Green Hydrogen Hype Deflates as Industry Faces Reality Check

Green hydrogen's ambitious targets are being scaled back due to high costs and practical challenges. The industry is reassessing its potential, focusing on specific applications rather than widespread adoption.

The green hydrogen industry is experiencing a reality check as ambitious targets are being scaled back. Over the past five years, proponents have touted this low-carbon gas as a potential replacement for fossil fuels in various applications. However, recent developments suggest a more pragmatic approach is emerging.

In July 2024, European Union auditors labeled the bloc's 2030 target of producing and importing 20 million tons of green hydrogen as "overly optimistic." Concurrently, Fortescue, an Australian iron ore miner valued at $38 billion, abandoned its goal of producing 15 million tons annually by 2030.

The challenges facing green hydrogen are multifaceted. Production costs currently stand at approximately $6 per kilogram, four times higher than conventional hydrogen derived from fossil fuels. The energy requirements for large-scale production are staggering, with estimates suggesting that using green hydrogen in steelmaking, aviation, and shipping would necessitate nearly five times the global solar and wind capacity installed in 2022.

Efficiency is another significant hurdle. Green hydrogen fuel cells lose about 70% of energy during production and transport, compared to only 20% for electric vehicles. This inefficiency is exemplified by the 500 Toyota Mirai hydrogen-powered cars supplied to the Paris Olympics.

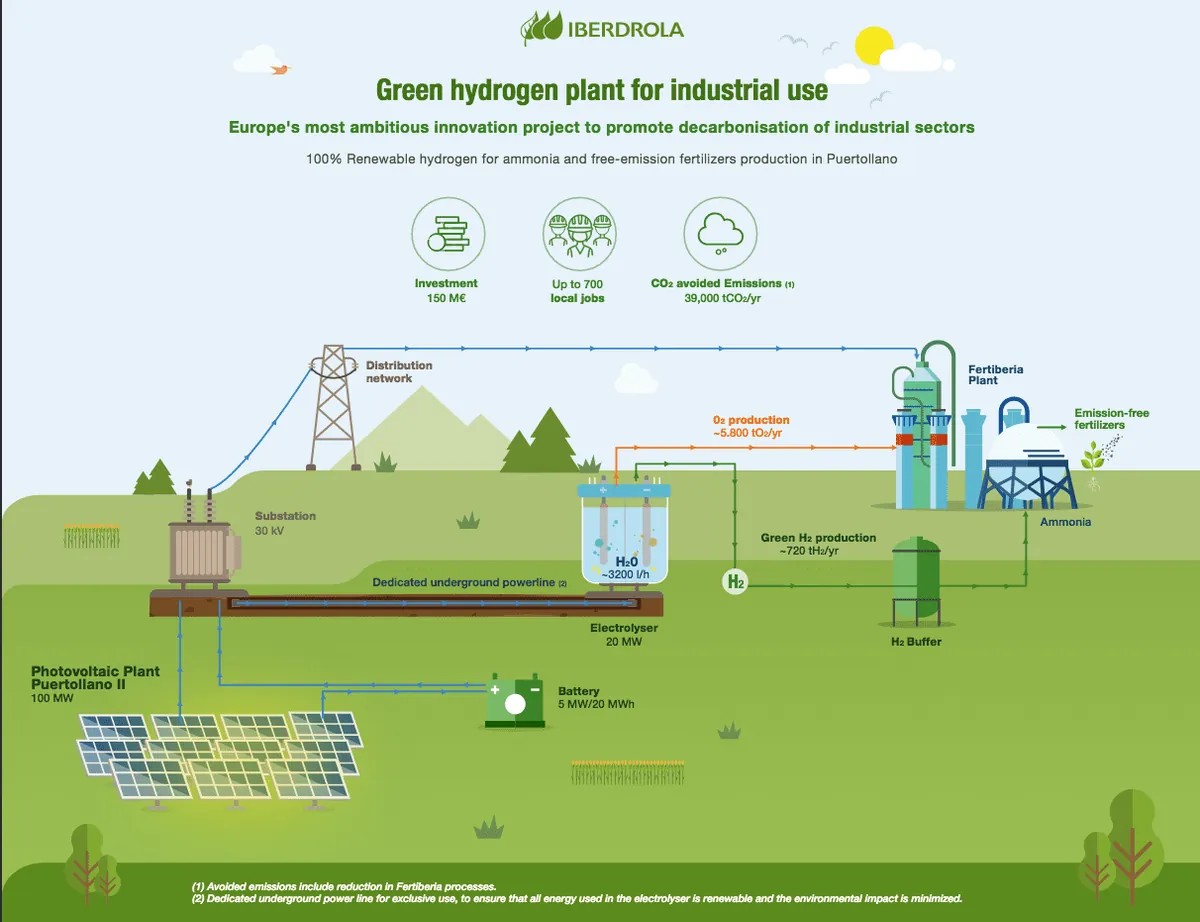

Despite these challenges, green hydrogen retains potential in specific industries. It could replace the 100 million tons of hydrogen produced annually from natural gas for fertilizer and petrochemical manufacturing. The steel industry is another promising application, with companies like Fortescue now focusing their efforts in this direction.

"Sceptics [of green hydrogen] are muppets."

However, for most applications in power, heating, and transport, alternatives such as electric batteries, heat pumps, and biogas are generally more viable. Green hydrogen may find a niche role as emergency long-term backup in some electricity grids.

The industry's reassessment is evident in the slow progress of green hydrogen projects. According to International Energy Agency data, only 1% of approximately 1600 projects have advanced beyond the exploratory stage.

As the green hydrogen bubble deflates, a more realistic and focused approach is emerging. The technology's potential remains, but its applications are likely to be more limited than initially envisioned. The coming years will be crucial in determining green hydrogen's role in the global energy transition.