UK Regulator Proposes £85,000 Cap on Fraud Reimbursement

UK's Payment Systems Regulator suggests lowering the fraud reimbursement cap to £85,000, aiming to balance victim protection and industry concerns. The new regime is set to start on October 7, 2024.

The Payment Systems Regulator (PSR) in the United Kingdom has proposed a significant change to the fraud reimbursement system, suggesting a cap of £85,000 ($111,460) for victims of Authorized Push Payment (APP) fraud. This proposal, announced on September 4, 2024, marks a substantial reduction from the previously expected £415,000 limit.

The PSR's decision comes after a comprehensive review of over 250,000 fraud cases, revealing that only 18 instances involved scams exceeding £415,000, while 411 cases surpassed the £85,000 threshold. David Geale, the PSR's managing director, stated that the new limit would still cover the vast majority of APP scams, striking a balance between victim protection and industry concerns.

APP fraud, a scheme where criminals deceive individuals into transferring money, resulted in approximately £460 million in losses during 2023, a 5% decrease from the previous year. However, the volume of scams increased by 12%, totaling 232,429 cases, according to data from UK Finance.

Currently, banks and payment companies in the UK reimburse APP fraud victims on a voluntary basis. For instance, TSB reimbursed 88% of customer losses in 2023, while AIB refunded only 9%. The proposed regime aims to establish a more consistent reimbursement approach, encouraging the industry to invest further in scam prevention and enhance customer protection.

The banking sector has expressed concerns about high payout caps potentially attracting criminal gangs and posing risks to smaller firms. The concept of "complicit fraud," where sophisticated criminals pose as victims to claim compensation, has been a particular worry.

"The lower reimbursement cap may not provide sufficient motivation for banks to implement more sophisticated and robust fraud monitoring systems. Maintaining a high compensation level could better protect victims and keep banks on high alert to avoid paying out in the first place."

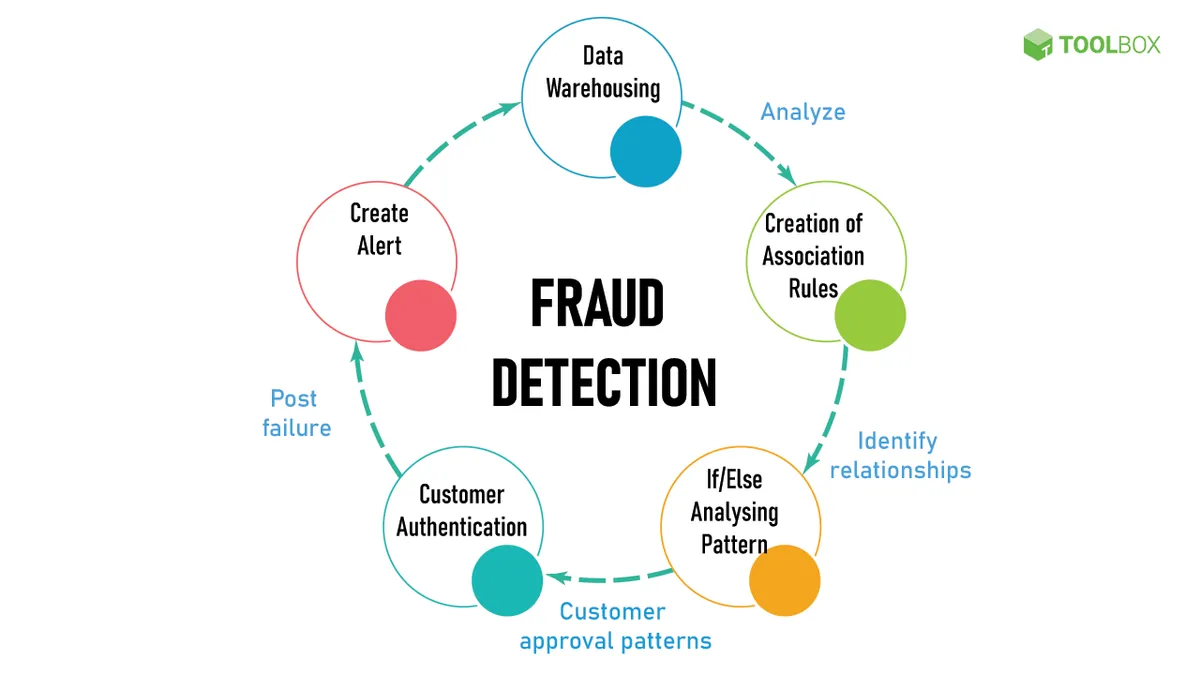

The UK has been at the forefront of developing measures to combat APP fraud, introducing initiatives such as the Contingent Reimbursement Model (CRM) Code in 2019 and the Confirmation of Payee system. These efforts, along with consumer education campaigns and advanced fraud detection technologies, have positioned the UK as a leader in fraud prevention strategies.

As the financial industry awaits the final decision, the PSR has initiated a 14-day consultation period ending on September 18, 2024. The new reimbursement regime is scheduled to take effect on October 7, 2024, potentially reshaping the landscape of fraud protection in the UK banking sector.