Midea's $3.9B Hong Kong Listing Boosts City's IPO Market

Chinese appliance giant Midea Group's $3.9 billion share sale in Hong Kong, the city's largest in three years, attracts strong investor interest. The listing highlights Midea's global expansion amid domestic market challenges.

In a significant boost to Hong Kong's initial public offering (IPO) market, Midea Group, a leading Chinese electronics manufacturer, is poised to complete a substantial share sale. The offering, expected to raise $3.9 billion, marks the largest listing in the city in over three years, injecting much-needed vitality into the financial hub's deal-making scene.

Midea Group, founded in 1968 and now one of the world's largest producers of home appliances, has attracted strong interest from institutional investors. This demand has led to the company pricing its shares at the top of the marketed range and potentially increasing the deal size. The listing is set to surpass the combined $2.5 billion raised by all Hong Kong IPOs so far in 2024, according to financial data provider Dealogic.

The timing of Midea's listing appears opportune, as the company reported a 14% increase in first-half earnings for 2024, reaching nearly 21 billion yuan on record revenue. This strong performance has allowed Midea to offer a relatively modest discount compared to its Shenzhen-listed shares, with the Hong Kong offering priced at up to 21% below the mainland closing price on September 11, 2024.

Despite the positive reception, Midea faces challenges in its home market. A national trade-in scheme for consumer goods, announced in March 2024, likely boosted the company's first-half sales. However, official data revealed that while sales of household appliances and electronics rose by almost 13% year-on-year in May 2024, they contracted in both June and July, suggesting the program may have simply accelerated future purchases rather than stimulating sustained growth.

Midea's global diversification strategy has proven beneficial, with foreign markets accounting for over 40% of its revenue in 2023. The company plans to allocate more than a third of the listing proceeds to enhance its overseas operations, a move that aligns with its long-term growth objectives. This international focus has attracted notable investors, including Hillhouse Investment and Singapore's GIC sovereign fund, reportedly in talks to acquire substantial stakes.

The success of Midea's listing demonstrates that well-managed Chinese companies with global operations can still generate significant investor interest. However, it remains to be seen how many other Chinese firms can replicate Midea's track record and appeal to international markets.

"Our Hong Kong listing represents a strategic step in our global expansion plans. We are committed to leveraging this capital to strengthen our international presence and continue delivering innovative products to consumers worldwide."

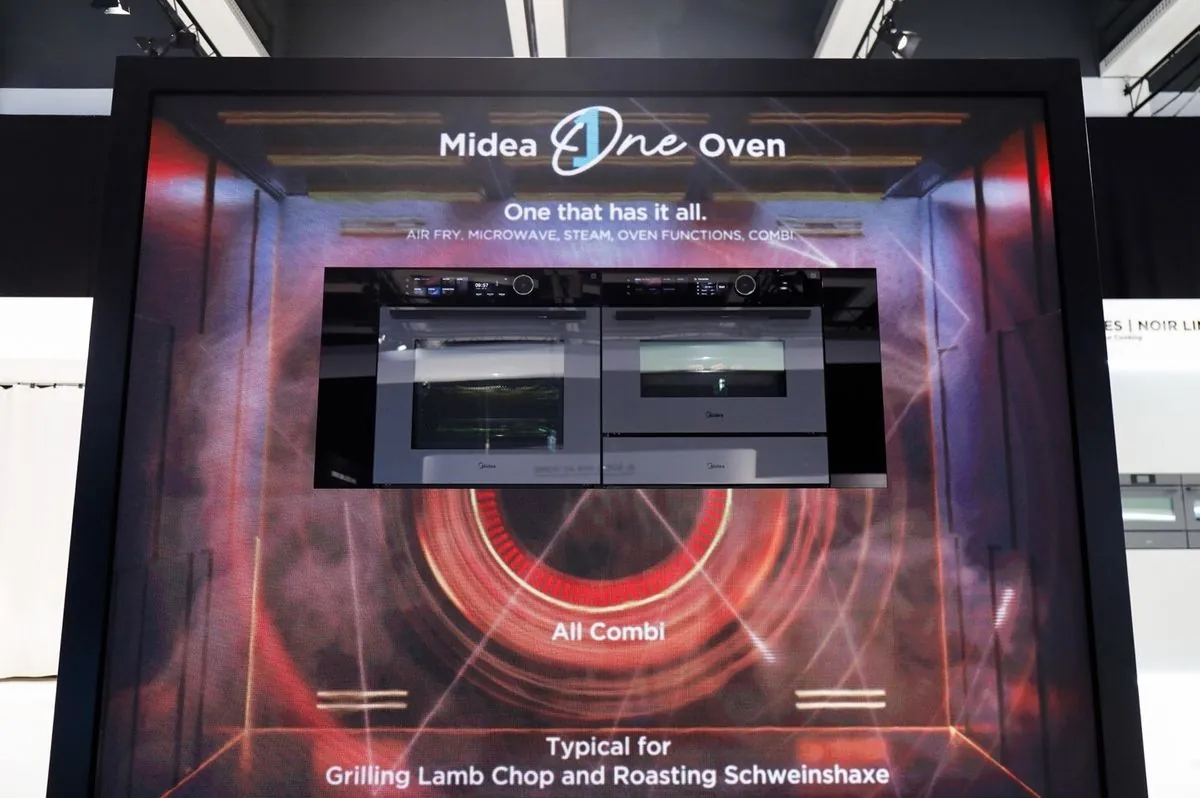

As Midea embarks on this new chapter, it faces both opportunities and challenges. The company's strong R&D capabilities, with centers in China, the United States, Japan, Italy, and Germany, position it well for continued innovation. Additionally, Midea's commitment to sustainability, aiming to significantly reduce carbon emissions by 2030, aligns with growing global environmental concerns.

The success of this listing not only benefits Midea but also revitalizes Hong Kong's IPO market, potentially paving the way for more Chinese companies to consider dual listings or overseas expansions. As the global economy navigates uncertain waters, Midea's strategic move may serve as a blueprint for other ambitious Chinese corporations seeking to strengthen their international presence.