U.S. Existing Home Sales Hit 12-Month Low Despite Easing Mortgage Rates

August 2024 saw U.S. existing home sales decline to a 12-month low, despite easing mortgage rates. The National Association of Realtors reports increased inventory and rising median prices amid ongoing market challenges.

The U.S. housing market experienced a downturn in August 2024, with existing home sales reaching their lowest point in nearly a year. According to data from the National Association of Realtors (NAR), sales decreased by 2.5% from July and 4.2% compared to August 2023, settling at a seasonally adjusted annual rate of 3.86 million units.

This decline occurred despite a recent easing of mortgage rates, which had previously reached a 23-year high of 7.79% in 2023. The average rate for a 30-year fixed mortgage dropped to 6.2% last week, the lowest since February 2023. However, this reduction has not yet translated into increased sales activity.

The housing market's performance fell short of economists' expectations, as reported by FactSet, which had projected sales to reach 3.9 million units. This underperformance highlights the ongoing challenges faced by the sector since the onset of the sales slump in 2022.

Despite the sales decline, the national median sales price continued its upward trajectory, marking the 14th consecutive month of year-over-year increases. In August 2024, the median price rose by 3.1% to $416,700 compared to the previous year.

Lawrence Yun, NAR's chief economist, expressed optimism about future market conditions:

"Home sales were disappointing again in August, but the recent development of lower mortgage rates coupled with increasing inventory is a powerful combination that will provide the environment for sales to move higher in future months."

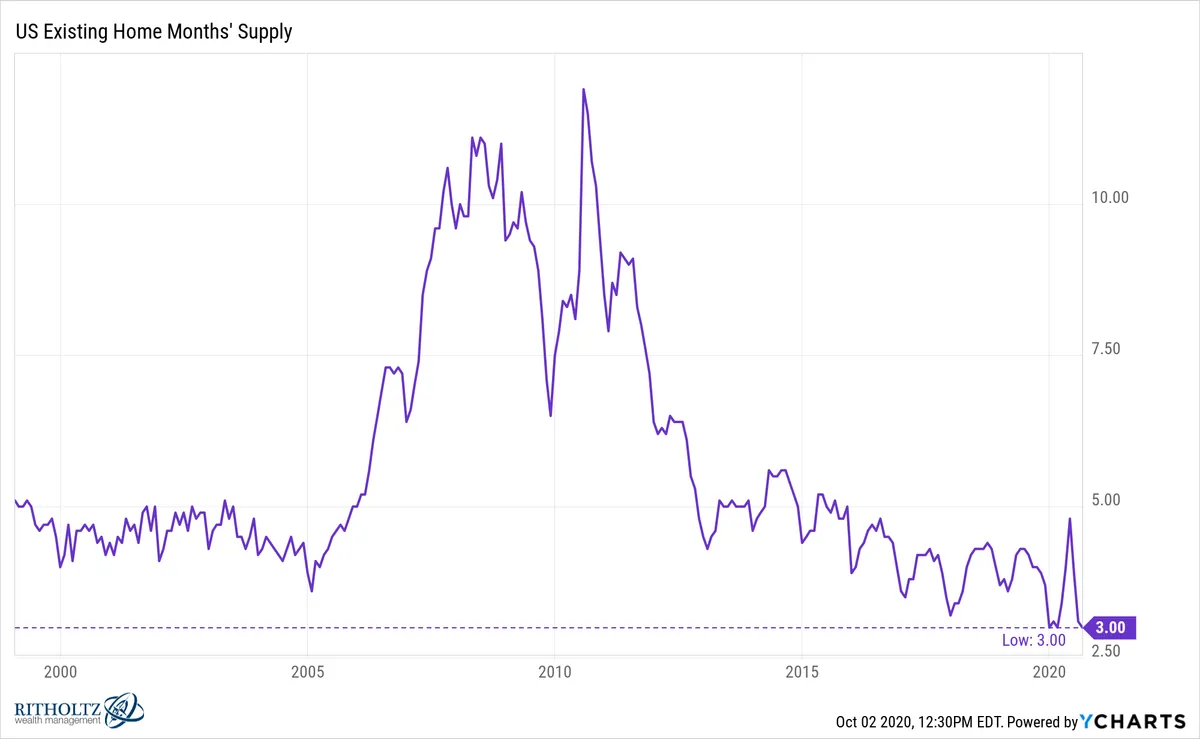

One positive development in the market is the increasing inventory of unsold homes. As of August 2024, there were approximately 1.35 million unsold properties, representing a 0.7% increase from July and a substantial 22.7% rise from August 2023. This growth in inventory translates to a 4.2-month supply at the current sales pace, up from a 3.3-month supply a year ago.

The concept of "months of supply" is crucial in assessing market balance. Traditionally, a 5-6 month supply indicates equilibrium between buyers and sellers. The current 4.2-month supply suggests a market still favoring sellers but moving closer to balance.

The housing market's performance is closely monitored as it serves as a key indicator of overall economic health. The current situation reflects the lingering effects of pandemic-era policies and subsequent economic adjustments. As the market continues to evolve, policymakers and industry professionals will be watching closely for signs of recovery or further challenges in this vital sector of the U.S. economy.