Indian Shares Poised for Flat Open After Record-Breaking Rally

Indian stock market expected to open flat following a significant rally to all-time highs. Foreign inflows and China's potential rate cut fueled the surge, with analysts anticipating market consolidation.

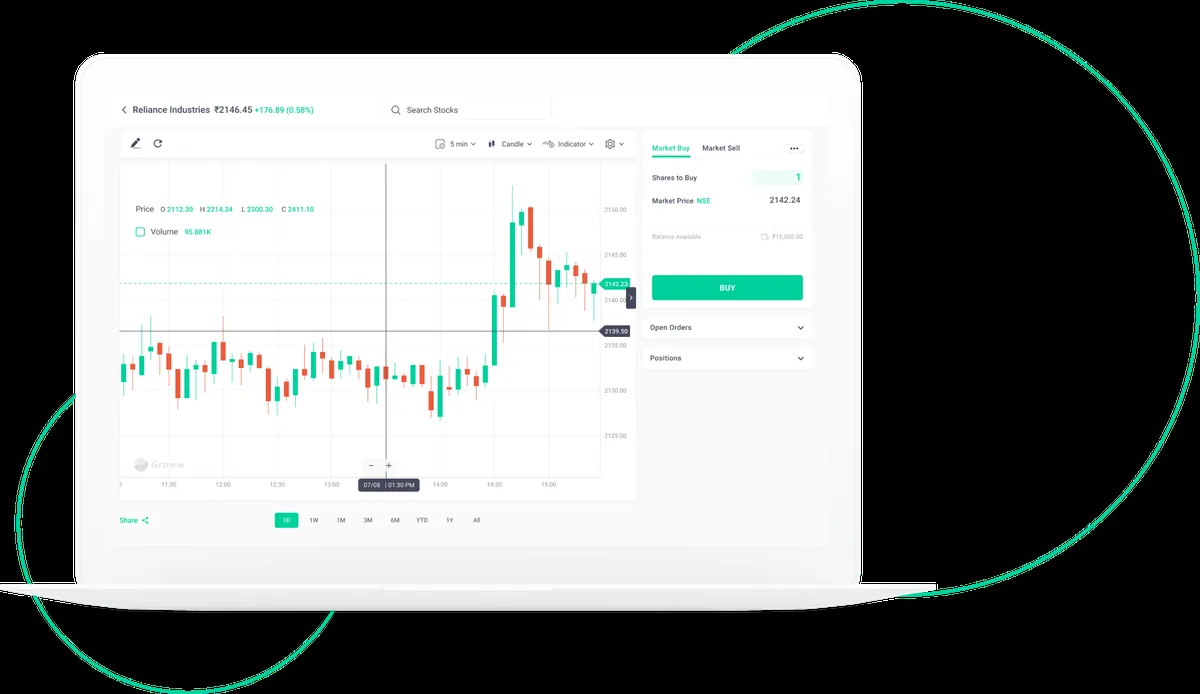

Indian shares are anticipated to commence trading on a flat note on September 13, 2024, following a remarkable rally that propelled the market to unprecedented heights. The GIFT Nifty, a key indicator, stood at 25,384.5 points at 08:17 a.m. IST, suggesting the NSE Nifty 50 would likely open near its record closing high of 25,388.9 achieved in the previous session.

On September 12, 2024, the Nifty 50 and S&P BSE Sensex, India's primary stock indices, surged approximately 2% each, marking their most robust performance since early June 2024. This rally was primarily driven by the commodities sector, fueled by substantial foreign inflows and expectations that China, the world's largest metals consumer, might reduce mortgage interest rates to stimulate consumption.

Foreign portfolio investors (FPIs) made significant purchases of Indian shares, with net inflows reaching 76.95 billion rupees ($916.66 million) on September 12, the highest since June 19, 2024. Analysts anticipate a continued increase in FPI inflows into Indian equities, supported by expectations of a modest U.S. rate cut and India's stable macroeconomic environment.

Siddhartha Khemka, head of research at Motilal Oswal Financial Services, noted, "The benchmarks' rally in the final hour was supported by major buying seen in large-caps, which outperformed the broader market." Market observers suggest that future movements may be incremental as equilibrium emerges between profit-taking and dip-buying strategies.

India's August 2024 retail inflation data, released after market hours on September 12, revealed that it remained below the Reserve Bank of India's target of 4% for the second consecutive month. However, rising food and vegetable prices have tempered expectations of an immediate rate cut in the upcoming monetary policy meeting.

In the global context, Asian markets displayed positive momentum, with the MSCI Asia ex-Japan index gaining 0.6%. Wall Street equities closed higher following the release of producer price index inflation data, which reinforced expectations of a 25-basis-point U.S. rate cut in the coming week.

Notable stocks to watch include HG Infra Engineering, which secured an order worth 7.16 billion rupees from Central Railway, and Adani Group companies, as the conglomerate refuted involvement in Swiss court proceedings after U.S. short-seller Hindenburg Research alleged the freezing of over $310 million of the group's funds. Additionally, Life Insurance Corporation of India increased its stake in IRCTC from 7.278% to 9.298%.

As the Indian stock market navigates these developments, investors and analysts alike will be closely monitoring the interplay between domestic factors and global economic trends in shaping the market's trajectory.