German Tax Revenue Slumps in July Amid Economic Challenges

Germany's tax revenue declined sharply in July 2023, reflecting broader economic struggles. The government's economic package aims to stimulate growth, with analysts forecasting improved revenue for 2024.

In July 2023, Germany experienced a significant decline in tax revenue, highlighting ongoing economic challenges faced by Europe's largest economy. According to the finance ministry's monthly report, federal and state governments' tax income fell by 7.9% compared to the same month in 2022, totaling 63.8 billion euros ($70.91 billion).

The primary factor behind this decrease was a sharp reduction in sales tax revenue. This decline is particularly noteworthy given Germany's complex tax system, which operates at federal, state, and municipal levels. The Value Added Tax (VAT) system, a crucial source of government income, appears to have been significantly impacted.

Despite the July setback, the cumulative tax revenue for the first seven months of 2023 showed a modest increase of 1.9% compared to the same period in 2022, reaching 477.8 billion euros. This figure reflects the resilience of the German economy, known for its strong export focus, particularly in automotive and machinery sectors.

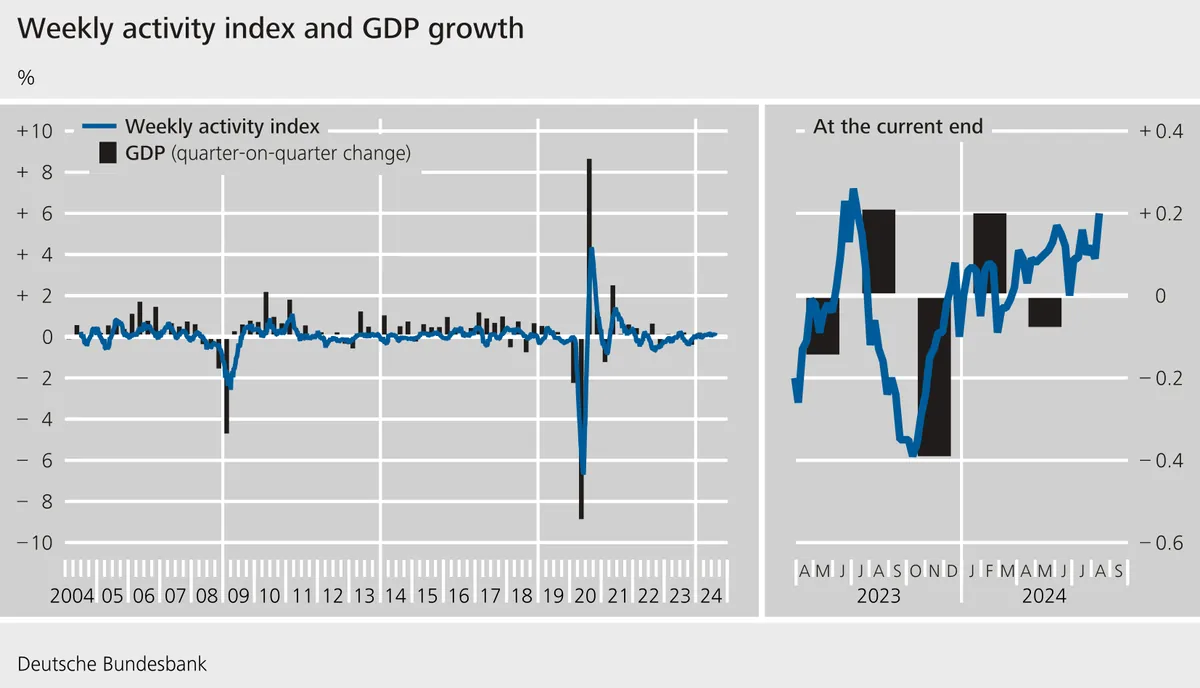

The economic landscape in Germany remains challenging. The country's economy unexpectedly contracted by 0.1% in the second quarter of 2023, underscoring the ongoing struggles of the Eurozone's largest economy. The finance ministry report noted, "Early indicators do not suggest an imminent dynamic recovery."

Looking ahead, analysts project a more positive outlook for 2024. Tax revenue is forecast to increase to 863.68 billion euros, representing a 4.1% rise from the previous year. This projection comes as Germany grapples with various economic challenges, including an aging population and the ongoing energy transition known as Energiewende.

In response to these economic headwinds, the German cabinet approved an economic package in July 2023. This initiative aims to revitalize the economy and boost growth by more than half a percentage point in 2025. The economy ministry estimates that this package could generate an additional 6 billion euros in revenue for 2024.

Germany's economic situation is closely watched due to its significant role in the European Union. As a major contributor to the EU budget and a proponent of fiscal discipline within the bloc, the country's economic performance has far-reaching implications for the entire region.

The current economic challenges come against the backdrop of Germany's strong tradition of social market economy (Soziale Marktwirtschaft) and its renowned Mittelstand - the small and medium-sized enterprises that form the backbone of its economic structure. These elements, combined with the country's low youth unemployment rate and ongoing transition to renewable energy sources, will play crucial roles in shaping its economic recovery.

As Germany navigates these economic hurdles, the effectiveness of its fiscal policies and economic stimulus measures will be closely monitored both domestically and internationally. The coming months will be critical in determining whether the country can reverse the current trend and return to a path of robust economic growth.