Meta Secures Major Carbon Offset Deal with Brazilian Bank BTG Pactual

Meta agrees to purchase up to 3.9 million carbon offset credits from BTG Pactual's forestry arm through 2038. The deal, potentially worth $16 million, supports Meta's goal of achieving net zero emissions by 2030.

Meta Platforms Inc, the parent company of Facebook and Instagram, has entered into a significant agreement with Brazilian investment bank BTG Pactual's forestry division to acquire carbon offset credits. This deal, announced on September 18, 2023, marks a substantial step in Meta's commitment to environmental sustainability.

The agreement allows Meta to purchase up to 3.9 million carbon offset credits through 2038. While the exact value of the transaction remains undisclosed, based on the average price of $4.22 per credit reported by Allied Offsets, the deal could potentially be worth up to $16 million.

Carbon offsets, first introduced in the 1990s as part of the Kyoto Protocol, enable companies to compensate for their greenhouse gas emissions by investing in projects that reduce emissions elsewhere. Each credit represents a reduction of one metric ton of carbon dioxide emissions. The global carbon offset market, valued at $2 billion in 2021, is expected to grow significantly, reaching an estimated $50 billion by 2030.

Under the terms of the contract, Meta has committed to buying 1.3 million carbon credits, with options to acquire an additional 2.6 million. This transaction aligns with Meta's goal to achieve net zero emissions across its value chain by 2030, a concept that gained prominence following the 2015 Paris Agreement.

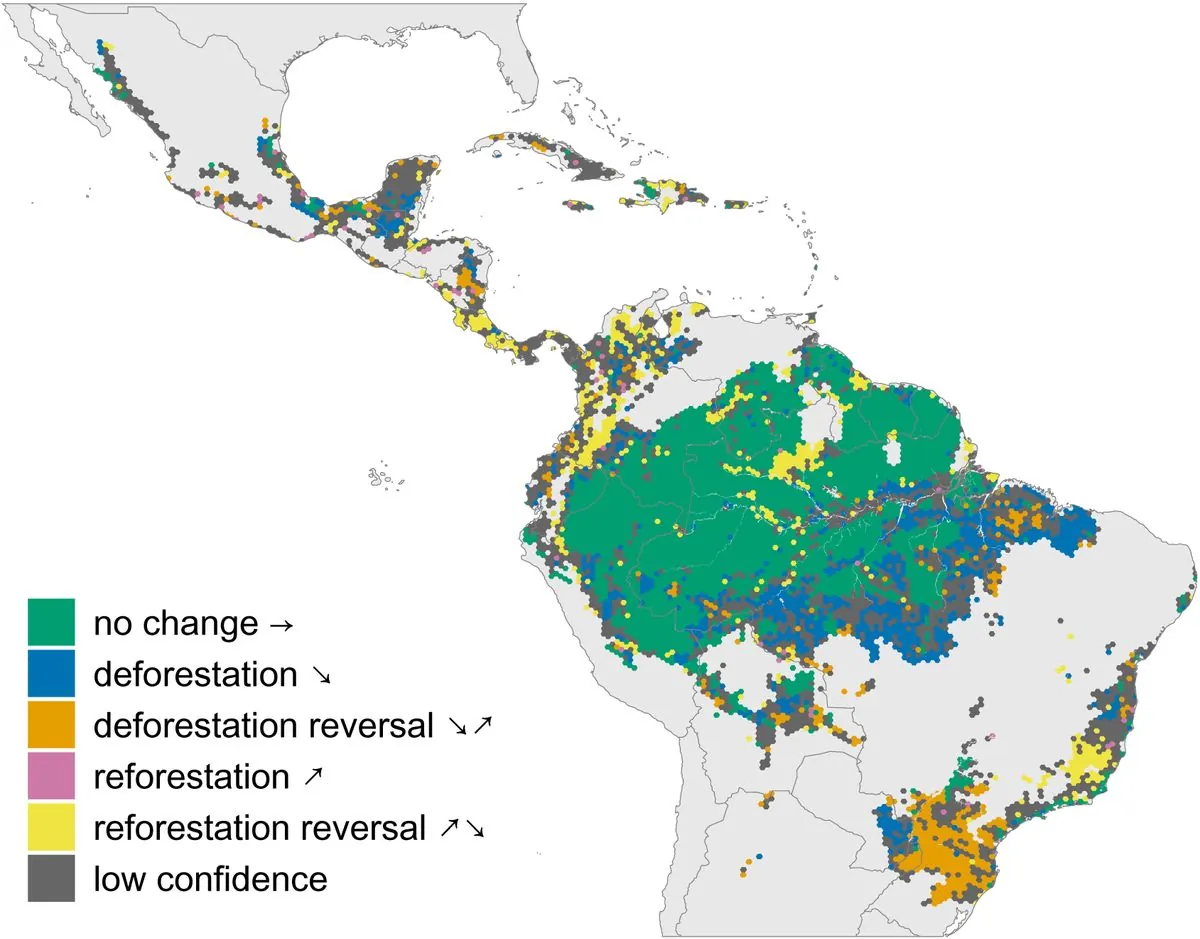

BTG Pactual Timberland Investment Group (TIG), the largest investment bank in Latin America, has generated these credits through forest restoration projects in the region. TIG has planted over 7 million seedlings, contributing to the preservation of Latin America's forests, which account for approximately 22% of the world's forest area.

This deal follows a similar transaction in June 2023, when TIG sold 8 million carbon credits to Microsoft Corporation, marking the largest-ever transaction of such credits worldwide. Microsoft has pledged to become carbon negative by 2030, demonstrating a growing trend among tech giants to address their environmental impact.

Despite these high-profile agreements, the broader carbon offset market has experienced a slowdown. Demand for offsets stalled in 2022, with some companies, including Nestle and Gucci, reducing their purchases due to concerns about the effectiveness of credits in reducing emissions.

The average lifespan of a carbon credit ranges from 8 to 12 years, and prices can vary widely, from less than $1 to over $50 per ton. Reforestation projects, like those implemented by BTG Pactual TIG, can sequester up to 15 tons of CO2 per hectare annually, making them a crucial component in the fight against climate change.

As the voluntary carbon market continues to evolve, companies like Meta, founded by Mark Zuckerberg in 2004, are taking significant steps to address their environmental impact. With over 1 billion active users on Instagram alone, Meta's commitment to sustainability has the potential to influence a vast global audience and set a precedent for other corporations to follow.