FTC Sues Major Pharmacy Benefit Managers Over Alleged Insulin Price Inflation

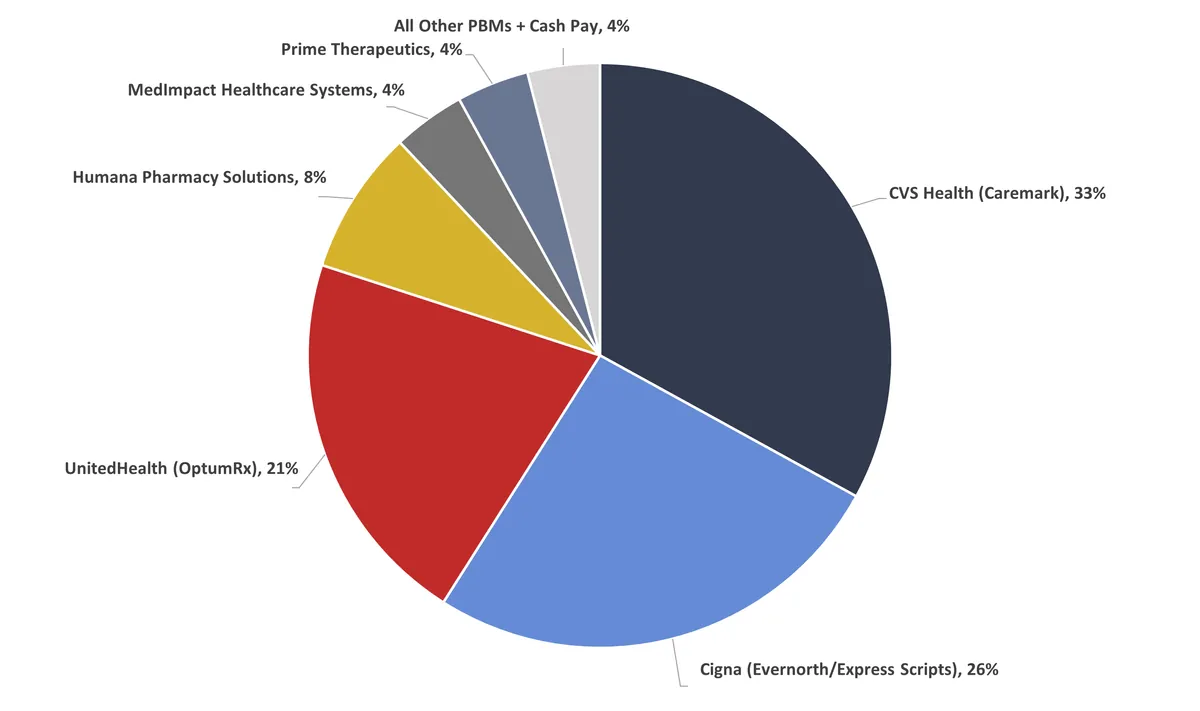

The U.S. Federal Trade Commission has filed a lawsuit against the three largest pharmacy benefit managers, accusing them of artificially inflating insulin costs. The action targets companies controlling 80% of the market.

The U.S. Federal Trade Commission (FTC) has taken legal action against the nation's three largest pharmacy benefit managers (PBMs), alleging that they have misused their market dominance to artificially inflate insulin prices. This lawsuit, announced on September 20, 2024, targets companies that collectively control 80% of the PBM market.

