US Economy Resilient Despite Market Turmoil: Consumer Spending Holds Strong

Despite recent market volatility, the US economy shows resilience, driven by robust consumer spending. Economists highlight a divide between affluent consumers and those facing financial challenges.

Recent market turbulence has sparked concerns about a potential recession, but economic indicators suggest the US economy remains resilient. The primary factor contributing to this stability is consumer spending, which accounts for approximately 70% of the country's gross domestic product.

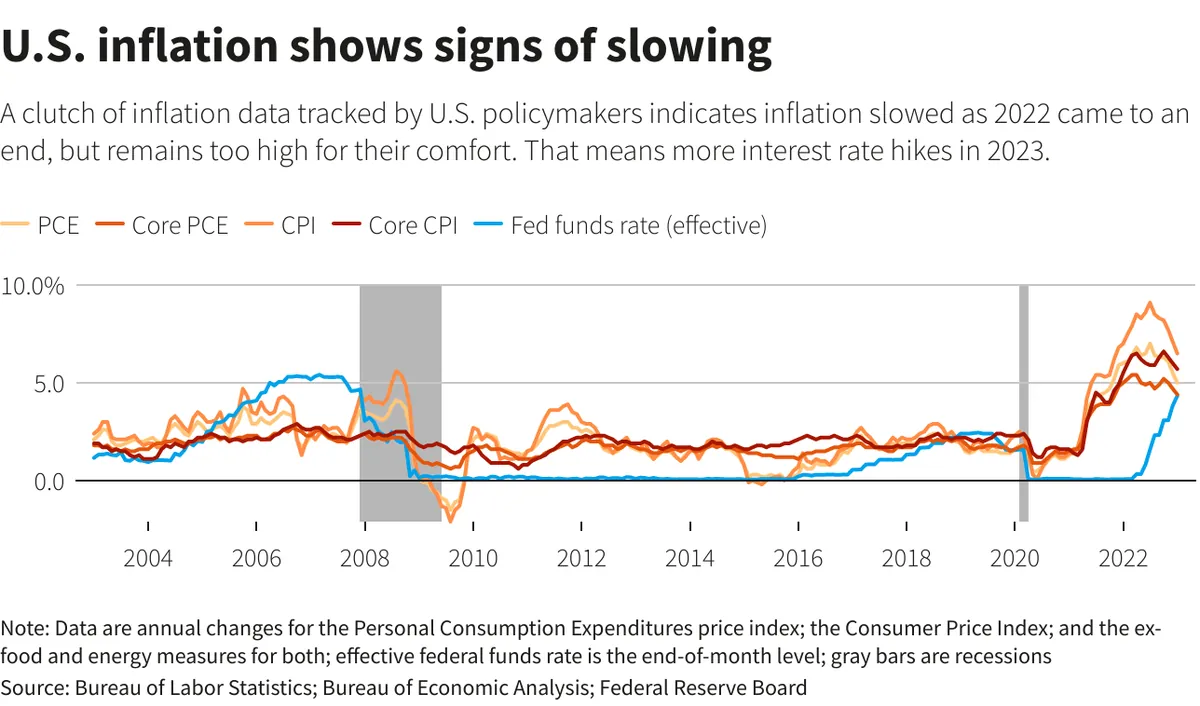

Despite facing challenges such as high inflation and steep interest rates, American households have maintained their spending habits. This trend has been particularly evident among affluent consumers, who continue to drive economic growth. However, a notable divide exists between high-income and low-income households.

Mark Mahaney, senior managing director at Evercore ISI, stated, "If I were to weigh all of the data points, I would say I have more evidence that there's a soft landing, that the consumer isn't rolling over."

