UK Housing Market Sees Uptick Following Bank of England Rate Cut

British estate agents report increased buyer interest after the Bank of England's recent interest rate reduction. Rightmove data shows a 19% rise in buyer enquiries compared to last year, signaling improved market sentiment.

The UK housing market has experienced a notable surge in buyer interest following the Bank of England's decision to reduce interest rates on August 1, 2024. This move, marking the first rate cut in 16 years, has positively impacted home-mover sentiment across the nation.

According to data from Rightmove, a prominent property website established in 2000, buyer enquiries in August 2024 have increased by 19% compared to the same period last year. This represents a significant jump from the 11% annual increase observed in July 2024. Rightmove, which advertises properties for over 90% of UK estate agents, serves as a reliable indicator of market trends.

Tim Bannister, a director at Rightmove, commented on the situation:

"While mortgage rates aren't yet substantially lower since the rate cut, the fact that the long-hoped-for first cut has finally arrived, and mortgage rates are heading downwards, is positive for home-mover sentiment."

The Bank of England, the world's second-oldest central bank founded in 1694, has played a crucial role in shaping the current market conditions. Andrew Bailey, the BoE Governor, has cautioned against rapid rate reductions, emphasizing the need for a measured approach.

Financial markets anticipate further rate cuts, with expectations of at least one or two additional quarter-point reductions by the end of 2024. This outlook has contributed to a decrease in mortgage rates, with the average five-year fixed-rate mortgage now standing at 4.80%, down from 5.82% a year ago.

The UK housing market, known for its regional variations and high prices compared to other European countries, has shown resilience in the face of economic challenges. The average asking price for newly advertised properties between July 7 and August 10, 2024, was £367,785 ($474,663), reflecting a typical seasonal dip of 1.5% from the previous month.

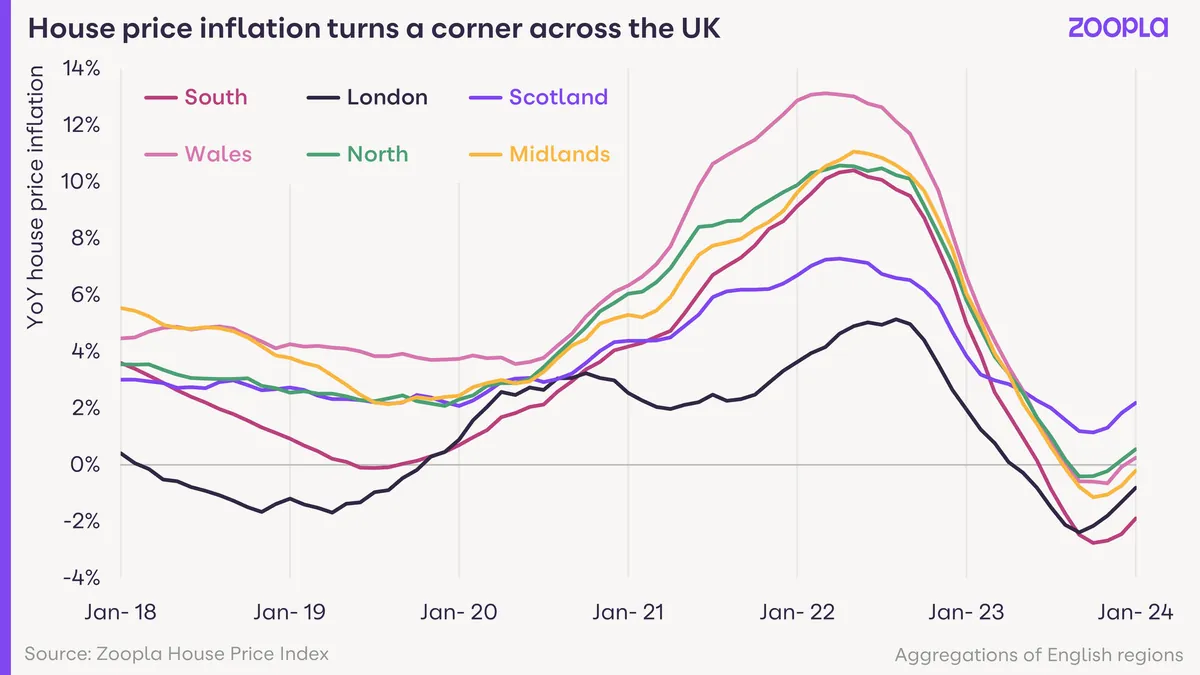

Despite this monthly decrease, asking prices were 0.8% higher than a year earlier, indicating a slight improvement from the 0.4% annual rise recorded in the previous month. Official data based on completed sales in June 2024 showed a more substantial 2.7% increase compared to the previous year, matching the highest growth rate since March 2023.

The current market dynamics are set against a backdrop of historical housing trends in the UK. The nation has experienced several housing bubbles, notably in the 1980s and early 2000s, and has one of the highest homeownership rates in Europe at approximately 65%. The government's introduction of schemes like Help to Buy in 2013 has aimed to support first-time buyers in a market where the average house price in 2023 was around £290,000.

As the UK housing market continues to evolve, factors such as urbanization, the growing private rental sector, and the country's aging housing stock will likely play significant roles in shaping future trends. The government's ongoing use of housing market performance as an indicator of overall economic health underscores the sector's importance to the UK economy.