Harris's Economic Proposals: Price Gouging Ban and Tax-Free Tips Spark Debate

Vice President Kamala Harris's recent economic policy speech proposes banning price gouging on groceries and making tips tax-free, sparking discussions on feasibility and potential impacts. Experts weigh in on the historical context and fiscal implications.

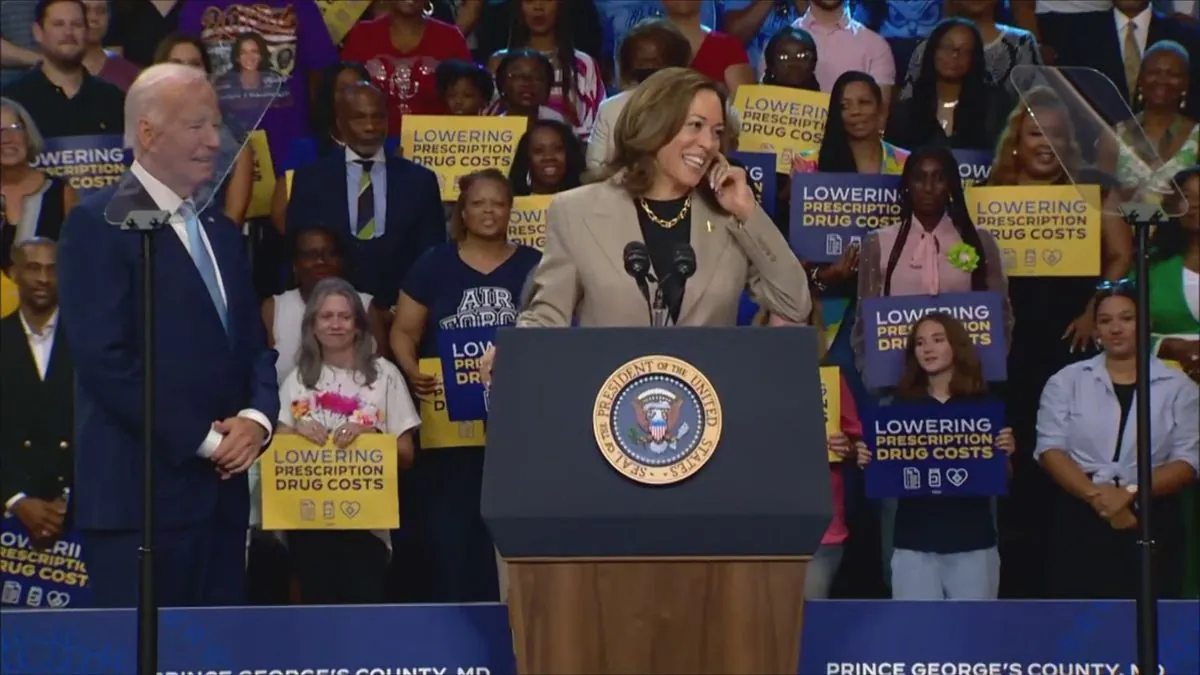

Kamala Harris, the first female, African American, and Asian American Vice President of the United States, recently delivered an economic policy speech that has sparked debate among economists and policymakers. Her proposals to ban price gouging on groceries and make tips tax-free have raised questions about their feasibility and potential impacts.

The concept of price gouging has legal definitions in 42 U.S. states, typically coming into effect during states of emergency or natural disasters. However, Harris's proposal appears to address a broader concern about rising grocery prices, which have increased by 20% over the past four years. Critics argue that extending this definition beyond emergency situations could be challenging to implement and enforce.

The history of tipping in the United States provides context for Harris's tax-free tips proposal. Tipping originated in Tudor England among the aristocracy and was introduced to the US in the 1850s-1860s. The practice became institutionalized through George Pullman's railway service, which hired freed Black men as poorly paid workers who relied on tips for compensation. This history highlights the complex relationship between tipping and racial inequality in the US.

The Fair Labor Standards Act of 1938 established minimum wages for non-tipped workers but excluded tipped workers. It wasn't until 1966 that a minimum wage for tipped workers was introduced. As of 2024, the federal minimum wage for tipped workers remains $2.13 per hour, unchanged since 1991, although some states have higher rates.

Making tips tax-free could have significant fiscal implications. With approximately 2.25 million waiters and waitresses in the US and annual restaurant bills exceeding $300 billion, the estimated tip flow ranges from $40 billion to $60 billion per year. Economists project that making tips tax-free could cost the US government $150-250 billion over 10 years.

"Whether anyone in the United States who is earning a substantial salary would want to take much of it in the form of a gratuity, I find that doubtful and surprising. The bigger question, I think, from an equity point of view, is what on earth does it mean to say that somebody working in a restaurant should not pay tax on a substantial part of their income when somebody who might be doing a similarly paid job in a warehouse would pay tax in full."

The COVID-19 pandemic has significantly impacted the tipping culture and service industry in the US, adding another layer of complexity to the debate. While Harris's proposals aim to address economic concerns, they also raise questions about equity and potential unintended consequences in the labor market.

As the discussion continues, policymakers will need to carefully consider the historical context, fiscal implications, and potential effects on income inequality when evaluating these proposed economic measures.