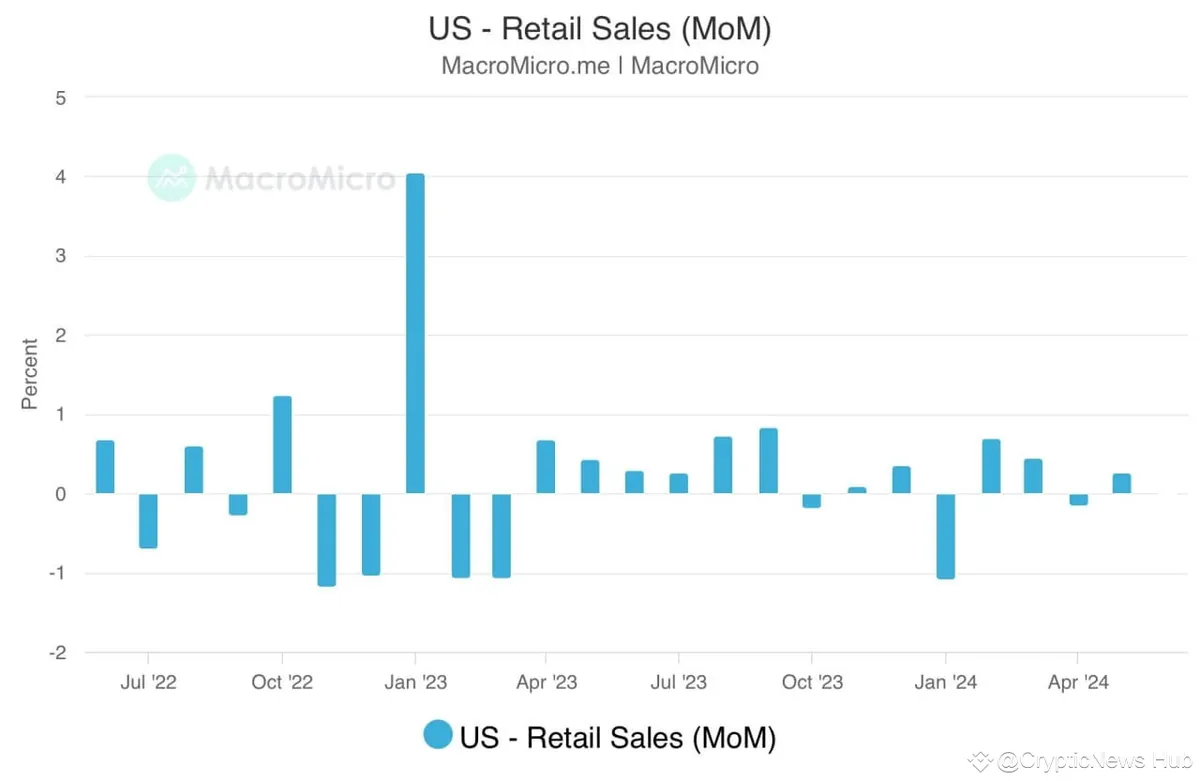

The economy demonstrated unexpected growth in the second quarter of 2024, with wages outpacing inflation. Retail sales in June 2024 showed positive trends, with online store sales increasing by almost 2% compared to the previous month. Food and drink establishments also experienced slight growth.

However, signs of financial strain are emerging among certain segments of the population. The Federal Reserve Bank of New York reported a 1.1% increase in total household debt during the first quarter of 2024. Additionally, nearly 9% of credit card balances and 8% of auto loans transitioned into delinquency on an annual basis.

Businesses are adapting to these changing consumer behaviors. In May 2024, Walmart executives noted growth among "high-end consumers" while acknowledging that many customers' pocketbooks were stretched. Similarly, Ramon Laguarta, CEO of PepsiCo, observed in July 2024 that some consumers were seeking more value in specific parts of their product portfolio.

The Federal Reserve's response to these economic developments is a subject of debate. While the Fed typically makes rate cuts in quarter-point increments, some analysts are discussing the possibility of a larger half-point cut. Goldman Sachs has forecasted rate cuts for November and December 2024, in addition to the previously expected September cut.

Constance Hunter, senior adviser at MacroPolicy Perspectives, commented on the potential impact of a larger rate cut: "If you're trying to buy any kind of financed good, that 50-basis point cut makes a huge difference."

As the economic landscape continues to evolve, policymakers and businesses alike are closely monitoring consumer behavior and its impact on the overall economy.

"In the U.S., there is clearly a consumer that is more challenged, and it's a consumer that is telling us that in particular parts of our portfolio, they want more value to stay with our brands. That is not for all the consumers. It's some consumers. That is not for all the portfolio. It's some parts of the portfolio."