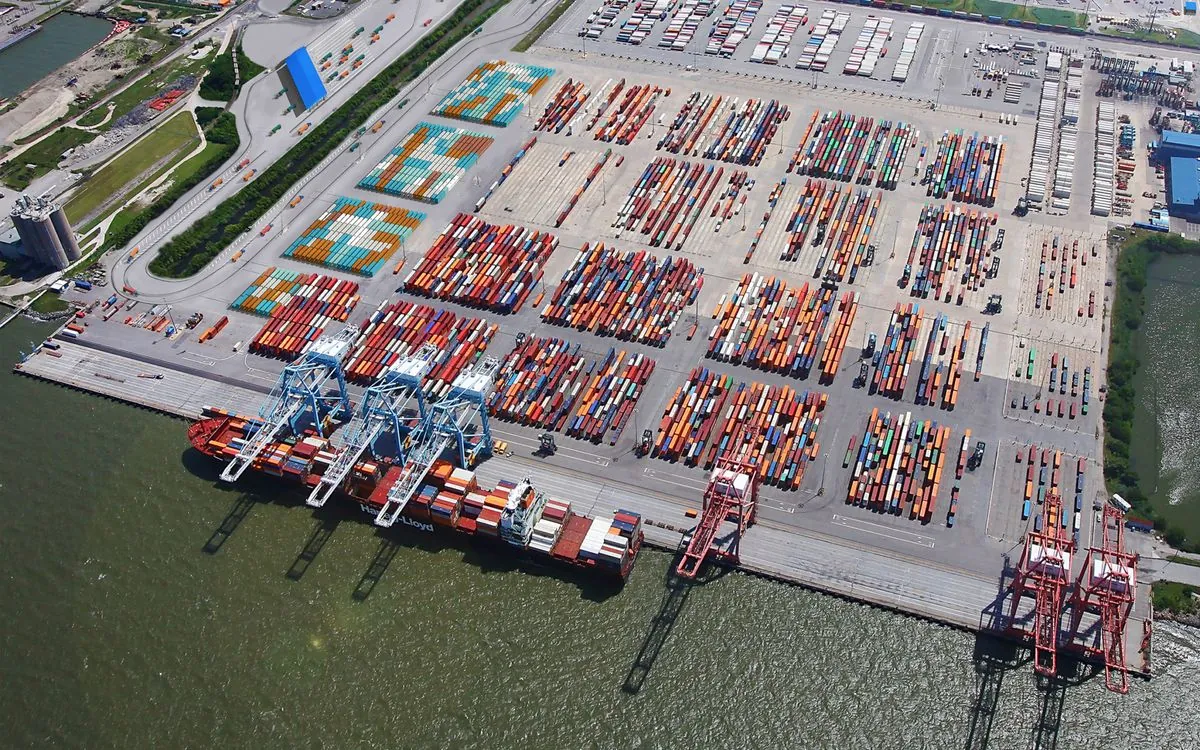

The dispute revolves around the Norfolk International Terminal, one of the largest intermodal facilities on the U.S. East Coast. CSX, which operates in 23 states and two Canadian provinces, alleged that Norfolk Southern denied it competitive access to the terminal, resulting in substantial financial losses. The company claimed damages amounting to hundreds of millions of dollars.

At the heart of the legal battle is the concept of intermodal freight transport, which was introduced in the 1950s and has since become crucial for efficient global supply chains. The Norfolk International Terminal serves as a vital hub where international container ships offload cargo onto trains and trucks for inland transportation.

The three-judge panel of the 4th U.S. Circuit Court of Appeals, based in Richmond, Virginia, ruled that CSX's allegations fell outside the four-year window allowed for filing such claims under U.S. antitrust law. This decision highlights the importance of the statute of limitations in antitrust cases, which ensures timely filing of claims.

CSX argued that the statute of limitations should not apply, as the allegedly unlawful "switch rate" for on-dock rail access was an ongoing issue causing accumulating harm. However, the panel, consisting of Circuit Judges Albert Diaz, A. Marvin Quattlebaum Jr., and Allison Jones Rushing, rejected this argument. They stated that maintaining the same allegedly unlawful rate for years did not inflict new harm within the limitations period.

This case brings attention to the complex landscape of U.S. antitrust laws, which date back to the Sherman Antitrust Act of 1890 and were expanded by the Clayton Antitrust Act of 1914. The U.S. Department of Justice and Federal Trade Commission jointly enforce these federal antitrust laws to maintain fair competition in the market.

The freight rail industry in the United States has undergone significant changes since the Staggers Rail Act of 1980, which deregulated the sector. Both CSX and Norfolk Southern were formed in the early 1980s through mergers of several railroad companies, and they have since become two of the largest Class I railroads in North America.

CSX, which reported over $14 billion in revenue last year, stated that it is evaluating all options while remaining committed to gaining competitive access at the terminal. The company's persistence in this matter underscores the high stakes involved in access to key infrastructure in the freight rail industry.

As the U.S. freight rail network spans nearly 140,000 miles of track, disputes over access to critical terminals can have far-reaching implications for the entire transportation sector. This case may set a precedent for how antitrust claims are handled in the industry, potentially influencing future legal strategies and competitive practices among major rail carriers.