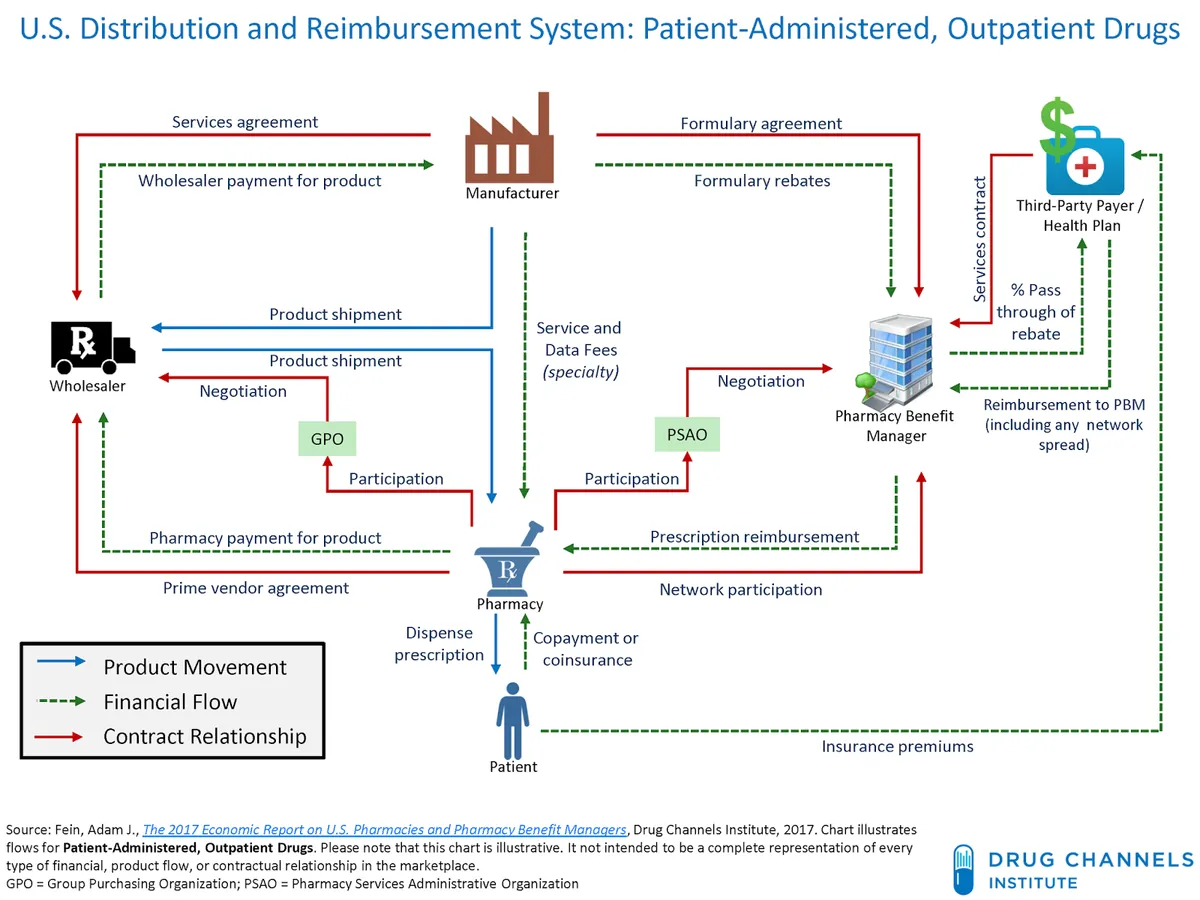

PBMs play a crucial role in the pharmaceutical supply chain, acting as intermediaries between health insurance companies, drug manufacturers, and pharmacies. These entities negotiate drug benefits, fees, and rebates on behalf of payers, which include health insurers, large employers, and Medicare prescription drug plans. CVS Health's CVS Caremark, Cigna's Express Scripts, and UnitedHealth Group's OptumRx are the primary targets of the FTC's complaint.

The PBM industry has grown significantly since its inception in the 1960s. Originally serving as claims processors for insurance companies, PBMs have evolved to manage prescription drug benefits for over 266 million Americans. The global PBM market was valued at $465.71 billion in 2022, highlighting the industry's substantial economic impact.

Despite claims that PBMs help reduce drug costs, the FTC's investigation, which began in 2022, has raised concerns about their impact on pricing and access to prescription medications. The agency's interim report, released in July 2024, suggested that healthcare consolidation has given these companies disproportionate influence over drug prices, potentially warranting regulation.

Key issues under scrutiny include:

- Rebate negotiations

- Pharmacy reimbursement practices

- Potential steering of patients to PBM-owned pharmacies

- Preference for higher-cost drugs that yield larger rebates

The pharmaceutical landscape has seen significant changes since the introduction of drug formularies in the 1980s. PBMs now use tiered formularies to encourage the use of generic or preferred brand-name drugs, a practice that has both supporters and critics.

Lawmakers have responded to these concerns with increased legislative efforts. Since 2023, approximately two dozen bills targeting PBMs have been introduced, with at least five receiving bipartisan support. These proposed regulations aim to address issues such as "spread pricing" and lack of transparency in negotiations.

"PBM executives faced heavy criticism during a July 2024 hearing, highlighting the bipartisan nature of concerns surrounding their business practices."

The Medicare Modernization Act of 2003 significantly expanded PBMs' role in managing Medicare Part D benefits, further cementing their importance in the U.S. healthcare system. However, this expanded role has also led to increased scrutiny and calls for reform.

As the FTC's lawsuit progresses, it may lead to significant changes in how PBMs operate and potentially reshape the pharmaceutical pricing landscape. The outcome could have far-reaching implications for consumers, healthcare providers, and the broader pharmaceutical industry.