HSBC Calls for Detailed Sector-Level Climate Plans from Governments

HSBC's sustainability chief urges governments to provide sector-specific emission reduction plans. The bank emphasizes the importance of clear policy direction for effective green financing and discusses nuclear energy's role in the transition.

HSBC Holdings PLC, one of the world's largest banking institutions, is advocating for more comprehensive climate action plans from governments. The bank's group chief sustainability officer, Celine Herweijer, emphasized the need for sector-specific details in national emission reduction strategies during a Reuters Newsmaker event in New York on September 25, 2024.

Herweijer highlighted the significance of the upcoming year, marking a decade since the Paris Agreement was adopted. Countries are required to submit their updated Nationally Determined Contributions (NDCs) by February 2025, outlining their strategies to achieve net-zero emissions. These NDCs are crucial components of the global effort to mitigate climate change and limit global warming.

The banking sector, including HSBC, has committed substantial resources to finance projects labeled as green or sustainable. However, financial institutions face challenges in meeting their sustainability goals without clear policy direction from governments. This situation underscores the intricate relationship between the financial sector and climate policy.

Herweijer stressed the importance of nuclear energy in the transition to cleaner power sources. HSBC is actively engaging with clients to finance both large-scale and small modular reactor projects, recognizing nuclear energy's potential as a low-carbon energy source.

The call for detailed sector-level plans aligns with the growing trend of implementing sector-specific emission reduction strategies. This approach allows for more targeted and effective climate action, addressing the unique challenges and opportunities within each industry.

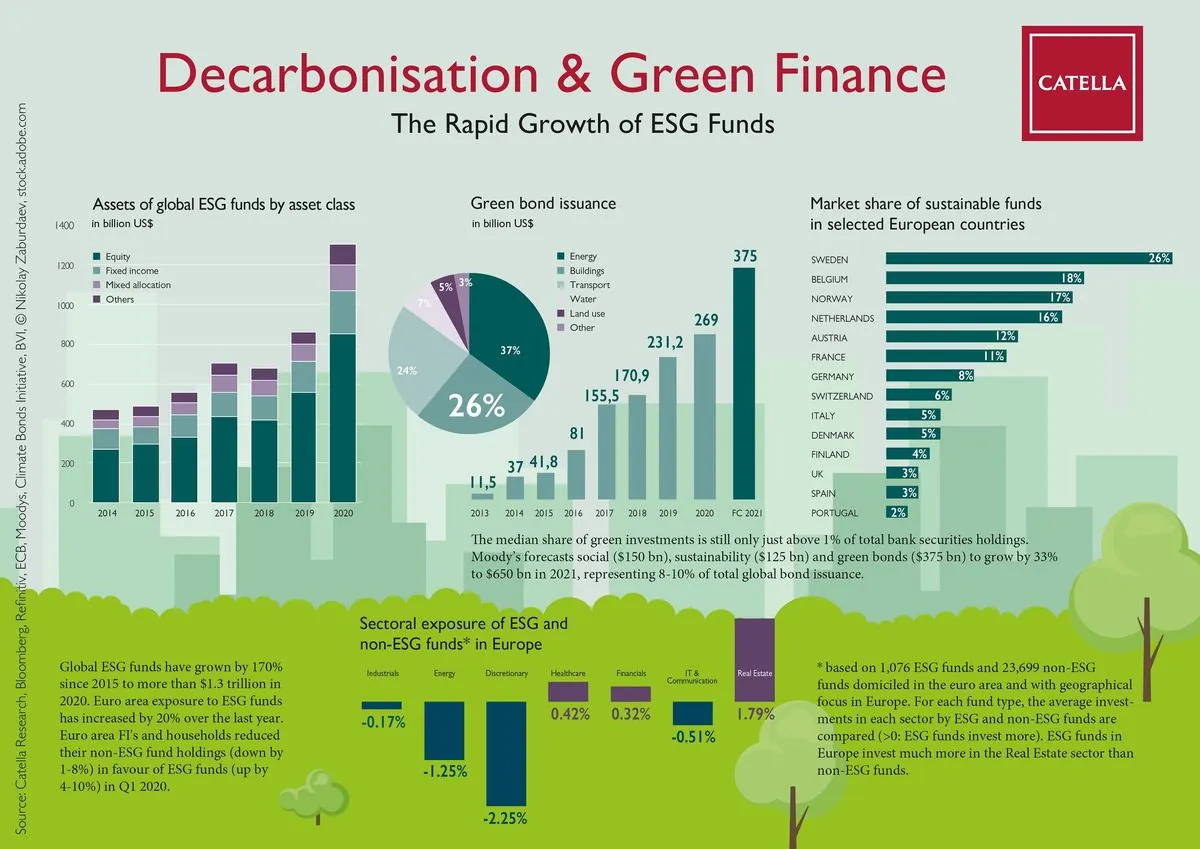

Financial institutions play a pivotal role in funding the transition to a low-carbon economy. The concept of green finance has gained significant traction, with instruments like green bonds becoming increasingly popular for funding environmental projects. However, the banking sector has also faced criticism for its continued financing of fossil fuel projects, highlighting the complex challenges in aligning financial activities with climate goals.

Climate change mitigation requires substantial investment in clean energy technologies. The financial sector's involvement is crucial, but it must be guided by clear and comprehensive government policies. This includes the implementation of carbon pricing mechanisms and the consideration of climate-related financial risks.

The Task Force on Climate-related Financial Disclosures (TCFD) has influenced corporate climate reporting, encouraging companies to be more transparent about their climate-related risks and opportunities. Additionally, financial regulators in some jurisdictions are introducing climate stress testing for banks, further emphasizing the integration of climate considerations into financial decision-making.

As the world moves towards a more sustainable future, the concept of a "just transition" has gained prominence, emphasizing the need to consider social impacts in climate action. This holistic approach to sustainability aligns with the broader goals of the Sustainable Development Goals (SDGs), which are closely linked to climate action and sustainable finance.

HSBC's call for detailed sector-level emission reduction plans reflects the growing recognition that effective climate action requires collaboration between governments, financial institutions, and various sectors of the economy. As the February 2025 deadline for updated NDCs approaches, the pressure is on for governments to provide the clarity and direction needed to accelerate the transition to a low-carbon future.

"Next year is important, its 10 years after the Paris Agreement and governments need to submit their NDCs. What we need within those is more detail at the sector level."

This statement underscores the urgency and specificity required in national climate action plans, setting the stage for more targeted and effective efforts to combat climate change in the years to come.