MSCI's ESG Growth Slows: A Barometer for Sustainable Finance Trends

MSCI's ESG segment faces growth challenges amid broader sustainable finance headwinds. Despite slowing revenue, the company remains committed to ESG, citing long-term opportunities in the evolving market landscape.

MSCI Inc, a leading provider of investment decision support tools, is experiencing a slowdown in its Environmental, Social, and Governance (ESG) segment growth, reflecting broader challenges in the sustainable finance sector. This trend offers investors a unique opportunity to gauge the future of ESG investing.

The New York-based company, known for its extensive index business, has seen its ESG and Climate segment's operating revenue growth decline from 50% in Q1 2022 to 12% in Q2 2024. This deceleration is attributed to various factors, including political pushback, regulatory uncertainties, and underperformance of ESG-related investments.

Despite these challenges, MSCI remains committed to its ESG initiatives. Andrew Wiechmann, MSCI's CFO, emphasized the long-term potential in sustainable investing during a recent financial conference. He stated, "We think there's a long way to go," acknowledging that growth may not be linear quarter-to-quarter.

MSCI's position in the ESG market is significant, holding a 25% share of the $1.9 billion ESG data provider market in 2023. The company serves approximately 7,000 clients globally and employs over 6,000 staff as of June 30, 2024. Notably, asset management giant BlackRock accounts for 10% of MSCI's operating revenue, primarily through fees on ETFs and other index-based products.

"We can't lose sight of how big the opportunity is in sustainable investing and climate investing, and climate considerations across broader financial services. And we're early in that journey."

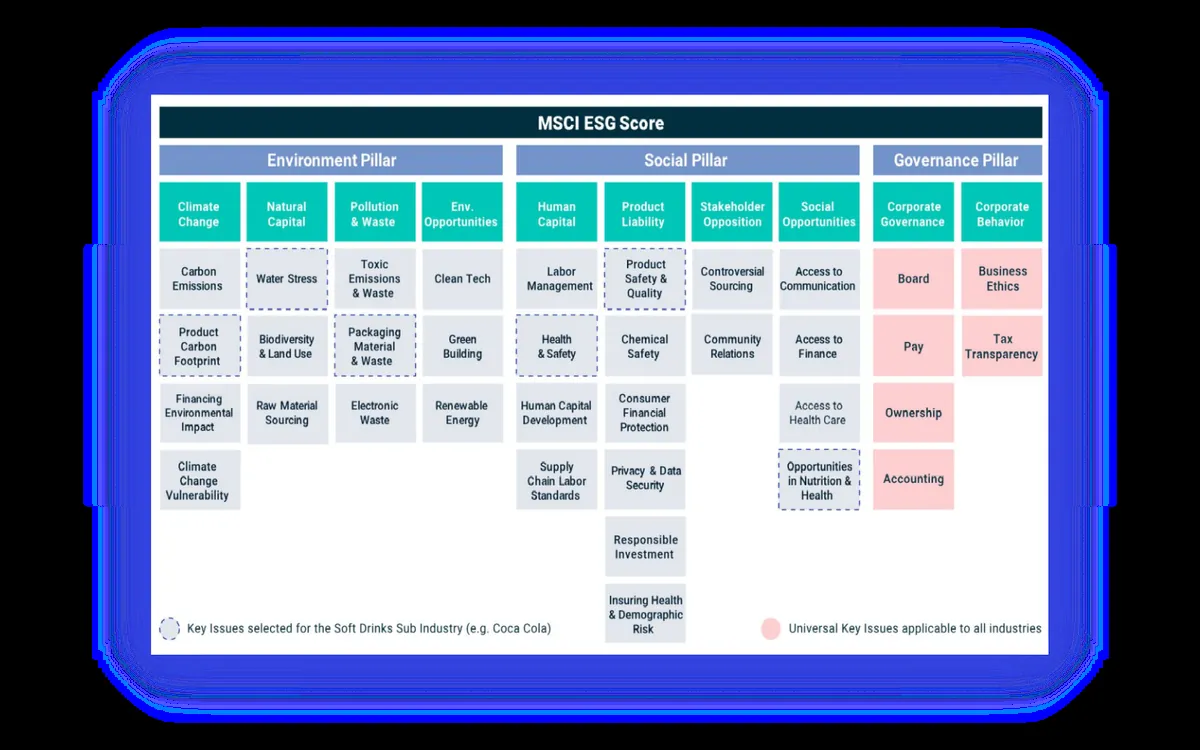

The company has been expanding its ESG offerings since launching its first ESG index in 2010. MSCI's ESG ratings now cover over 8,500 companies globally, using a scale from AAA to CCC. These ratings are utilized by more than 1,300 investors worldwide, highlighting the widespread adoption of MSCI's ESG tools.

In July 2024, MSCI formed a partnership with Moody's Corp, granting the latter access to MSCI's ESG data for products aimed at banking, insurance, and corporate customers. This collaboration underscores the ongoing demand for comprehensive ESG data and analysis.

The regulatory landscape plays a crucial role in shaping the ESG market. While European Union regulations have pushed for more precise ESG claims, U.S. regulators have delayed finalizing rules on corporate climate disclosures and ESG fund reporting. This regulatory uncertainty contributes to the challenges faced by MSCI and other ESG-focused companies.

As MSCI's stock performance remains flat in 2024, compared to the S&P 500's 15% gain, investors are reassessing the value of ESG-related businesses. However, MSCI's diverse index offerings and its position as a key player in the ESG data market suggest that its performance may continue to serve as a barometer for the broader sustainable finance trend.