UK Investment Sentiment Shifts as Economic Concerns Mount

Investors retreat from UK assets amid economic worries and pre-budget caution. Sterling falters and stocks turn lower as focus shifts to emerging markets and US-focused vehicles.

In recent weeks, investor sentiment towards UK assets has undergone a significant shift, with many retreating from bullish positions on Britain. This change comes as the optimism surrounding the new Labour leadership's potential to revive growth and investment is overshadowed by concerns about the debt-laden economy and potential tax hikes in the upcoming budget.

Neil Birrell, chief investment officer at Premier Miton Global Investors, recently reduced his British stock allocation in multi-asset funds from 45% to 30% of global equity holdings. This move reflects growing apprehension about the UK's economic outlook and potential budget implications.

"We have been positive on the UK for some time and had very significant exposure. But this is risk management. I was worried about the level of UK exposure we had."

The shift in sentiment is evident in recent fund flows. According to fund tracker Calastone, investors withdrew a net £666 million from UK stock funds in September 2024, while adding money to other geographically focused fund sectors, particularly US-focused vehicles.

Several factors contribute to this cautious outlook:

- Declining business and consumer confidence

- Concerns about potential tax increases in the October 30, 2024 budget

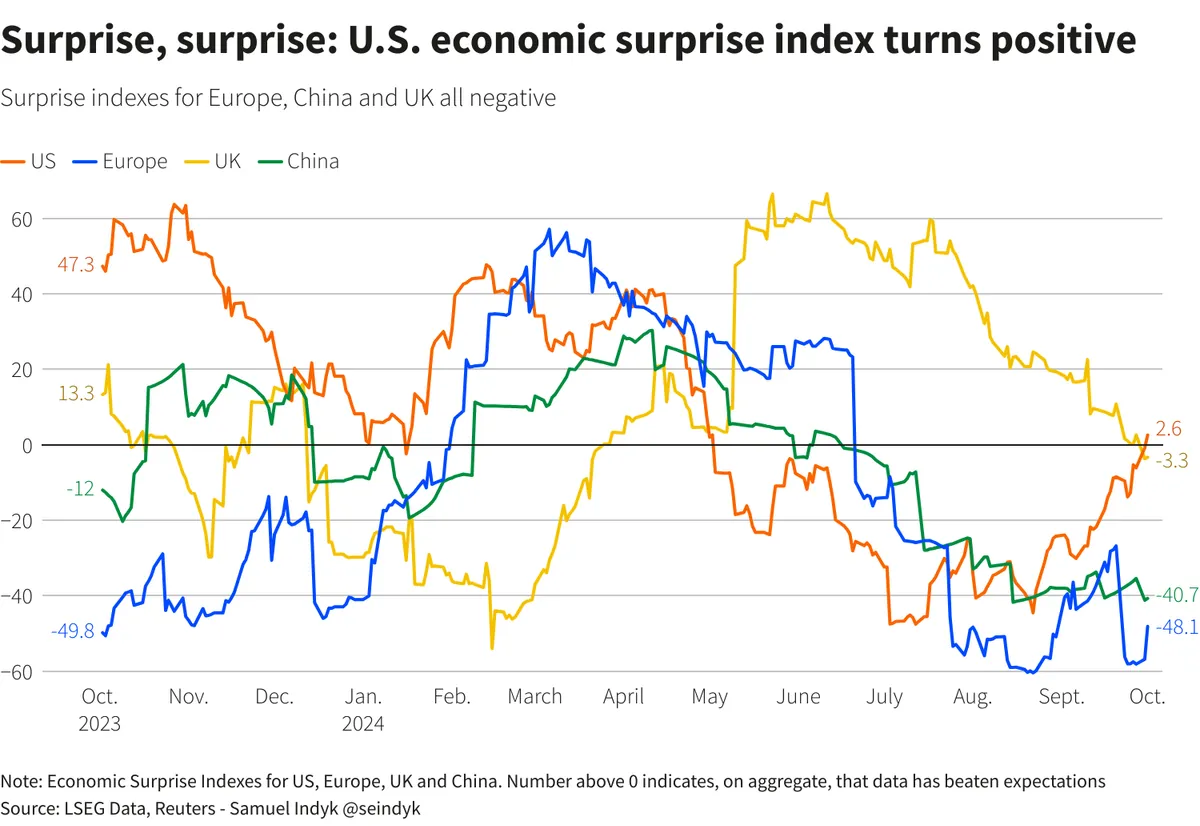

- Slowing economic growth trends

The UK's economic challenges are reflected in its stock market valuations. The FTSE 100, which comprises the 100 largest companies by market capitalization listed on the London Stock Exchange, is trading at a 46% valuation discount compared to the S&P 500, approaching a record-wide gap.

