Market Crash Sparks Recession Fears, Yet U.S. Consumer Spending Holds Firm

Despite a global market downturn raising recession concerns, the U.S. economy shows resilience, largely due to robust consumer spending. Economists highlight a divide between affluent and struggling households.

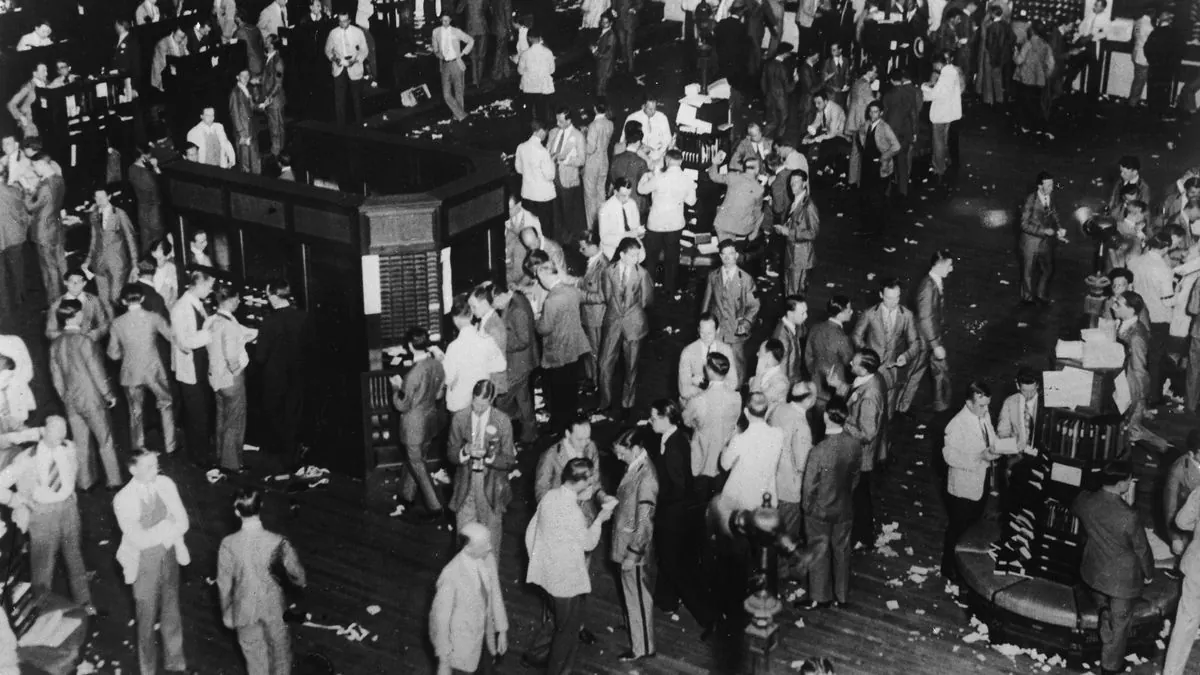

A significant market decline on Monday, August 5, 2024, has sparked concerns about a potential recession, despite indications of a resilient U.S. economy. The crash impacted American stocks and investments, yet economists emphasize that consumer spending, which accounts for approximately 70% of the country's gross domestic product, remains strong.

Mark Mahaney, senior managing director at Evercore ISI, stated, "If I were to weigh all of the data points, I would say I have more evidence that there's a soft landing, that the consumer isn't rolling over." This perspective underscores the crucial role of consumer spending in maintaining economic stability.

The U.S. economy has demonstrated remarkable resilience in the face of high interest rates and inflation. Recent data shows that the economy grew more than expected in the second quarter of 2024, with wages outpacing inflation. Retail sales in June 2024 were solid, with online store sales increasing by almost 2% compared to the previous month.

However, a clear economic divide is emerging:

- Affluent Americans continue to spend robustly

- Lower-income households face growing financial challenges

This split is evident in recent business reports. Ramon Laguarta, PepsiCo CEO, noted in a July 2024 earnings call, "In the U.S., there is clearly a consumer that is more challenged, and it's a consumer that is telling us that in particular parts of our portfolio, they want more value to stay with our brands."

The Federal Reserve Bank of New York reported a 1.1% increase in total household debt in the first quarter of 2024. Notably, credit card debt in the U.S. reached a record high of over $1 trillion in 2023, highlighting the financial strain on many households.

The Federal Reserve's response to these economic shifts is a subject of intense speculation. Some analysts now predict interest rate cuts at every Fed meeting until the end of 2024. The debate extends to the size of potential cuts, with some arguing for larger half-point reductions to provide more immediate relief to struggling Americans.

Constance Hunter, senior adviser at MacroPolicy Perspectives, cautioned against hasty judgments based on single data points but acknowledged signs of softness in the labor market. She emphasized the significant impact a 50-basis point cut could have on financed goods purchases.

As the Federal Reserve navigates these complex economic conditions, its decisions will be crucial in shaping the financial landscape for businesses and consumers alike. The coming months will be critical in determining whether the U.S. economy can maintain its resilience or if the current challenges will lead to a more significant downturn.

"If I were to weigh all of the data points, I would say I have more evidence that there's a soft landing, that the consumer isn't rolling over."