RBI Expected to Cut Rates by 50 bps, Likely Starting in December

Economists predict a modest 50 basis point rate cut by RBI over six months, with the first reduction expected in December. Stable inflation and strong economy support the central bank's cautious approach.

The Reserve Bank of India (RBI) is anticipated to implement a modest 50 basis point reduction in interest rates over the next six months, according to a recent Reuters poll of economists. The majority of experts believe the central bank will likely initiate this process in December rather than October.

India's inflation has remained below the RBI's medium-term target of 4.0% for two consecutive months as of August 2024. While a slight increase is expected in the coming months, inflation has stayed within the 2%-6% comfort zone for nearly a year and is projected to remain there until mid-2026.

Most economists assert that the RBI will not rush to follow the U.S. Federal Reserve's recent 50 basis-point cut, citing India's robust domestic economy and stable currency as key factors. The median forecasts for the repo rate have remained unchanged in Reuters polls since April 2024.

The poll, conducted from September 17-26, 2024, revealed that over 80% of economists (63 out of 76) predict the RBI will maintain the repo rate at 6.50% at the conclusion of its October 7-9 meeting. Twelve experts forecast a 25 basis-point cut, while one anticipated a reduction to 6.15%.

It's worth noting that the RBI, established on April 1, 1935, is the 27th oldest central bank globally. Since its nationalization on January 1, 1949, following India's independence, the bank has played a crucial role in managing the country's monetary policy.

Suman Chowdhury, an economist at Acuite Ratings, explained the RBI's cautious approach: "The reason why the RBI will not be in a hurry, unlike the Fed who had to go for a cut, is because the Indian economy is still on a very strong wicket. With food inflation showing signs of coming down and for the next few months likely to behave better compared to last year, I see the likelihood of the cut in December."

The RBI's current governor, Shaktikanta Das, the 25th person to hold this position, recently emphasized the importance of not being swayed by temporary dips in inflation. This statement has led many to conclude that the central bank will require several more readings of benign inflation before considering rate cuts.

Some uncertainty surrounds the upcoming monetary policy decisions due to the impending appointment of three new external members to the Monetary Policy Committee, as the terms of current members expire on October 4, 2024. The RBI's Monetary Policy Committee, established in 2016, consists of six members, including the governor, and conducts bi-monthly policy reviews.

"It is important to not get carried away by some dips in inflation."

Median forecasts indicate a quarter-point cut in the next quarter, with nearly 60% (41 of 71) of economists expecting rates to be at 6.25%. However, just under a third (22) anticipate rates remaining at 6.50%, while the rest (8) project rates at 6.15% or lower.

The RBI is expected to implement another 25 basis-point cut in February 2025, bringing the repo rate to 6.00%. This pace is considerably slower than the Federal Reserve's projected cuts of 50 basis points in the next three months and 100 basis points in 2025.

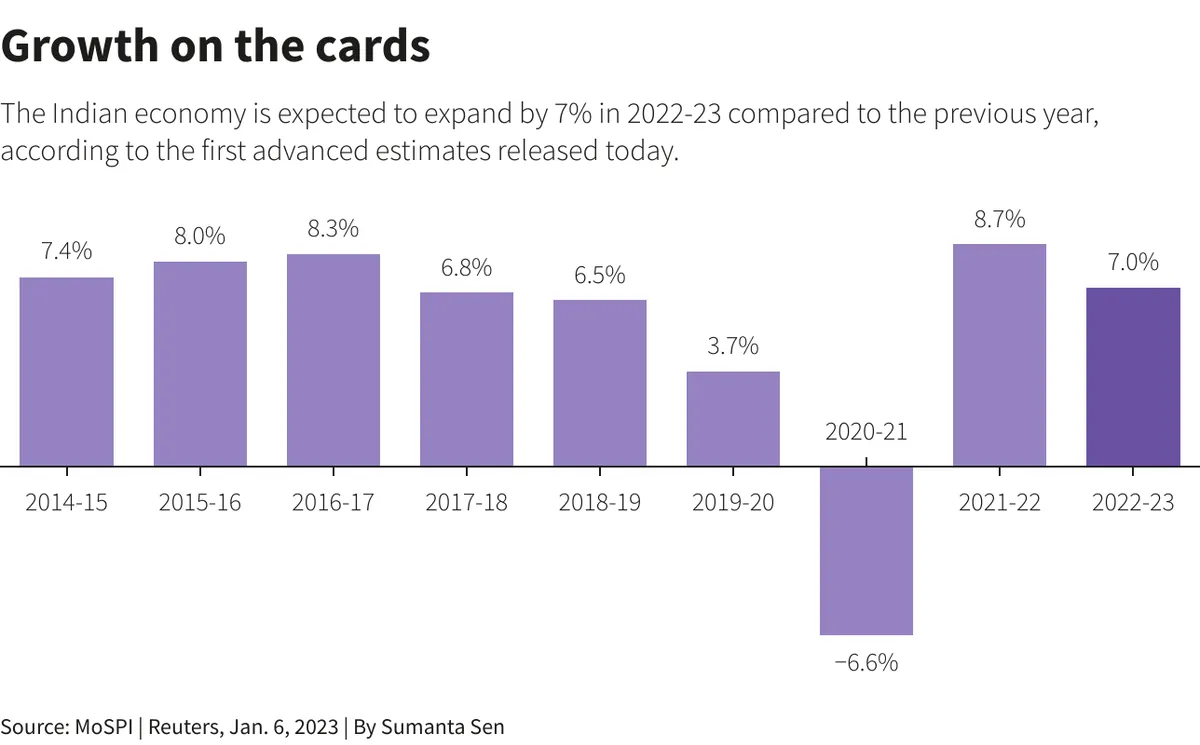

Despite the recent decline, inflation is forecast to rise again, averaging 4.5% in the current fiscal year and 4.3% in the next. India's economy is projected to grow by 6.9% this fiscal year, a moderation from the 8.2% growth in FY 2023-24, but still maintaining its position as the fastest-growing major economy.

As the RBI navigates these economic challenges, it continues to manage India's foreign exchange reserves, which are among the world's largest, and oversees crucial financial systems such as the Real Time Gross Settlement (RTGS) for large-value fund transfers.