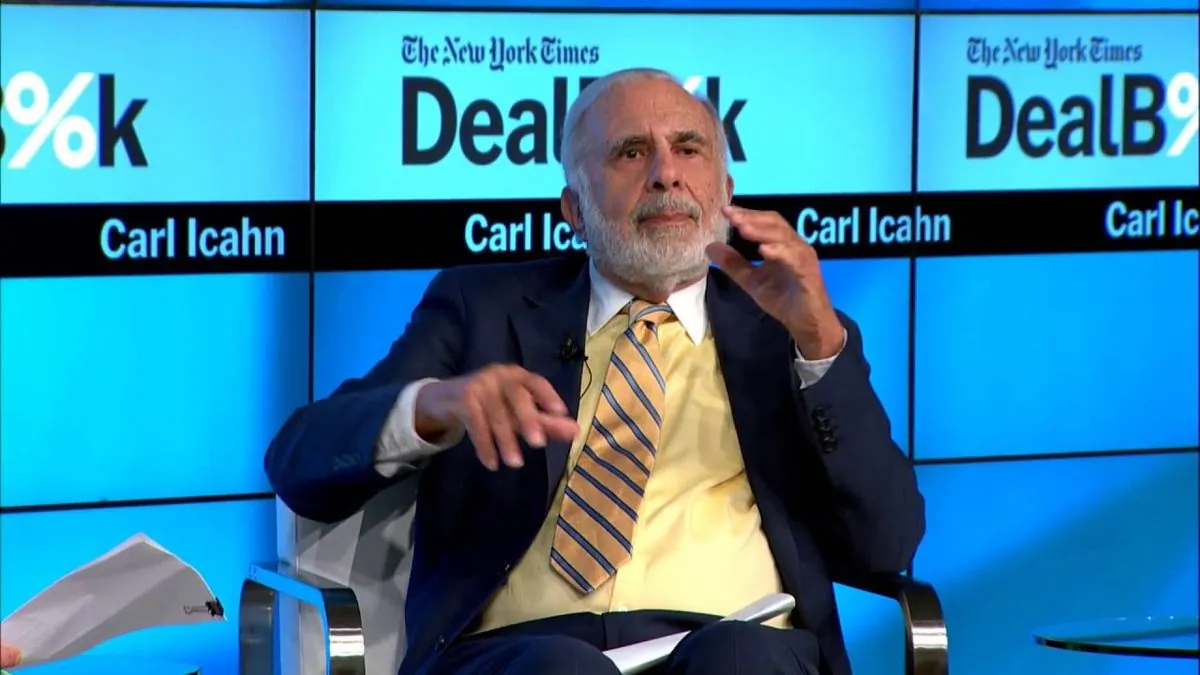

Federal Judge Dismisses Fraud Lawsuit Against Carl Icahn's Company

A U.S. federal judge has dismissed a lawsuit accusing billionaire Carl Icahn of defrauding shareholders. Icahn expressed satisfaction with the decision, denying allegations and reaffirming his commitment to his company.

A federal judge has dismissed a lawsuit against Carl Icahn, alleging that the billionaire investor defrauded shareholders of his investment company, Icahn Enterprises. The decision, made on September 15, 2024, marks a significant development in the ongoing controversy surrounding the company's financial practices.

The lawsuit stemmed from a report published by Hindenburg Research in May 2023, which questioned Icahn Enterprises' dividend policies and borrowing practices. Hindenburg Research, known for its short-selling reports, suggested that the company was operating a "Ponzi-like economic structure."

Carl Icahn, who owns 85% of Icahn Enterprises, has experienced a substantial decrease in his net worth since the Hindenburg report. The company's stock price has fallen by more than three-quarters, reaching a 20-year low last week. According to Forbes magazine, Icahn's fortune, which previously exceeded $10 billion for many years, now stands at $4.9 billion.

U.S. District Judge K. Michael Moore, presiding in Miami, ruled that Icahn Enterprises had adequately disclosed its risks to shareholders. The judge also noted that evidence suggested Icahn "believed in the long-term value" of his company.

In response to the dismissal, Icahn stated, "We are pleased that the spurious claims of various unscrupulous characters, working together in a coordinated and clandestine network, have been debunked." He also refuted media reports claiming he was selling shares of Icahn Enterprises, asserting, "I am absolutely not selling."

It's worth noting that in August 2024, Icahn and his company agreed to pay $2 million in civil fines to settle U.S. Securities and Exchange Commission (SEC) charges. The SEC alleged that Icahn did not disclose the pledging of large quantities of shares as collateral for his loans. However, this settlement was reached without admitting wrongdoing.

The dismissal of this lawsuit and Icahn's response highlight the complex nature of shareholder litigation and the challenges faced by activist investors. As a diversified holding company, Icahn Enterprises continues to navigate the scrutiny of regulators and investors alike.

"We are pleased that the spurious claims of various unscrupulous characters, working together in a coordinated and clandestine network, have been debunked."

This case, known as Kosowsky v Icahn Enterprises LP et al, was heard in the U.S. District Court, Southern District of Florida. The dismissal serves as a reminder of the importance of proper risk disclosure in corporate communications and the role of federal courts in adjudicating shareholder disputes.