SEBI Probes Paytm's IPO: Founder's Shareholder Status Under Scrutiny

India's market regulator issues notices to Paytm's founder and board over alleged misrepresentation in 2021 IPO. Controversy centers on Vijay Shekhar Sharma's shareholder classification, impacting stock price.

India's Securities and Exchange Board (SEBI) has initiated an inquiry into Paytm's 2021 initial public offering (IPO), focusing on potential misrepresentation of facts. The regulatory body has issued show-cause notices to Vijay Shekhar Sharma, the founder of Paytm, and other board members who held positions during the company's public debut.

The investigation centers on Sharma's classification as a public shareholder rather than a large shareholder. This categorization allowed him to receive shares through employee stock ownership plans (ESOPs), a practice SEBI is scrutinizing. The regulator's actions have had an immediate impact on Paytm's stock, causing a decline of up to 8.9% following the news.

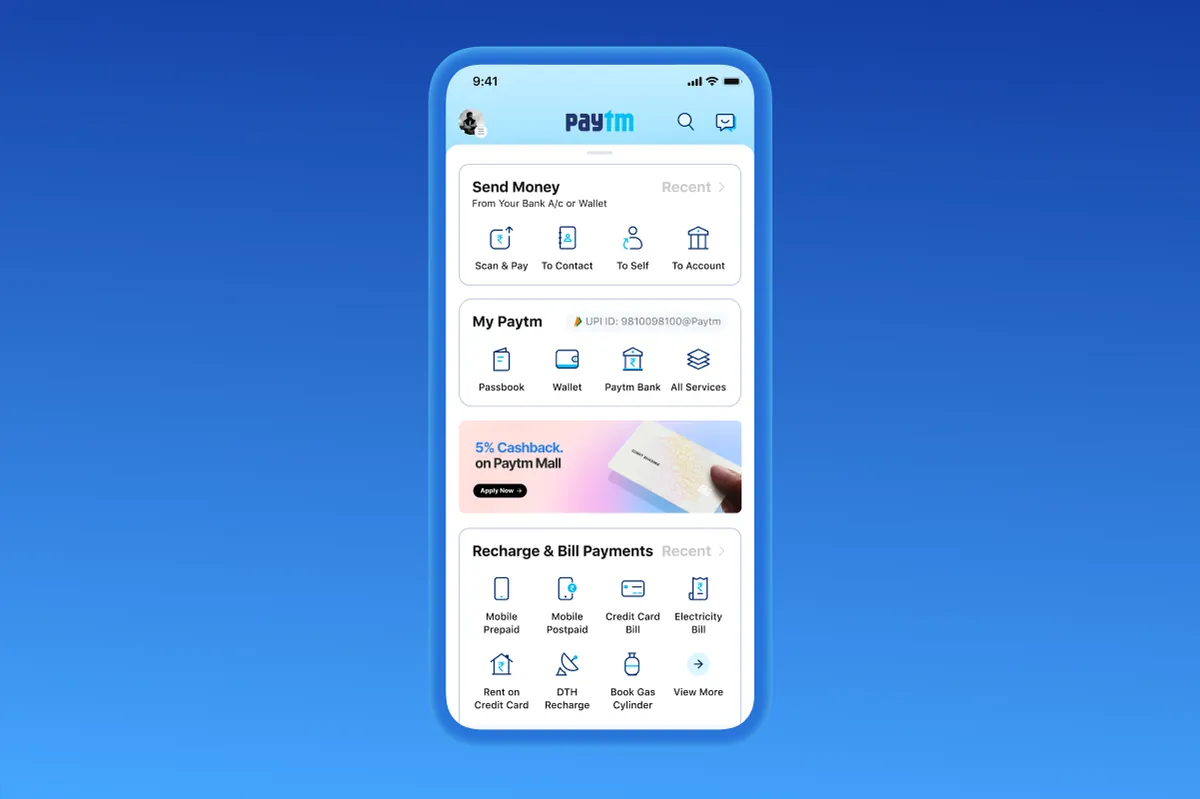

Sharma, who founded Paytm in 2010, has been a key figure in India's digital payment revolution. The company, whose full name is One97 Communications Limited, has grown from a mobile recharge platform to a comprehensive financial services provider. Paytm's user base exceeded 350 million in 2021, highlighting its significant role in India's move towards a cashless economy.

The controversy stems from Sharma's shareholding reduction prior to the IPO filing. In 2021, he decreased his stake from 14.7% to 9.1% by transferring shares to a family trust. This reduction made him eligible for ESOP benefits, as regulations prohibit shareholders with more than a 10% stake from receiving stock options in publicly-listed companies.

SEBI's investigation reflects broader concerns about founders of technology and app-based startups owning shares through ESOPs. The regulator is considering rule changes to address these issues, as reported by Reuters in March 2023. These potential amendments could significantly impact how startup founders manage their shareholdings and compensation structures.

Paytm's 2021 IPO was a landmark event, raising $2.5 billion and becoming India's largest public offering at the time. However, the company has faced regulatory challenges since its inception, with this latest probe adding to its compliance concerns.

The outcome of SEBI's investigation could have far-reaching implications for Paytm and the broader Indian startup ecosystem. It underscores the increasing regulatory scrutiny of high-profile tech companies and the complexities of navigating public markets.

As the situation unfolds, stakeholders will be closely watching for any developments that could affect Paytm's operations and the regulatory landscape for Indian startups. The case highlights the delicate balance between fostering innovation and ensuring compliance in India's rapidly evolving financial technology sector.