Kenya Nears $1.5 Billion UAE Loan Deal Amid Budget Challenges

Kenya is close to securing a $1.5 billion loan from the UAE at 8.2% interest, aiming to diversify budget support. This comes as the country faces financial hurdles and an expanding budget deficit.

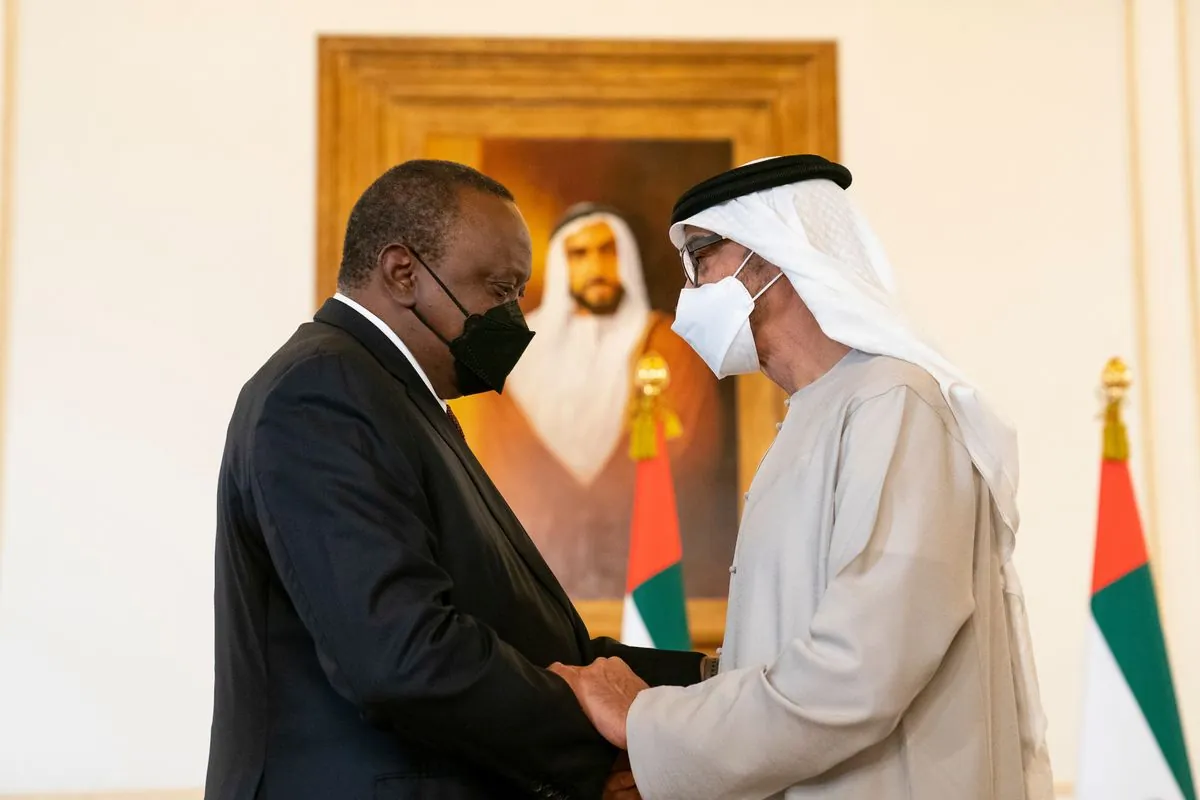

Kenya, the largest economy in East Africa, is on the verge of finalizing a $1.5 billion loan agreement with the United Arab Emirates (UAE). This financial arrangement, featuring an interest rate of 8.2%, is part of Kenya's strategy to diversify its sources of budget support. A source familiar with the negotiations stated, "The deal is as good as done."

This development comes at a crucial time for Kenya, a nation of over 50 million people that gained independence from the United Kingdom in 1963. The country has been grappling with financial challenges, exacerbated by recent events and delayed international support.

In June 2024, President William Ruto was compelled to abandon planned tax hikes worth more than 346 billion Kenyan shillings (approximately $2.7 billion) due to widespread protests. This decision, coupled with a delay in funding from the International Monetary Fund (IMF), has put additional pressure on Kenya's fiscal situation.

As a result of these setbacks, Kenya's overall budget deficit is projected to expand to 4.3% of GDP in the fiscal year 2025, a significant increase from the previously anticipated 3.3%. This widening deficit underscores the importance of securing alternative funding sources.

Kenya, known for its diverse wildlife and as a major exporter of tea and coffee, has been experiencing significant economic growth in recent years. The country's GDP was estimated at $106.04 billion in 2022, reflecting its status as a key player in the region. However, the current financial challenges highlight the complexities of managing a mixed economy in a developing nation.

The potential loan from the UAE is seen as a strategic move for Kenya, which has been a member of the United Nations since 1963 and is part of the East African Community (EAC). This financial agreement could help bridge the nation's financing gap and support its ongoing development efforts.

Kenya's capital, Nairobi, serves as a major hub for air travel in East Africa and hosts the UN Environment Programme headquarters, further emphasizing the country's regional importance. The nation's diverse landscape, including Mount Kenya, the second-highest mountain in Africa, and its Indian Ocean coastline, contributes to its economic potential, particularly in sectors such as tourism.

As Kenya navigates these financial challenges, it continues to build on its strengths, including its growing technology sector and its status as a republic since 1964. The country's division into 47 semi-autonomous counties and its bicameral parliament system provide a framework for governance as it addresses these economic hurdles.

The ongoing negotiations with Abu Dhabi for this loan deal demonstrate Kenya's proactive approach to securing its financial future. As of September 25, 2024, neither the UAE Ministry of Finance nor the UAE Central Bank had provided immediate comments on the potential agreement.

This financial development occurs against the backdrop of Kenya's rich cultural heritage, including the distinctive customs of the Maasai people, and its commitment to economic progress. As the nation works to overcome its current fiscal challenges, it continues to play a vital role in the East African region and the global economy.