India's Central Bank Expected to Hold Rates Amid Economic Slowdown

India's central bank likely to maintain 6.5% repo rate amid slowing growth. Some investors anticipate a shift to neutral stance, potentially paving the way for future rate cuts.

As India's economy faces a slowdown, the Reserve Bank of India (RBI) is anticipated to maintain its current monetary policy stance in its upcoming meeting. Established in 1935, the RBI, which is the 27th oldest central bank globally, is expected to keep the repo rate steady at 6.5% for the tenth consecutive time since February 2023.

A Reuters poll of 76 economists reveals that over 80% predict no change in rates. However, a minority of investors are speculating on a potential shift to a neutral stance, which could signal future rate cuts. This comes as India, the world's fifth-largest economy by nominal GDP as of 2019, grapples with decelerating growth and evolving global economic conditions.

The RBI's decision, scheduled for October 9, 2024, comes in the wake of the U.S. Federal Reserve's 50-basis-point rate cut last month. This global shift has led market participants to anticipate earlier rate cuts from the RBI, with expectations now centered on December 2024 rather than early 2025.

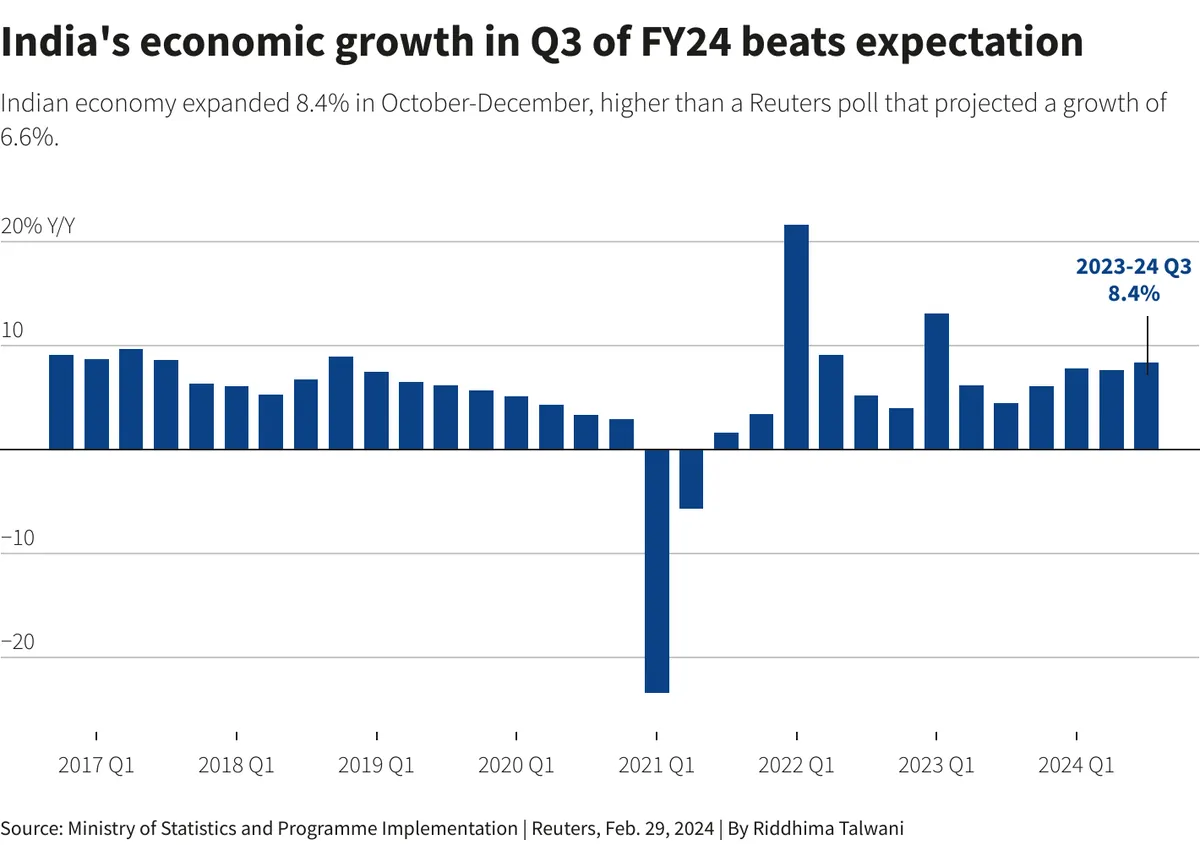

India's economic landscape has shown mixed signals. While the country maintained its position as the fastest-growing major economy, GDP growth slowed to 6.7% in the April-June quarter. This deceleration is attributed partly to reduced government spending during national elections. High-frequency indicators further underscore this trend, with the manufacturing Purchasing Managers' Index (PMI) hitting an eight-month low and the services PMI reaching a 10-month trough in September 2024.

Inflation, a key factor in monetary policy decisions, has remained within the RBI's target range of 2-6% for the past 12 months. This target, set in 2016 and reviewed every five years, reflects the RBI's adoption of flexible inflation targeting. August 2024 saw annual retail inflation at 3.65%, slightly above July's revised 3.60% but below economists' projections of 3.5%.

Despite recent favorable inflation data, economists anticipate an uptick, with Reuters poll estimates suggesting an average of 4.5% for the current fiscal year and 4.3% for the following year. It's worth noting that India's financial year runs from April 1 to March 31, a practice that dates back to the colonial era.

The RBI's monetary policy committee (MPC), established in 2016, plays a crucial role in these decisions. Comprising six members – three from the RBI and three external experts – the committee undergoes a reshuffle every four years. This rotation could potentially influence voting patterns, with some economists speculating that at least one new member might advocate for a rate cut.

"Given the undershooting in the initial Q1 GDP growth relative to the MPC's forecast, and the likely sizeable undershooting in the Q2 CPI inflation print as well, we believe a stance change to neutral may be appropriate in the October 2024 policy review."

As the RBI navigates these economic challenges, it's important to remember that the central bank's role extends beyond setting interest rates. Established during British rule and nationalized in 1949 following India's independence, the RBI is responsible for issuing and managing the Indian Rupee, a currency first introduced in 1861. The bank also oversees India's foreign exchange reserves, which reached a record high of $642 billion in 2021.

With its headquarters in Mumbai and 31 regional offices across the country, the RBI continues to adapt to changing economic landscapes. From introducing the Real Time Gross Settlement (RTGS) system in 2004 to managing repo rates that have fluctuated from a high of 14.75% in August 1991 to a low of 4% during the COVID-19 pandemic, the central bank remains at the forefront of India's economic policy-making.

As global economic winds shift and domestic growth patterns evolve, all eyes will be on the RBI's decision and its potential implications for India's economic trajectory in the coming months.