India Set to Unveil Market Borrowing Plan Amid High Demand for Long-Term Bonds

India's government is expected to announce its market borrowing plan for October-March. Investors anticipate increased supply of longer-dated bonds as yields hit record lows, reflecting strong demand from insurers and pension funds.

The Indian government is poised to reveal its market borrowing strategy for the latter half of the fiscal year on September 26, 2024. This announcement comes as India, the world's largest democracy, grapples with managing its substantial debt while facing strong demand for long-term securities.

For the fiscal year spanning April 2024 to March 2025, the government has already borrowed 7.4 trillion rupees, leaving 6.61 trillion rupees to be raised in the coming six months. This borrowing is crucial for India to finance its fiscal deficit, which has been a point of concern given the country's debt-to-GDP ratio of approximately 90% as of 2023.

Market participants are divided on whether the government will maintain its budgeted borrowing or implement cuts. A. Prasanna, head of research at ICICI Securities Primary Dealership, noted, "The market has not given up hope of a cut in the borrowing program, possibly in December or January. A reduction in borrowing would be particularly positive for longer-term bonds."

Investors are keenly observing the government's approach to shorter-term treasury bills, especially after the unprecedented cancellation of two such auctions earlier this month. Treasury bills, which are short-term government securities with maturities under one year, play a crucial role in managing short-term liquidity needs.

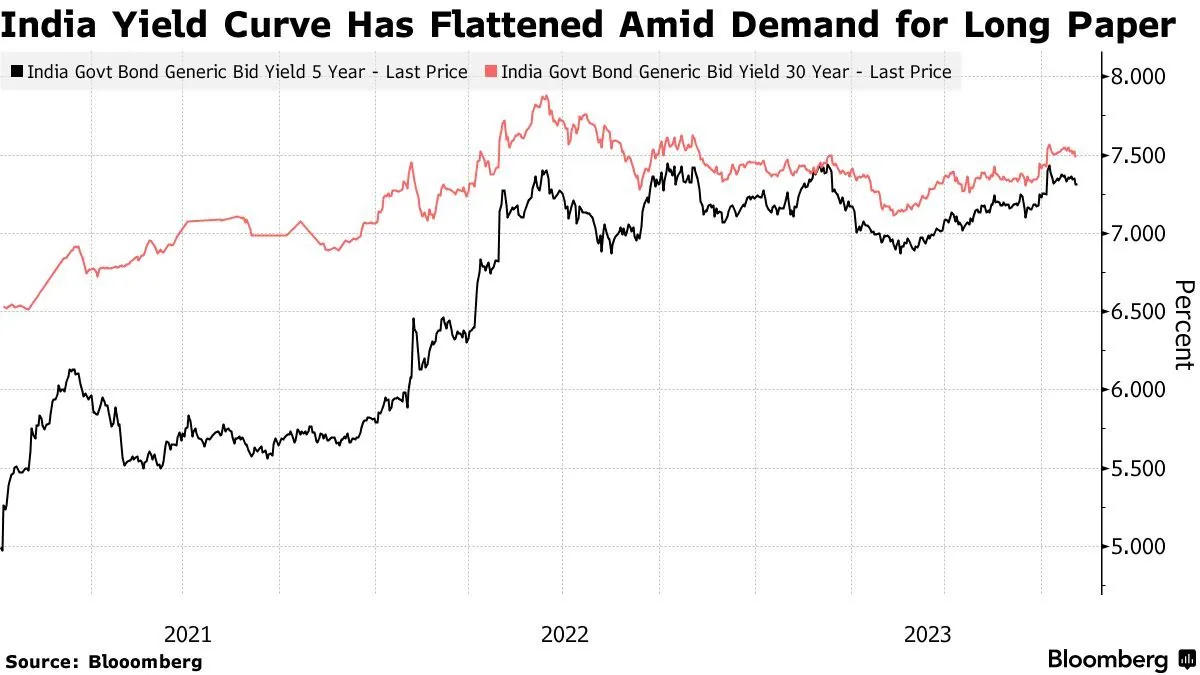

However, the primary focus remains on longer-dated bonds, where demand has surged, driving yields to historic lows. The yield on 50-year bonds recently dipped below 7% for the first time ever, while 30-year bond yields have decreased by 50 basis points since the beginning of the year. This trend has significantly reduced the government's borrowing costs for long-term debt to a near three-year low.

The robust demand for long-term bonds is primarily driven by insurance companies and pension funds, which require these securities to match their long-term liabilities. A trader from a major pension fund, speaking anonymously, stated, "We are present at every auction with a demand of 10-15 billion rupees, and regardless of the yields, we must purchase long-term papers for our product mix."

It's worth noting that nearly 40% of the government's borrowing from April to September was through longer-end papers, reflecting this strong demand. The Reserve Bank of India, as the country's central bank, plays a crucial role in managing these auctions and maintaining stability in the bond market.

The Indian bond market, one of the largest among emerging economies, operates through the Negotiated Dealing System-Order Matching (NDS-OM), an electronic trading platform for government securities. The Clearing Corporation of India Ltd (CCIL) provides clearing and settlement services for these transactions.

As India continues to navigate its economic challenges, the upcoming borrowing plan announcement will be closely watched by both domestic and international investors. The government's strategy will need to balance its funding needs with market dynamics, potentially influencing India's sovereign credit rating and its borrowing costs in international markets.

"The market has not given up hope of a cut in the borrowing program, possibly in December or January. A reduction in borrowing would be particularly positive for longer-term bonds."

This announcement comes at a time when the global economic landscape is evolving, and India's approach to its debt management could have far-reaching implications for its fiscal health and economic growth in the coming years.