Despite these challenges, some investors see potential opportunities. James Henderson, an equity portfolio manager at Janus Henderson, plans to increase UK exposure while reducing US holdings, stating, "There's opportunities for things to turn out a little better than expected."

The UK's economic landscape is complex, with several key factors influencing investor decisions:

- The Bank of England, founded in 1694, plays a crucial role in setting interest rates.

- The UK's public debt reached £2.59 trillion at the end of the 2022-2023 financial year.

- The country's GDP in 2023 was approximately £2.37 trillion, making it the sixth-largest economy globally.

- The financial services industry contributes around 7% to the UK's GDP.

- The UK's inflation rate peaked at 11.1% in October 2022, the highest in 41 years.

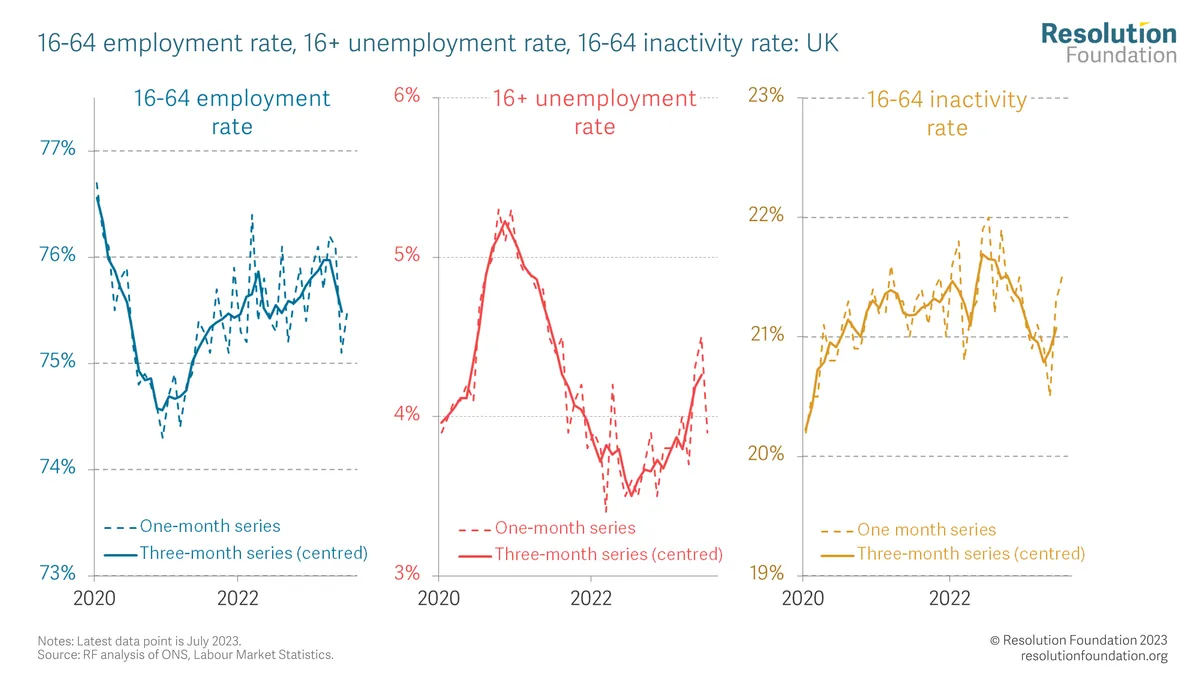

- The unemployment rate stood at 4.3% in the three months to July 2023.

As investors reassess their positions, emerging markets are gaining attention. Trevor Greetham, multi-asset head at Royal London Asset Management, has reduced UK equity holdings in favor of emerging markets, which are benefiting from Chinese stimulus measures.

The upcoming budget on October 30, 2024, is a focal point for investors. There are concerns about potential changes to inheritance tax breaks that incentivize investment in stocks listed on the Alternative Investment Market (AIM), a sub-market of the London Stock Exchange designed for smaller companies.

In the currency markets, the pound sterling, despite being this year's top-performing major currency against the dollar, is experiencing its worst weekly decline since April 2024. This shift partly reflects traders reconsidering long-held bullish positions.

As the UK navigates these economic challenges, the government and investors alike will be closely monitoring key indicators and policy decisions in the coming months. The outcome of the October budget and subsequent economic data will likely play a crucial role in shaping investor sentiment towards UK assets in the near future.