PDD Holdings Misses Q2 Revenue Estimates Amid Chinese Economic Challenges

PDD Holdings reports lower-than-expected Q2 revenue as Chinese consumer spending weakens. Shares drop 14% premarket amid economic uncertainties and intensifying e-commerce competition.

PDD Holdings, the parent company of Chinese e-commerce platform Pinduoduo, reported disappointing second-quarter revenue figures on August 26, 2024, falling short of market expectations. The company's performance reflects the ongoing challenges in the Chinese economy and the increasingly competitive e-commerce landscape.

PDD's revenue for Q2 2024 reached 97.06 billion yuan ($13.64 billion), missing analysts' projections of 100 billion yuan. This shortfall led to a significant 14% decline in the company's shares during premarket trading, highlighting investors' concerns about the firm's growth prospects.

The underwhelming results can be attributed to several factors affecting the Chinese market:

- Fragile economic conditions

- Persistent weakness in the property sector

- High unemployment rates

These issues have prompted Chinese consumers to exercise caution in their spending habits, impacting the retail and e-commerce sectors.

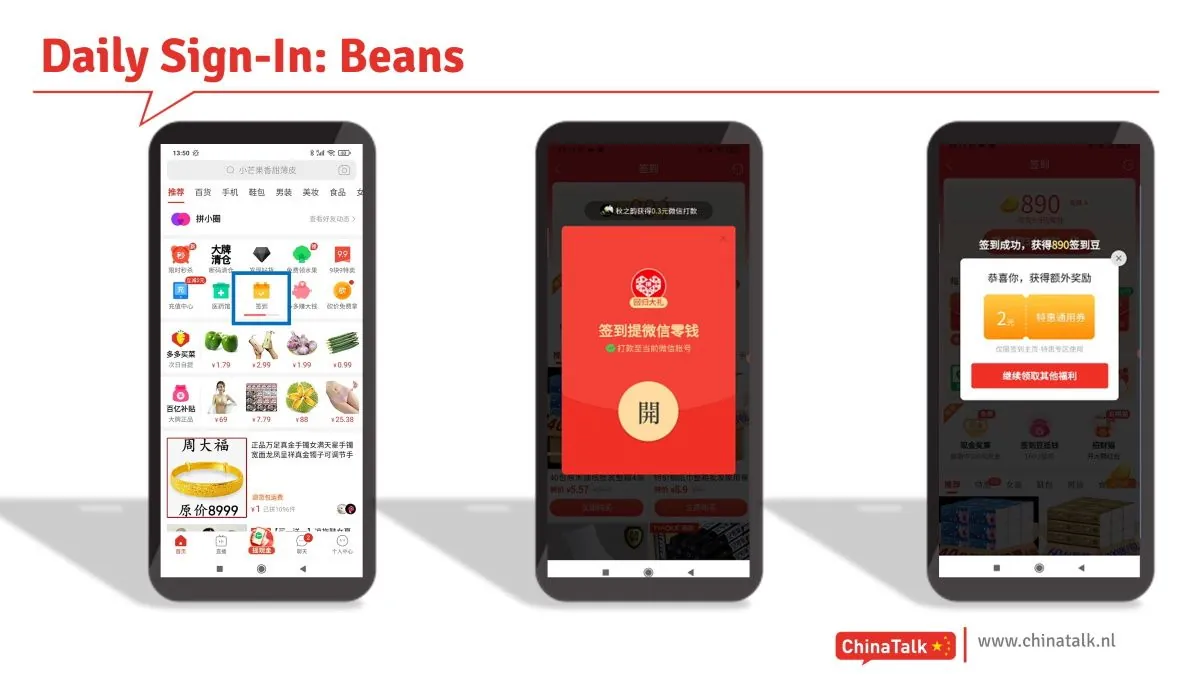

Despite the challenges, Pinduoduo's strategy of offering low prices and substantial discounts on a wide range of products, from groceries to electronics, has continued to attract cost-conscious shoppers. This approach has been crucial in maintaining the platform's user base, which exceeded 700 million active buyers in 2023.

Jun Liu, vice president of finance at PDD, acknowledged the difficulties ahead, stating:

"Looking ahead, revenue growth will inevitably face pressure due to intensified competition and external challenges... Profitability will also likely be impacted as we continue to invest resolutely."

The company's commitment to ongoing investments suggests a focus on long-term growth despite short-term pressures. This strategy aligns with PDD's history of innovation, including its investments in AI, big data technologies, and expansion into new areas such as online grocery services and international markets through its Temu platform.

PDD's situation mirrors the broader challenges faced by China's e-commerce giants. Alibaba recently missed its revenue estimates, while JD.com reported a mere 1.2% growth in quarterly revenue. These results underscore the intensifying competition in the Chinese e-commerce sector and the impact of economic headwinds on consumer spending.

Founded in 2015, PDD Holdings has rapidly ascended to become a major player in Chinese e-commerce, disrupting the dominance of established giants like Alibaba and JD.com. The company's innovative "team purchase" feature and direct farmer-to-consumer connections have set it apart in the market. However, as the economic environment becomes more challenging, PDD will need to navigate carefully to maintain its growth trajectory and market position.

As the company continues to invest in areas such as rural revitalization, autonomous driving, and smart logistics, it remains to be seen how these initiatives will contribute to overcoming the current economic hurdles and drive future growth in an increasingly competitive landscape.