US SIF CEO Navigates ESG Investing Landscape Amid Political Challenges

Maria Lettini, CEO of US SIF, discusses the state of sustainable investing in the US compared to Europe, addressing ESG backlash and political challenges while emphasizing the industry's resilience and growth.

Maria Lettini, CEO of US SIF, an advocacy group for sustainable investing, recently shared insights on the current state of Environmental, Social, and Governance (ESG) investing in the United States. Her perspective, shaped by experiences in both the UK and US, offers a unique view of the challenges and opportunities facing the industry.

Lettini, who assumed her role approximately 15 months ago, has observed significant differences in attitudes towards sustainable investing between the US and Europe. While European investors generally embrace ESG considerations as integral to financial decision-making, the US market has faced more skepticism and political pushback.

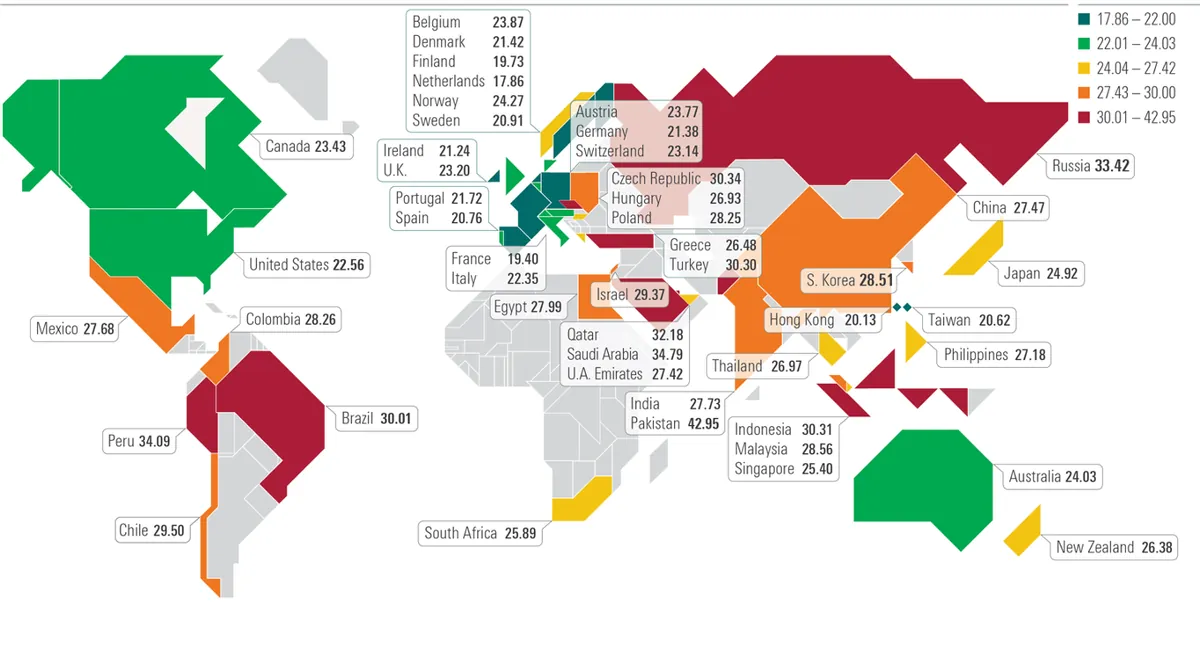

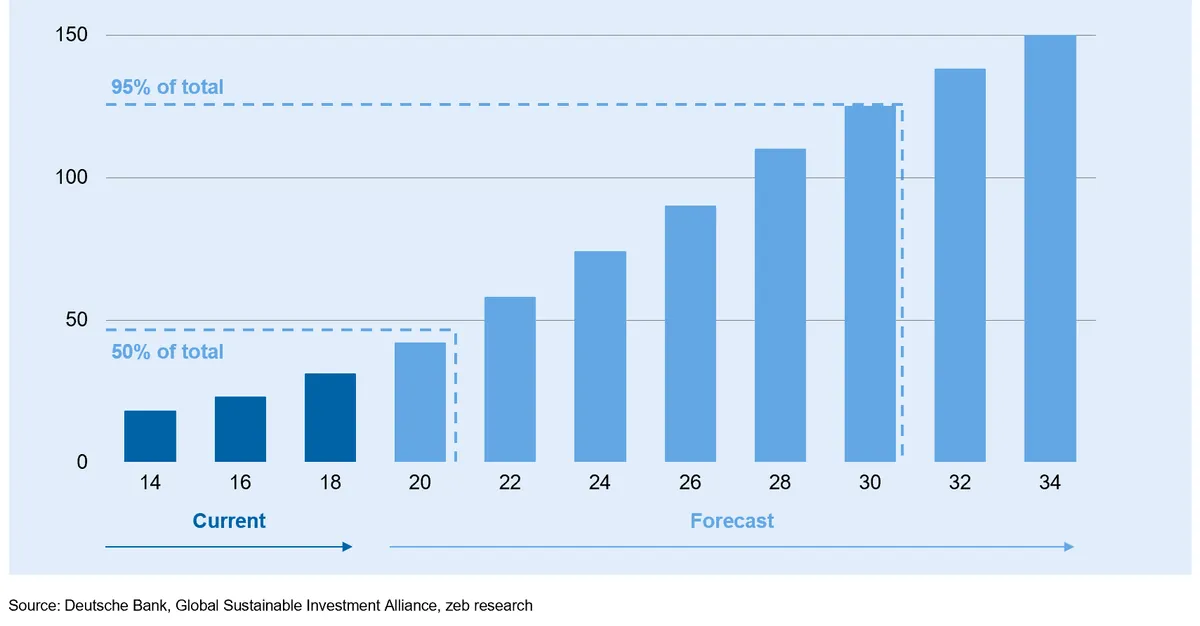

The concept of ESG investing, which emerged in the early 2000s, has grown rapidly, with global ESG assets estimated to exceed $35 trillion as of 2022. This growth has been supported by initiatives such as the UN Principles for Responsible Investment (PRI), launched in 2006, and the Global Reporting Initiative (GRI), established in 1997.

Despite this global momentum, Lettini noted a surprising level of anti-ESG sentiment in the US, particularly in Washington D.C. She attributes much of this backlash to political posturing and well-funded opposition campaigns. However, she emphasized that the market has largely remained resilient, with many investors continuing to recognize the importance of considering long-term environmental and social risks.

"At the end of the day, what the market has been really good at doing is standing up to the culture wars and staying the course."

The political landscape has presented challenges, with nearly 160 anti-ESG bills tracked across various states. However, Lettini reported that only a small number have become law, and some states are already considering rolling back these measures due to potential negative impacts on state pensions and overall business.

Looking ahead, Lettini remains optimistic about the future of sustainable investing, regardless of potential election outcomes. She emphasized that core priorities such as improved disclosure of material information and shareholders' rights are not inherently partisan issues.

The sustainable investing industry has seen significant developments in recent years, including the introduction of the EU's Sustainable Finance Disclosure Regulation (SFDR) in 2021 and ongoing debates about ESG considerations in pension fund investments. Major asset managers like BlackRock and Vanguard have also increased their focus on ESG factors.

As the industry matures, Lettini noted that US SIF members continue to deliver on client demands for sustainable investment options. She believes that investors increasingly recognize the importance of considering ESG factors for long-term resilience and leadership in the rapidly evolving global capital markets.

The conversation with Lettini highlights the complex interplay between sustainable investing principles, political pressures, and market dynamics. As the industry continues to evolve, it faces the ongoing challenge of balancing financial performance with broader environmental and social considerations, all while navigating an increasingly polarized political landscape.