UK Fiscal Policy Shift: Balancing Investment and Debt Concerns

Britain considers fiscal rule changes to boost investment, while experts warn of borrowing risks. The government's approach to debt measurement could significantly impact borrowing capacity.

The UK government is contemplating modifications to its fiscal rules, potentially altering its approach to public borrowing and investment. This shift comes as Rachel Reeves, the finance minister, prepares to unveil her inaugural budget on October 30, 2024.

Reeves has indicated a desire to reassess the Treasury's perspective on investments, emphasizing the need to recognize benefits alongside costs. This approach marks a departure from traditional fiscal conservatism, reflecting a broader debate on the role of government spending in economic growth.

The Institute for Fiscal Studies (IFS), a non-partisan think tank established in 1969, has cautioned against unchecked borrowing increases. Isabel Stockton, a senior research economist at the IFS, stressed the importance of justifying any surge in borrowing for public investment, warning that such moves are not without risk.

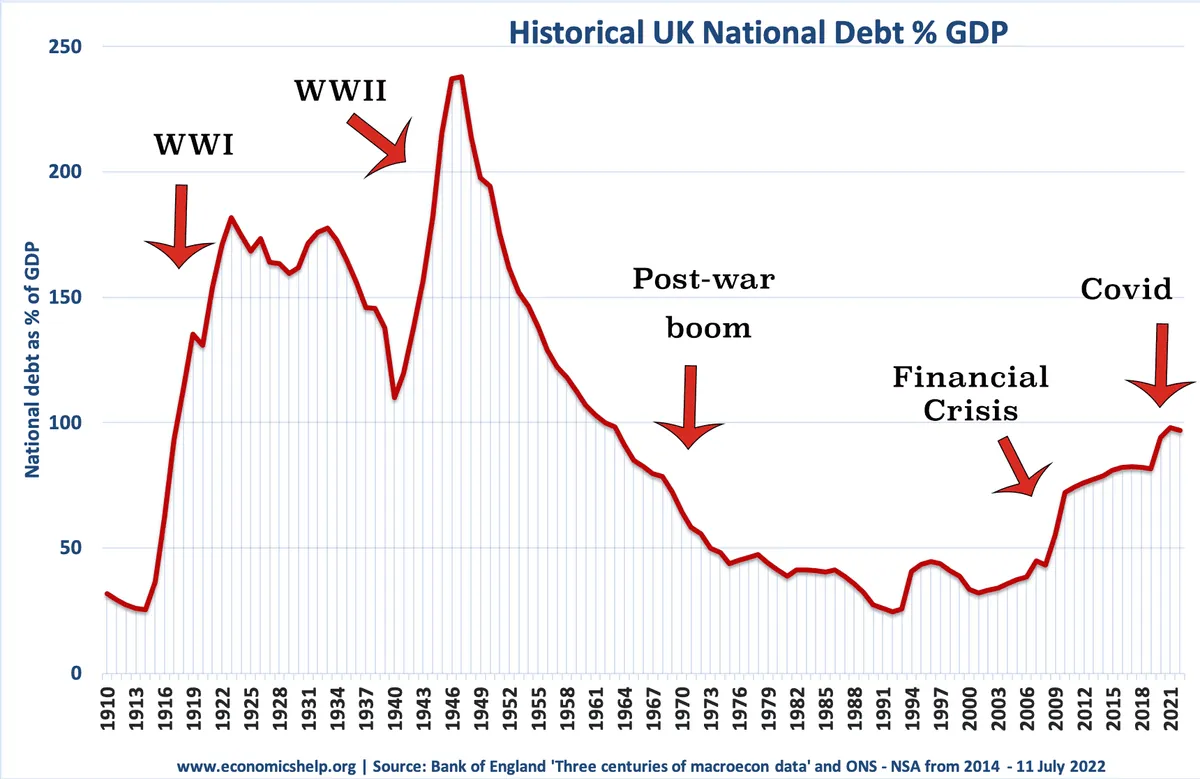

The UK's public debt has seen a significant rise, reaching 100% of annual economic output, a stark increase from 64% in 2009/10. This level of debt hasn't been seen since the aftermath of World War II when it peaked at 259%. The current debt situation underscores the delicate balance the government must strike between investment and fiscal prudence.

Reeves has committed to maintaining the existing target for public debt reduction between the fourth and fifth years of the fiscal plan. However, the method of debt measurement remains unspecified, leaving room for potential adjustments that could significantly impact borrowing capacity.

The IFS estimates that shifting to a "public sector net financial liabilities" measure could allow for an additional £53 billion in borrowing for investment. This change in measurement could provide the government with greater fiscal flexibility, but it also raises questions about transparency and market perception.

"Markets might not worry if extra borrowing was for productive investment. But on the other side, you also need to be careful to show the market that you are not just opportunistically changing the rules."

The Organisation for Economic Co-operation and Development (OECD), founded in 1961, has suggested that self-imposed fiscal targets may hinder investments crucial for long-term economic growth. This perspective aligns with a growing global debate on the role of government spending in fostering economic resilience and innovation.

Investors, however, remain cautious. Ben Nicholl, a senior fund manager at Royal London Asset Management, noted market nervousness about potential changes to fiscal goalposts and increased borrowing. This apprehension reflects the delicate balance between stimulating growth and maintaining market confidence.

As the UK navigates these complex fiscal decisions, it's worth noting that the country has maintained a continuous national debt since the 17th century. The upcoming budget presentation will be a critical moment in shaping the UK's economic trajectory, balancing the need for investment with the imperative of fiscal stability in an uncertain global economic landscape.