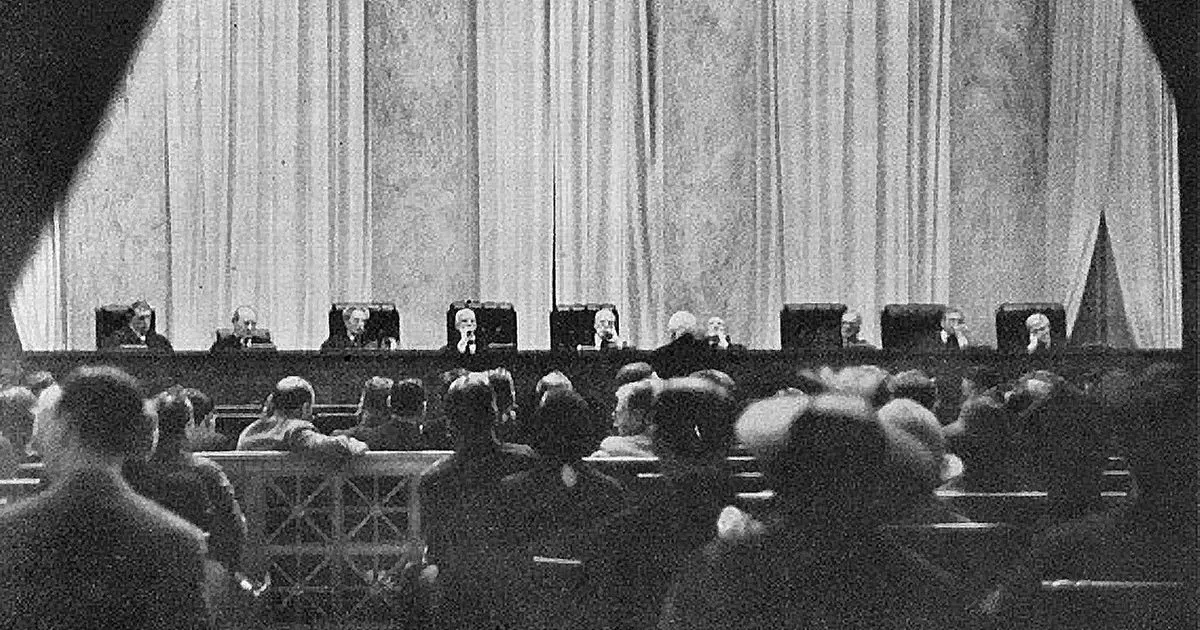

Supreme Court to Resolve ERISA Claims Dispute in Cornell Case

U.S. Supreme Court agrees to review a case involving Cornell University employees' retirement plans, aiming to settle disagreements among lower courts on ERISA claim requirements. Decision could impact future employee benefit lawsuits.

The U.S. Supreme Court has agreed to address a legal disagreement among lower courts regarding the requirements for pursuing claims under the Employee Retirement Income Security Act (ERISA) of 1974. This decision comes as the court prepares to review a case involving Cornell University employees and their retirement plans.

ERISA, enacted 50 years ago, aims to protect employee benefit rights and covers both pension and welfare benefit plans. The law prohibits employers from engaging in certain transactions with third parties unless they are necessary for plan operation and the costs are reasonable.

The case in question stems from a class action lawsuit filed on behalf of 28,000 Cornell University employees. The plaintiffs allege that the university's retirement plans paid excessive recordkeeping fees, which they claim violates ERISA's provisions. Recordkeeping is a crucial aspect of managing retirement plans, and the fees associated with this service are often scrutinized in ERISA-related lawsuits.

The legal dispute centers on the standard that plaintiffs must meet to allege prohibited transactions under ERISA. Currently, there is a split among federal appeals courts on this issue:

- At least two appeals courts have ruled that plaintiffs only need to allege that a prohibited transaction occurred.

- The 2nd U.S. Circuit Court of Appeals and three other courts have held that plaintiffs must also allege that the plan engaged in the transaction with the intent to benefit the third party.

The Cornell plaintiffs argue that the 2nd Circuit's interpretation misconstrues ERISA by placing the burden on plaintiffs to disprove exemptions to liability, rather than on defendants to prove them.

This case is part of a broader trend of ERISA lawsuits against colleges and universities that began approximately eight years ago. These lawsuits typically accuse institutions of failing to adequately monitor retirement plans, remove underperforming investments, or limit fees.

The Supreme Court's decision to hear this case is significant, as it could have far-reaching effects on legal interpretations of ERISA. The court typically hears about 80 cases per year, and its decisions can shape the landscape of employee benefit law for years to come.

It's worth noting that this is not the first ERISA case to reach the Supreme Court in recent years. In 2022, the court unanimously ruled in a case involving Northwestern University that offering a broad range of investment choices does not shield employers from claims of imprudent options with high fees.

Several universities have chosen to settle similar ERISA cases in recent years, with settlements reaching up to $13 million. However, these institutions have consistently denied any wrongdoing.

As the Supreme Court prepares to hear this case, legal experts and employee benefit professionals will be watching closely. The court's decision could potentially clarify the standards for ERISA claims and impact how future lawsuits in this area are handled.

"We are pleased that the Supreme Court accepted the case, and that it will now review our position that summary judgment should not have been granted in this case."

The Supreme Court's term begins on the first Monday in October, and a decision in this case is expected by late June or early July of the following year. As the court exercises its power of judicial review, its ruling could provide much-needed guidance on the interpretation of ERISA and the responsibilities of plan fiduciaries.