Trump Advocates for Presidential Influence on Federal Reserve Decisions

Former President Donald Trump suggests U.S. presidents should have a say in Federal Reserve decisions, potentially challenging the central bank's independence. This stance aligns with proposals from his allies for increased White House oversight.

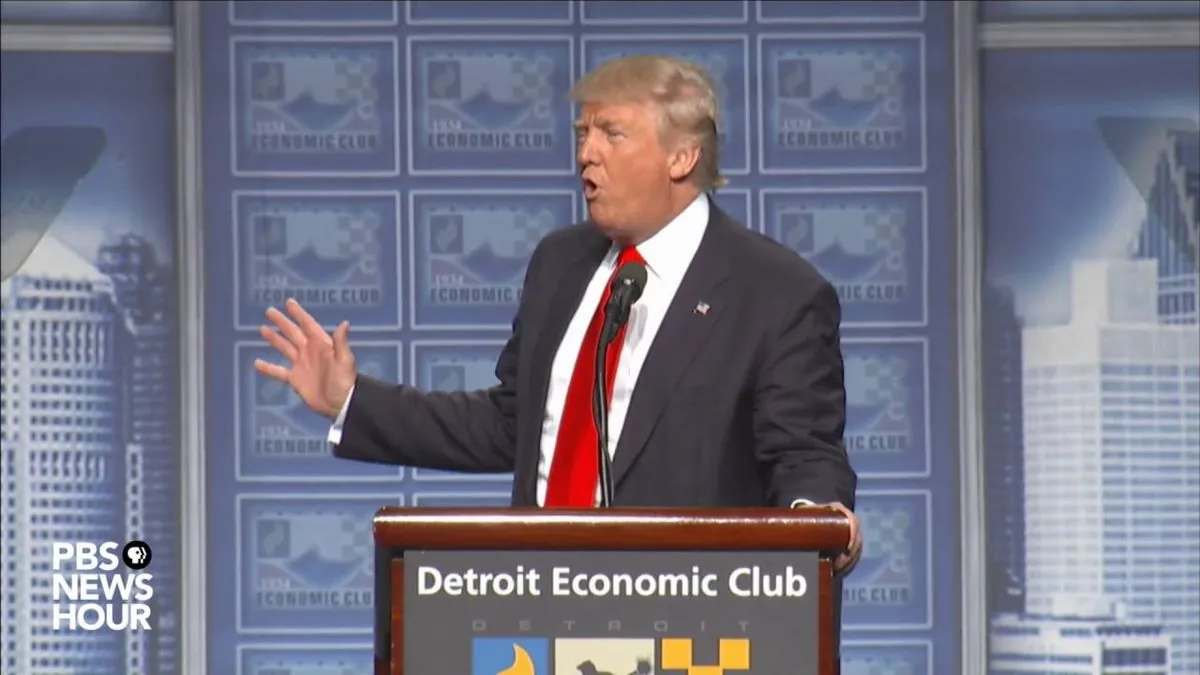

In a recent statement, Donald Trump has expressed his belief that U.S. presidents should have influence over Federal Reserve decisions, potentially challenging the central bank's long-standing independence. This declaration, made on August 8, 2024, at his Mar-a-Lago residence in Florida, aligns with proposals drafted by Trump's allies earlier this year.

The Federal Reserve, established in 1913, has maintained operational independence in setting monetary policy, a crucial factor in the U.S. dollar's status as the world's primary reserve currency. This independence, formally established by the Banking Act of 1935, has been instrumental in the Fed's ability to fulfill its dual mandate of promoting maximum employment and stable prices.

Trump argued for presidential input, citing his business acumen: "I think that in my case, I made a lot of money, I was very successful, and I think I have a better instinct than in many cases, people that would be on the Federal Reserve or the chairman."

This stance raises concerns among economists, who point to historical precedents such as the early 1970s. During that period, Fed Chairman Arthur Burns faced pressure from President Richard Nixon to maintain expansionary monetary policy despite rising inflation. By 1974, inflation had surpassed 12%, leading to a decade-long economic challenge.

The Federal Open Market Committee (FOMC), which meets eight times a year to set monetary policy, has traditionally operated without direct political interference. This independence has been crucial in maintaining the "exorbitant privilege" of the U.S. dollar, allowing the government to borrow at relatively low interest rates despite a national debt that surpassed $30 trillion in January 2022.

Trump's comments also reflect his past conflicts with current Fed Chair Jerome Powell, whom he appointed in 2018. "I used to have it out with him, I had it out with him a couple of times very strongly," Trump recalled. Despite these tensions, Trump recently stated he would not attempt to remove Powell if re-elected.

The next U.S. president will have the opportunity to nominate a new Fed Chair within their first two years in office, as Powell's term expires in 2026. This appointment could potentially reshape the Fed's approach to monetary policy and its relationship with the executive branch.

As the U.S. economy continues to navigate challenges, including the aftermath of the COVID-19 pandemic and recent interest rate hikes to combat inflation, the debate over the Federal Reserve's independence remains crucial. The Fed's decisions not only impact the U.S. economy but also influence global financial markets and economies worldwide.

"I think that in my case, I made a lot of money, I was very successful, and I think I have a better instinct than in many cases, people that would be on the Federal Reserve or the chairman."

This ongoing discussion underscores the delicate balance between political oversight and central bank independence, a topic that will likely remain at the forefront of economic policy debates in the coming years.