US Job Growth Significantly Lower Than Initially Reported, BLS Reveals

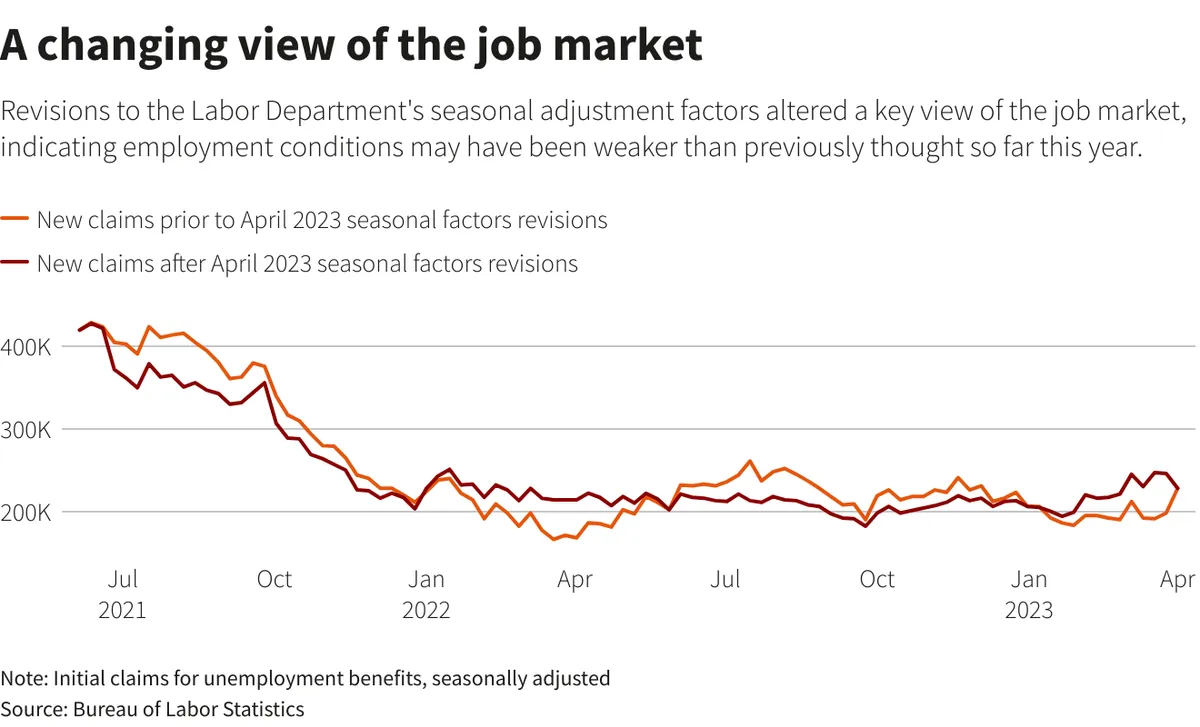

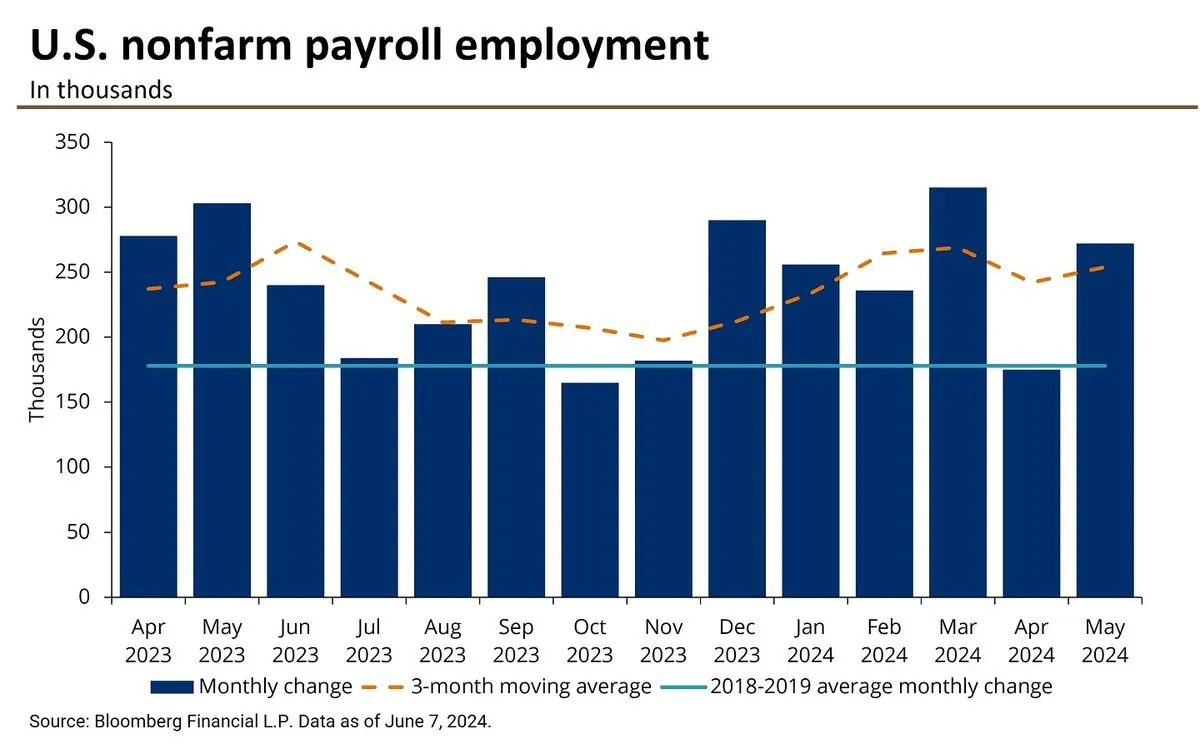

The Bureau of Labor Statistics has revised job creation figures, showing 818,000 fewer jobs created from April 2023 to March 2024. This major revision may influence Federal Reserve policy decisions.

The Bureau of Labor Statistics (BLS) has released a significant revision to US employment data, revealing that job growth between April 2023 and March 2024 was substantially lower than initially reported. This adjustment, the largest in 15 years, indicates 818,000 fewer jobs were created during this period.

This revelation comes at a crucial time, just days before the annual Jackson Hole Economic Symposium, where global policymakers and economists gather to discuss economic trends and policies. The symposium, held annually since 1978, serves as a platform for important policy discussions and announcements.

The revised figures may exert pressure on the Federal Reserve to reconsider its interest rate policy. Diane Swonk, chief economist at KPMG, suggests that the Fed may need to cut rates to maintain economic stability:

"We already knew we had been living the best of consumers being discerning but not defeated. That narrative is contingent on the labor market holding up and layoffs remaining in check. The Fed needs to cut if they want to sustain the Goldilocks scenario."

The concept of a "Goldilocks economy," referring to an ideal state of moderate growth and low inflation, has been a goal for policymakers. However, this significant data revision challenges the perception of a robust labor market, which is crucial for maintaining economic balance.

The BLS, established in 1884, regularly releases employment data and revisions. However, the magnitude of this revision is unusual and may have far-reaching implications for economic policy and market perceptions. The final figures will be confirmed in February 2025, potentially influencing long-term economic strategies.

Jerome Powell, the 16th Chair of the Federal Reserve, is scheduled to speak at the Jackson Hole symposium on August 23, 2024. His remarks are eagerly anticipated by financial markets for potential hints about future rate cuts. Powell has previously acknowledged the possibility of job data overstatement, indicating the Fed's awareness of potential discrepancies in economic indicators.

The Federal Reserve, created in 1913, plays a crucial role in maintaining economic stability through its dual mandate of price stability and maximum sustainable employment. This recent data revision presents a challenge to the Fed's understanding of current economic conditions and may influence future policy decisions.

This situation echoes past economic challenges, such as the 2008 financial crisis and the COVID-19 pandemic, which caused significant job market volatility. The unemployment rate peaked at 10% in October 2009 during the financial crisis and reached an unprecedented 14.7% in April 2020 due to the pandemic.

As the economic landscape continues to evolve, the accuracy and interpretation of employment data remain crucial for policymakers and market participants alike. The coming months will likely see increased scrutiny of economic indicators and their implications for monetary policy.