Fed Chief Powell Signals Shift Towards Job Growth at Jackson Hole

Federal Reserve Chairman Jerome Powell indicates a potential pivot in monetary policy, emphasizing job market support while addressing inflation concerns at the annual Jackson Hole symposium.

In a significant shift of focus, Jerome Powell, Chairman of the Federal Reserve, has signaled a potential change in monetary policy direction during his address at the annual economic symposium in Jackson Hole, Wyoming. The event, which has been a platform for crucial economic discussions since 1982, saw Powell emphasizing the importance of supporting job growth while maintaining control over inflation.

The Federal Reserve, established in 1913, operates under a dual mandate of price stability and maximum employment, a responsibility formalized in 1977. Powell's speech highlighted the delicate balance between these two objectives, suggesting that the Fed may be approaching a turning point in its policy stance.

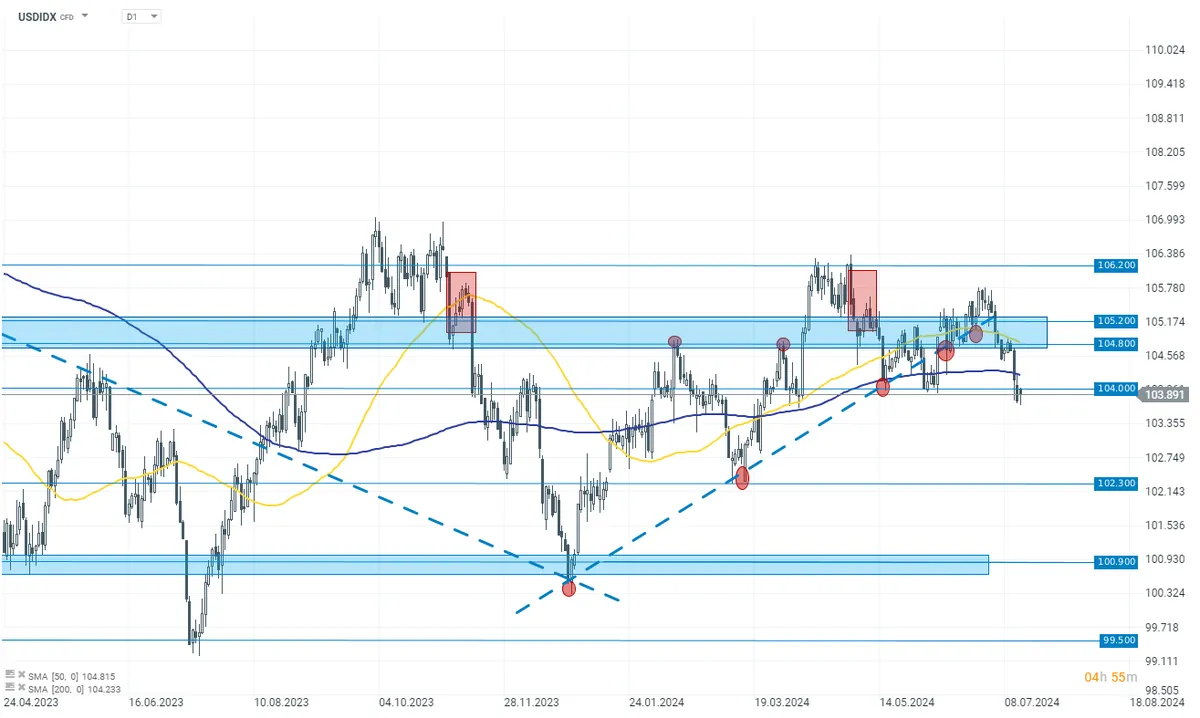

Market participants have been anticipating potential rate cuts, with futures prices indicating expectations of a percentage point reduction by the end of 2024. This would necessitate a substantial 50 basis point cut in one of the three remaining Federal Open Market Committee (FOMC) meetings this year. The FOMC, which convenes eight times annually to set monetary policy, faces the challenge of determining the appropriate pace for these potential rate adjustments.

Powell's emphasis on achieving a "soft landing" - a concept popularized in the 1990s referring to reducing inflation without triggering a significant rise in unemployment - was evident in his remarks. He stated that the Fed would "not seek or welcome further cooling in labor market conditions," signaling a potential shift from the hawkish stance maintained since 2022.

Recent labor market data has shown signs of slowdown. The unemployment rate, calculated by the U.S. Bureau of Labor Statistics, rose to 4.3% in July 2024, up from a half-century low of 3.4% in January 2023. Additionally, revised government data revealed that the economy created 818,000 fewer jobs than initially estimated over the year ending March 2024.

The Federal Reserve's inflation target stands at 2% on average over time. While inflation has been trending downward, it has not yet reached this target. This situation presents a complex challenge for Powell and the six other members of the Federal Reserve Board of Governors as they navigate the path towards a neutral interest rate - a level that neither stimulates nor depresses economic activity.

"We will not seek or welcome further cooling in labor market conditions."

This year's speech marks a stark contrast to Powell's 2022 Jackson Hole address, where he signaled a determination to combat inflation through rate hikes. The Fed subsequently maintained a patient hawkish stance, focusing on controlling price increases.

The current economic landscape presents a critical juncture for the Federal Reserve. The institution, which was granted additional powers following the 2008 financial crisis and significantly expanded its balance sheet during the COVID-19 pandemic, now faces the challenge of timing its policy shift to support the labor market without reigniting inflationary pressures.

As the Fed navigates this complex economic terrain, the coming months will be crucial in determining whether it can successfully achieve its dual mandate and meet market expectations for policy easing.