South African Rand Dips Amid Middle East Tensions and Strong Dollar

South African rand weakens slightly against a stable dollar due to Middle East tensions. Despite short-term setbacks, long-term outlook remains positive with expected rate cuts.

The South African rand experienced a minor setback in early trading on October 2, 2024, as global markets reacted to escalating tensions in the Middle East. At 0803 GMT, the rand traded at 17.3975 against the dollar, marking a 0.1% decrease from its previous close.

This slight weakening of the rand, South Africa's official currency since 1961, comes in the wake of an Iranian missile attack on Israel the previous day. The incident has heightened concerns about regional stability, prompting investors to seek safer assets and strengthening the US dollar.

Andre Cilliers, currency strategist at TreasuryONE, provided insight into the situation:

The rand's sensitivity to global events is not unusual for emerging market currencies. As the world's largest producer of platinum, chrome, and manganese, South Africa's economic health is closely tied to international commodity prices and geopolitical stability.

Despite the current challenges, South Africa's financial landscape remains robust. The Johannesburg Stock Exchange (JSE), Africa's largest stock market, saw its blue-chip Top-40 index rise by approximately 1.2% in early trading. This resilience underscores the strength of South Africa's financial sector, which includes major banks and insurers, and boasts a stock market capitalization exceeding $1 trillion.

However, the country's benchmark 2030 government bond showed signs of strain, with yields increasing by 19.7 basis points to 9.162%. This movement reflects the complex interplay of domestic and international factors affecting South Africa's economy, which ranks as the second-largest in Africa and 33rd globally by nominal GDP.

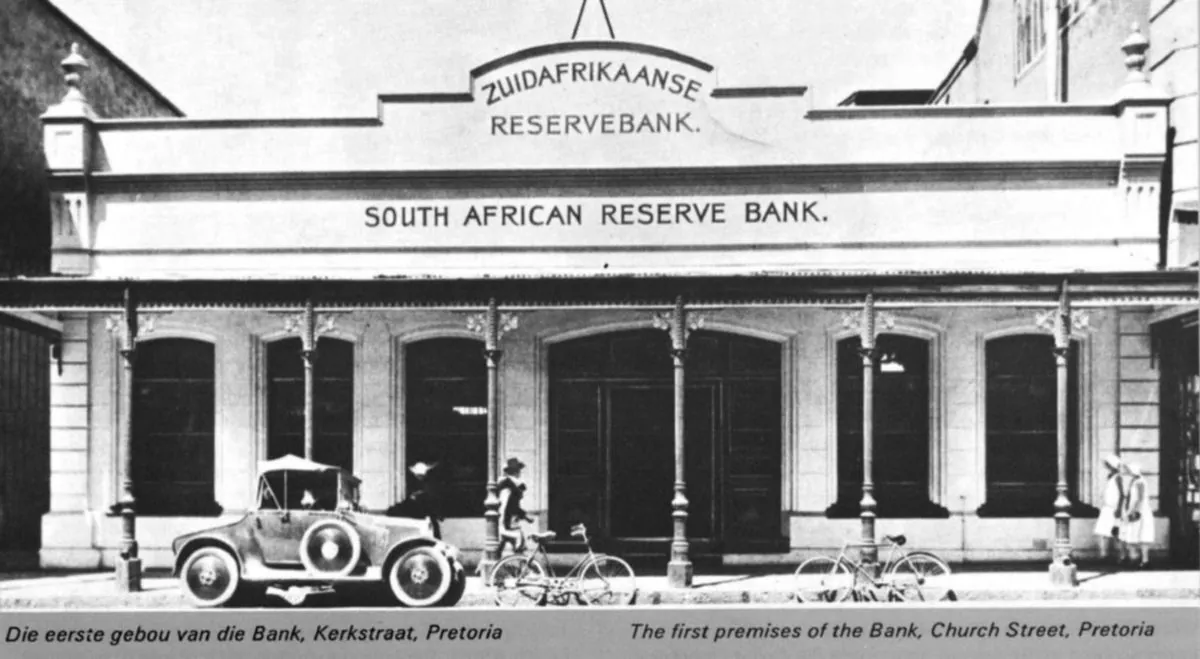

Looking ahead, analysts remain cautiously optimistic about the rand's prospects. The South African Reserve Bank, responsible for monetary policy and currency stability, is expected to implement rate cuts in the future. This approach aims to stimulate economic growth in a country facing significant challenges, including high unemployment and income inequality.

As a member of the BRICS group of major emerging economies, South Africa continues to navigate the complexities of global finance. The nation's diverse economy, which includes a thriving tourism sector and world-renowned wine industry, provides a foundation for potential growth. However, like many countries, South Africa must balance economic development with environmental concerns, particularly given its heavy reliance on coal for energy.

In the context of today's geopolitical tensions, the rand's performance serves as a reminder of the interconnectedness of global markets. As South Africa approaches the three-decade mark of its progressive constitution, adopted in 1996, the country's economic resilience will be crucial in facing both domestic and international challenges.