Trump Media Reports $16.4M Loss Amid Slow Revenue Growth

Trump Media, owner of Truth Social, disclosed a $16.4 million loss and under $1 million in quarterly revenue. The company faces financial challenges despite its high-profile public debut earlier this year.

Trump Media and Technology Group, the company behind the social media platform Truth Social, has reported significant financial losses in its recent quarterly filing. The firm, which went public earlier this year, disclosed a $16.4 million loss and revenue of less than $1 million for the second quarter of 2024, highlighting the ongoing financial challenges faced by the enterprise.

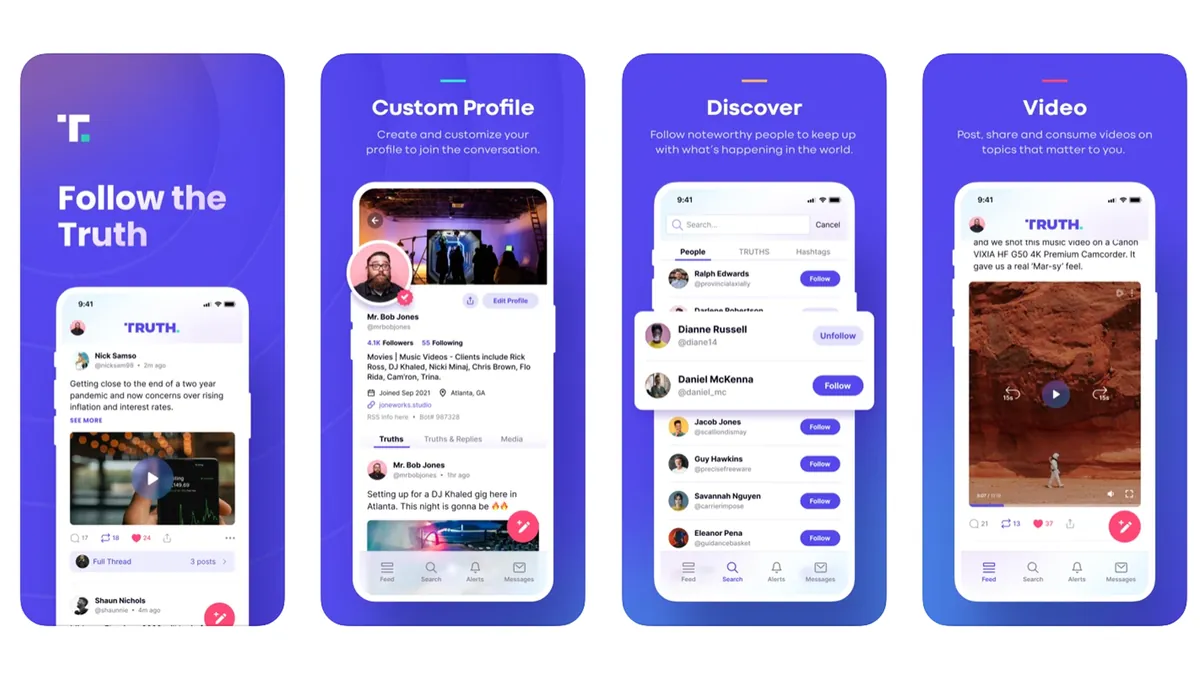

Donald Trump's media venture, launched in February 2021, has struggled to generate substantial revenue despite its high-profile status. Truth Social, created as an alternative to Twitter after Trump was banned from major social media platforms in 2021, has become a key communication tool for the former president's presidential campaign. With 7.5 million followers on the platform, Trump relies heavily on Truth Social to reach his supporters.

The company's financial struggles are not new. In April 2024, Trump Media reported a $58 million loss for the previous year, causing a significant drop in its stock price. The recent filing with the Securities and Exchange Commission (SEC) reveals that legal expenses accounted for a substantial portion of the company's losses, with $8.3 million spent on costs associated with its merger and public listing.

Despite these challenges, Trump Media is pursuing growth strategies. In August 2024, the company launched Truth+, a TV streaming platform aimed at competing with industry giants like Netflix and Disney+. CEO Devin Nunes, who resigned from Congress to lead the company in January 2022, emphasized their commitment to free speech and minimizing reliance on Big Tech.

"From the beginning, it was our intention to make Truth Social an impenetrable beachhead of free speech, and by taking extraordinary steps to minimize our reliance on Big Tech, that is exactly what we are doing."

The company's success is closely tied to Donald Trump's popularity and reputation. The SEC filing explicitly mentions this connection, stating that any diminishment in Trump's popularity could affect the company's value. Trump owns 59.9% of Trump Media's common stock, further intertwining his personal brand with the company's fortunes.

As Trump Media navigates its financial challenges, it faces scrutiny from regulators and lawmakers over its business practices and financial disclosures. The platform has also struggled to attract major advertisers compared to larger social media networks, adding to its revenue generation difficulties.

The company's journey from its founding in February 2021 to its public debut on Nasdaq in March 2024 under the ticker symbol "DJT" has been marked by both fanfare and financial hurdles. As it moves forward, Trump Media's ability to expand its user base, generate revenue, and overcome its initial setbacks will be crucial in determining its long-term viability in the competitive social media and streaming markets.