Turkey's Inflation Set to Dip Below Central Bank Rate, Economists Predict

Turkey's annual inflation expected to fall to 48.3% in September, dropping below the central bank's 50% policy rate for the first time since 2021. Economists forecast gradual decline amid persistent challenges.

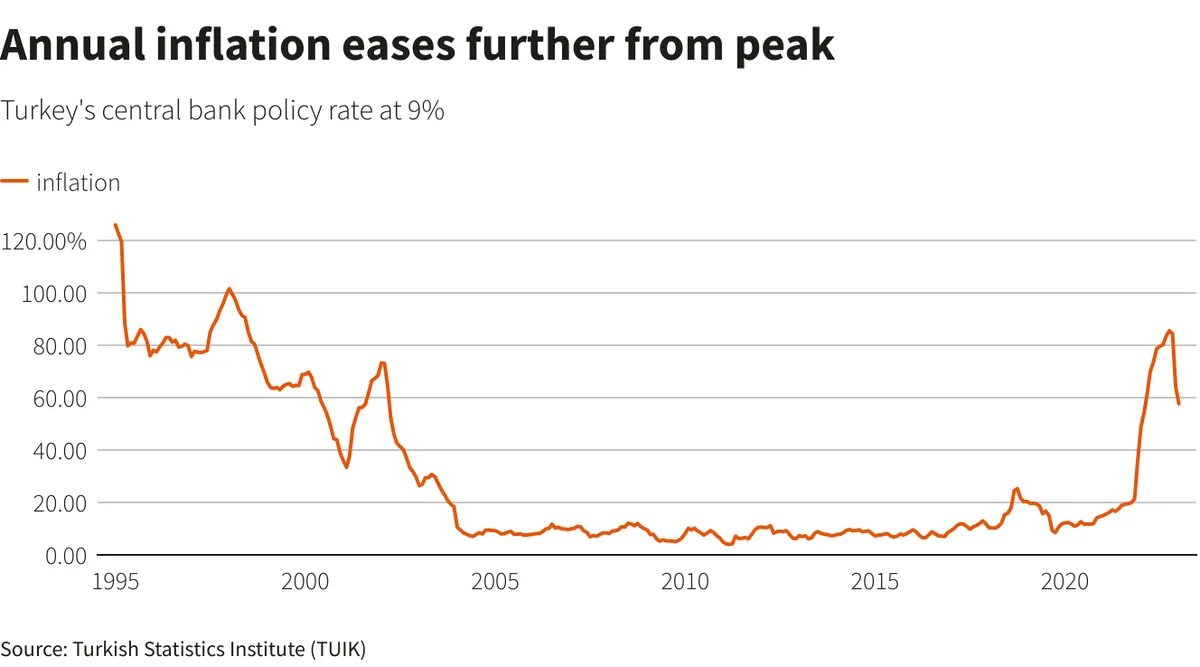

Turkey's annual inflation is projected to continue its downward trend in September, potentially falling below the central bank's policy rate for the first time in over two years, according to a recent Reuters poll. This development marks a significant shift in the country's economic landscape, as Turkey grapples with persistent inflationary pressures.

The survey, which included responses from 19 economists, indicates a median estimate of 48.3% annual inflation for September, a notable decrease from August's 51.97%. This projected decline is particularly significant as it would bring inflation below the Central Bank of the Republic of Turkey's (CBRT) current policy rate of 50%, a threshold not crossed since 2021.

Monthly inflation is anticipated to rise slightly to 2.2%, with forecasts ranging from 2% to 2.8%. This follows a pattern of fluctuating monthly inflation rates throughout 2023, influenced by various factors including wage adjustments and price updates.

Turkey, the world's 19th largest economy by nominal GDP, has been implementing a series of economic measures to combat high inflation. The CBRT has raised interest rates by a substantial 4,150 basis points since June 2022, demonstrating a commitment to monetary tightening. However, the central bank recently held its main interest rate steady at 50% for the sixth consecutive month, signaling a potential shift in strategy.

Bank of America analysts suggest an initial rate cut may occur in December, citing persistent challenges in services inflation and monthly inflation rates that have not yet aligned with the central bank's targets. The analysts note that while the real sector is experiencing economic pressure, current data indicates a soft landing rather than a severe economic downturn.

"We don't see a need for a rush to big cuts given the slow adjustment and still high level of inflation."

The CBRT aims for inflation to decrease to 38% by the end of 2023 and further to 14% in 2024. However, the government's medium-term program sets a more conservative target of 41.5% inflation by the end of 2024. The Reuters poll suggests a median estimate of 43% inflation by the end of 2023, higher than the central bank's forecast but lower than current levels.

Turkey's economy, classified as an emerging market by the IMF, faces unique challenges due to its diverse economic structure. As a major exporter of textiles, vehicles, and electronics, and a popular tourist destination, the country's economic stability is crucial for both domestic and international stakeholders.

The country's geographic position bridging Europe and Asia contributes to its economic complexity. With a young population and ambitious economic goals, Turkey aims to become one of the world's top 10 economies by 2023. However, historical experiences of economic crises, including those in 2001 and 2018, underscore the importance of managing inflation and maintaining economic stability.

As Turkey continues to navigate these economic challenges, the coming months will be critical in determining whether the current inflationary trends can be effectively managed, paving the way for sustainable economic growth and stability.