IEA: Hydrogen Investments Surge, but Demand Lags Behind

IEA reports doubling of hydrogen project investments, led by China. Despite growth, low demand and technological challenges persist, hindering progress towards climate goals.

The International Energy Agency (IEA) has released a report highlighting significant growth in hydrogen project investments, despite persistent challenges in demand and technology. This development comes as the world seeks innovative solutions to combat climate change and transition to cleaner energy sources.

According to the IEA, final investment decisions for hydrogen projects have doubled in the past year, with China leading the charge. This surge represents a potential five-fold increase in low-emission hydrogen production by 2030, surpassing even the rapid expansion rates seen in the solar industry. China alone accounts for over 40% of these investments, showcasing its commitment to hydrogen technology.

However, the report also reveals a stark contrast between production ambitions and actual demand. Current demand targets only cover slightly more than a quarter of the proposed production projects. This disparity raises concerns about the industry's ability to meet climate objectives effectively.

Fatih Birol, the IEA Executive Director, emphasized the need for careful consideration of demand creation tools while addressing cost reduction and regulatory clarity to support further investment in the sector. The agency's projections suggest a potential increase in global hydrogen demand by approximately 3 million tonnes in 2024, primarily driven by the refining and chemical sectors.

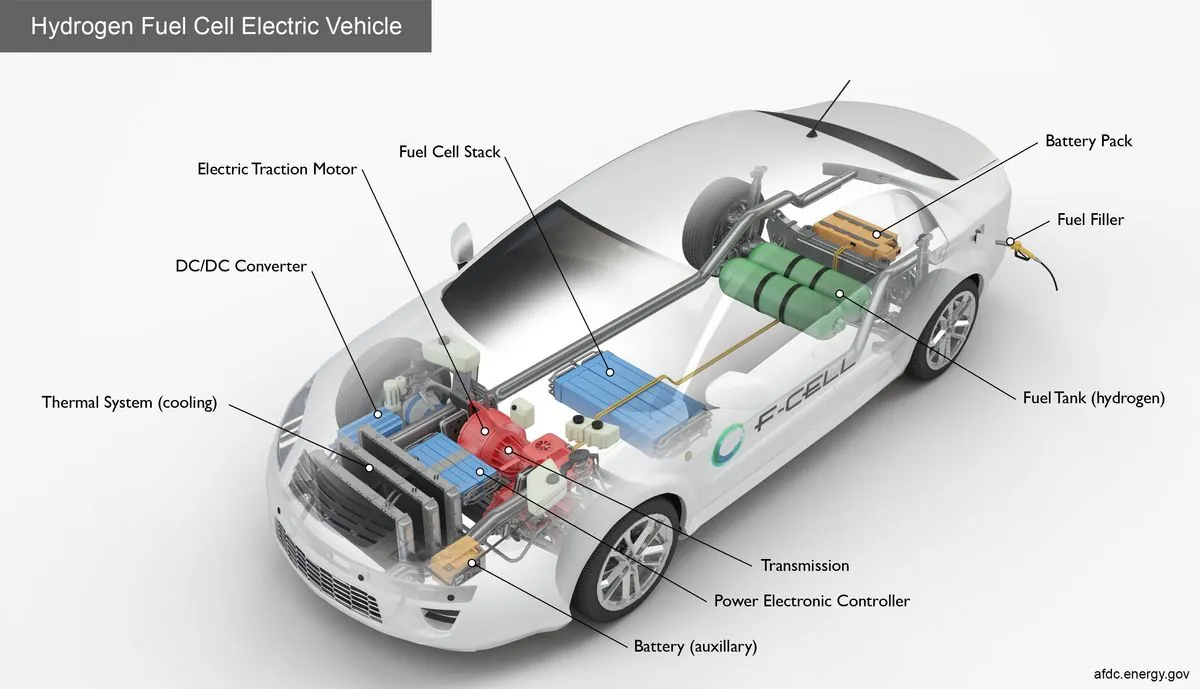

It's worth noting that hydrogen, the most abundant element in the universe, has a long history of technological development. The first hydrogen fuel cells were invented in 1838, and the first hydrogen-powered car was developed in 1966. Today, hydrogen is used in various applications, including the production of ammonia for fertilizers.

