Harris Echoes Trump's Pledge to Eliminate Taxes on Tips for Service Workers

Vice President Kamala Harris promises to eliminate taxes on tips if elected president, mirroring a proposal by Donald Trump. The idea, long advocated by unions, faces implementation challenges and requires congressional action.

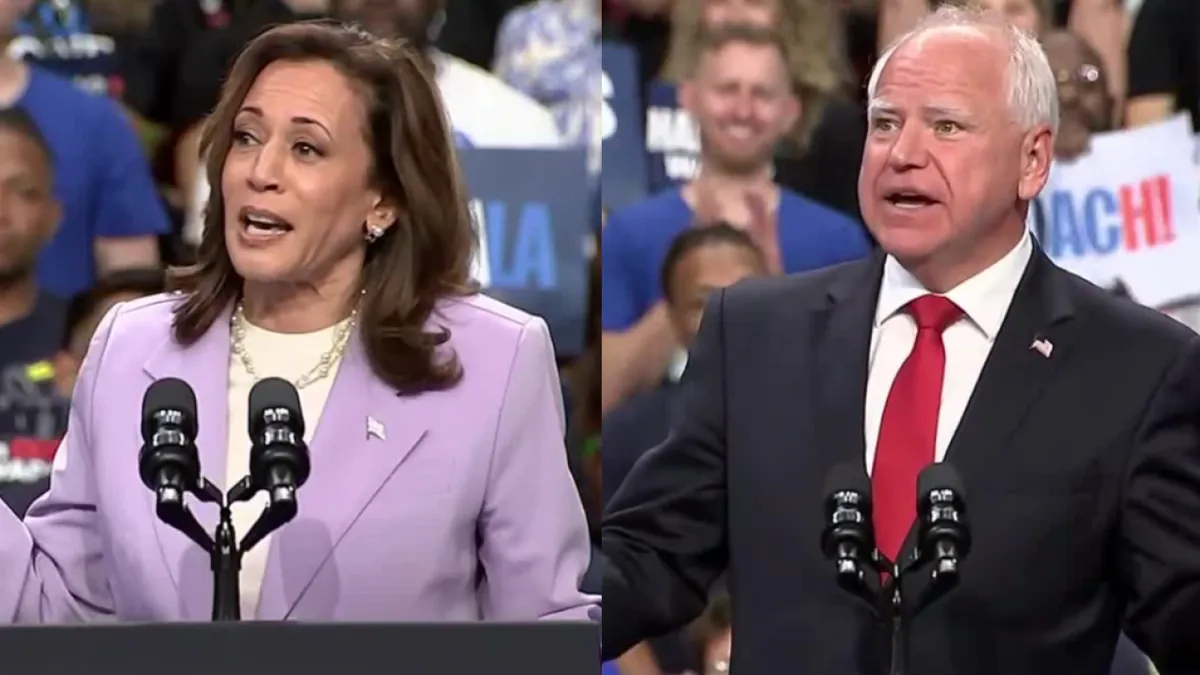

In a recent campaign rally at the University of Nevada at Las Vegas, Vice President Kamala Harris made a bold pledge to eliminate taxes on tips for service and hospitality workers if elected president. This proposal echoes a similar idea put forth by her opponent, Donald Trump, just two months earlier.

Harris stated, "When I am president, we will continue our fight for working families of America, including to raise the minimum wage and eliminate taxes on tips for service and hospitality workers." This announcement came during a tour of swing states, including Nevada, where the service industry plays a crucial role in the economy.

The leisure and hospitality sector is particularly significant in Las Vegas, accounting for over 25% of total employment in the metropolitan area as of January 2023. This industry has been a major focus for both candidates, given its importance to the local economy and workforce.

Trump had previously made a similar promise at a rally in Las Vegas, stating, "For those hotel workers and people that get tips, you're going to be very happy. Because when I get to office, we are going to not charge taxes on tips." Following Harris's announcement, Trump accused her of copying his policy idea.

It's important to note that the concept of eliminating taxes on tips is not new. Unions representing service and hospitality workers have been advocating for this change for years. The federal minimum wage in the United States currently stands at $7.25 per hour, with many states allowing a lower tipped minimum wage under the Fair Labor Standards Act (FLSA).

"Relief is definitely needed for tip earners, but Nevada workers are smart enough to know the difference between real solutions and wild campaign promises from a convicted felon."

While the idea has gained traction, implementing such a policy would require an act of Congress. There appears to be some bipartisan support for the concept, as evidenced by the introduction of the No Tax on Tips Act in June 2024 by Senator Ted Cruz and Representative Byron Donalds. This legislation received backing from Nevada's two Democratic senators, Jacky Rosen and Catherine Cortez Masto.

An analysis by the Budget Lab, a nonpartisan policy research center affiliated with Yale University, suggests that the direct impact of eliminating taxes on tips would be relatively small. Tipped workers represent less than 3% of all employment in the United States, and many already pay no federal income tax due to their earnings falling below federal minimums.

Both candidates' proposals lack specific details. A Trump spokeswoman simply stated that he would ask Congress to eliminate taxes on tips. A Harris campaign official, speaking anonymously, clarified that their proposal would include income limits and strict requirements to prevent abuse by high-earning professionals.

As the debate over tip taxation continues, it's clear that this issue resonates with a significant portion of the workforce, particularly in hospitality-heavy regions like Las Vegas. The implementation of such a policy, however, remains a complex challenge that would require careful consideration and legislative action.