Oil Markets Brace for Potential Israeli Strike on Iran's Energy Sector

As tensions escalate in the Middle East, oil markets react to speculation about Israel targeting Iran's oil facilities. The potential impact on global oil supply and prices remains uncertain.

The global oil market is on high alert as speculation mounts regarding Israel's potential retaliation against Iran's recent missile attack. The focus has shifted to Iran's oil industry as a possible target, causing ripples in the energy sector.

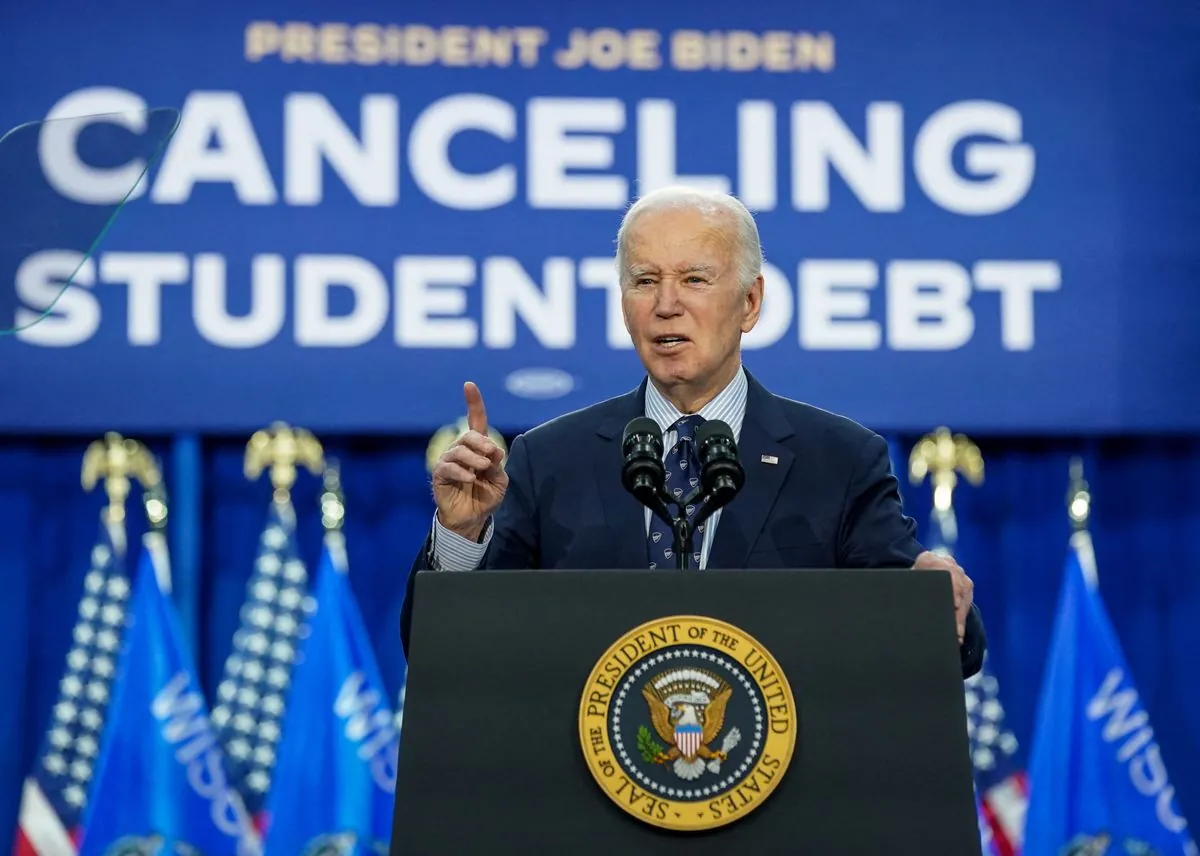

President Joe Biden's recent comments have fueled this speculation. When questioned about Israel's plans to potentially strike Iran's oil facilities, Biden stated, "We're discussing that." This remark, while seemingly dismissive, did not outright reject the possibility, unlike his previous stance on targeting Iran's nuclear installations.

The oil market's response was swift. Brent crude, the global benchmark, surged to nearly $78 per barrel, marking a 5% increase. This reaction stands in stark contrast to the market's previous indifference to escalating tensions in the Middle East.

Interestingly, the oil market has remained relatively calm since the Hamas attack on Israel on October 7, 2023, despite ongoing conflicts in Gaza, Lebanon, and the Red Sea. This stability can be attributed to a well-supplied market, with OPEC+ working to cap production amid lackluster global demand.

The potential impact of an Israeli strike on Iranian oil facilities depends on several factors:

- The specific targets chosen

- Iran's potential retaliation

- The response of other major oil producers

An attack on Kharg Island, Iran's primary oil export terminal, could significantly disrupt Iran's ability to export its daily 1.7 million barrels of oil. This could potentially drive oil prices into the mid-$80s per barrel range. Alternatively, targeting Iran's domestic refining complexes, such as the Abadan Refinery, would primarily affect Iran's internal market.

Iran's potential retaliation is another critical factor. The country could target vulnerable oil facilities in the region, particularly in Saudi Arabia and Gulf states. The most extreme option would be attempting to close the Strait of Hormuz, a vital waterway through which one-quarter of the world's tanker-shipped oil passes.

"We reserve the right to respond to any aggression against our nation's interests, including our energy infrastructure."

The role of other major oil producers in balancing the market is crucial. While countries like Saudi Arabia have spare production capacity, their willingness to use it may be limited by geopolitical considerations and their own economic interests.

As the situation unfolds, the oil market remains cautiously watchful. The current well-supplied market has dampened immediate price shocks, but the potential for significant disruption looms large. The coming weeks will be critical in determining whether the current tensions will translate into tangible impacts on global oil supply and prices.