The hydrogen industry faces several challenges, including unclear demand signals, financing hurdles, incentive delays, regulatory uncertainties, and operational issues. Many projects are still in their early stages, and the project pipeline is at risk due to these factors.

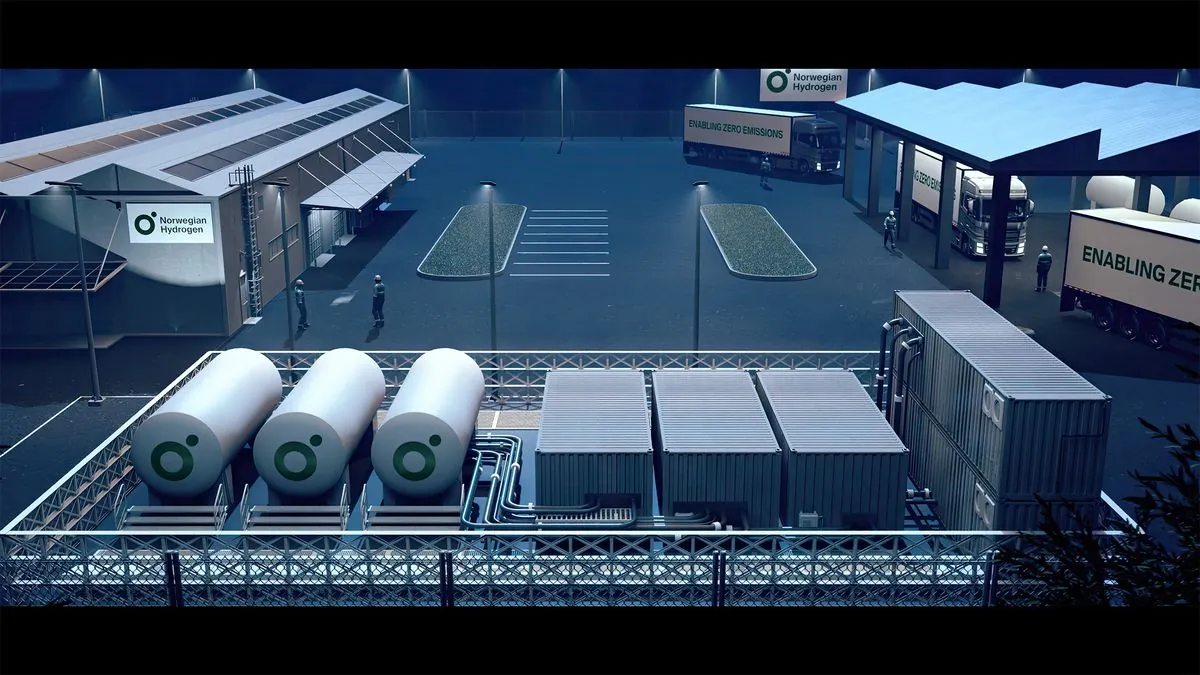

Despite these obstacles, the potential for hydrogen in decarbonizing various sectors remains significant. The global hydrogen market is projected to reach $200 billion by 2030, with applications ranging from heavy industry to long-haul transportation. Countries like Japan are even aiming to become "hydrogen societies" with ambitious goals for hydrogen use.

The IEA report also highlights the current dominance of hydrogen produced from unabated fossil fuels, with low-emissions hydrogen playing only a marginal role. This underscores the need for continued investment in green and blue hydrogen production methods, which utilize renewable energy sources and carbon capture technologies, respectively.

Technological advancements and cost reductions are crucial for the industry's growth. While the cost of producing green hydrogen has decreased by about 40% since 2015, further improvements are necessary. The electrolyzer market, in particular, faces challenges due to higher prices and tight supply chains.

As the hydrogen industry continues to evolve, it's clear that balancing production capabilities with demand creation will be essential for its success. The coming years will be critical in determining whether hydrogen can fulfill its potential as a key player in the global energy transition and contribute significantly to climate change mitigation efforts.

"Policymakers and developers must look carefully at the tools for supporting demand creation while also reducing costs and ensuring clear regulations are in place that will support further investment in the sector."