Verra Rejects Chinese Rice Projects in Carbon Market Integrity Push

Verra, a leading carbon registry, has rejected 37 Chinese low-emission rice cultivation projects following a quality review. This move highlights growing scrutiny of the voluntary carbon market and efforts to ensure credibility.

In a significant development for the voluntary carbon market, Verra, the U.S.-based registry setting standards for carbon credits, has rejected 37 low-emission rice cultivation projects in China. This decision, announced on August 28, 2024, follows a comprehensive quality control review and underscores the growing scrutiny faced by the carbon offset industry.

The voluntary carbon market, valued at $2 billion in 2021, allows companies to purchase credits to offset their emissions and meet climate targets. However, environmental groups have increasingly criticized this system, arguing that it often generates "junk" credits enabling firms to "greenwash" their operations.

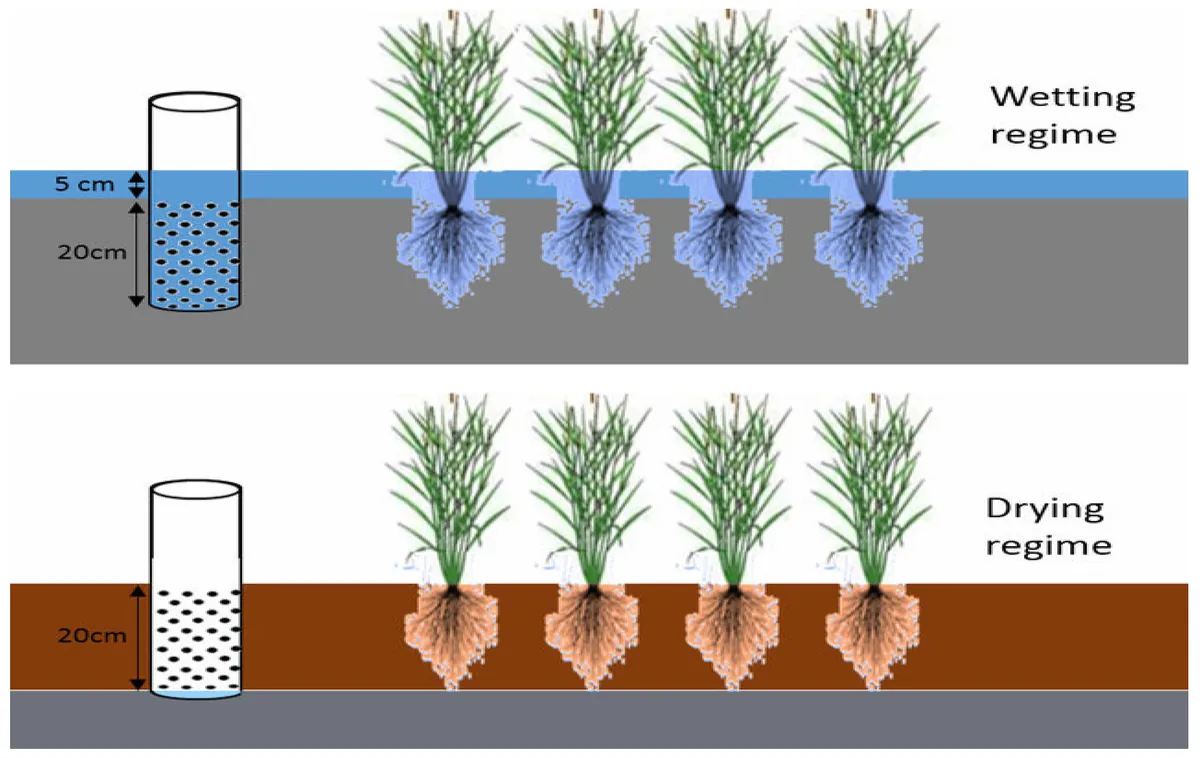

The integrity of the Chinese rice projects, which utilize alternative irrigation methods to reduce methane emissions from rice fields, was initially questioned in 2023. These projects employ the alternate wet and drying (AWD) technique, which can reduce water use by up to 30% and significantly cut methane emissions.

Verra has taken unprecedented action by permanently deactivating the methodology used to calculate credits for these projects. The organization identified serious flaws in the calculation methods, revealing that projects had overstated their size and emission reduction potential.

In response to these findings, Verra has ordered project backers to compensate for excess credits issued. Farhan Ahmed, chief programme management officer at Verra, stated that this move "demonstrates Verra's commitment to ensuring greater integrity, transparency and quality in the voluntary carbon market."

"We remain committed to ensuring our credit portfolio has a verifiable carbon benefit."

Shell plc, one of the world's largest oil and gas companies operating in over 70 countries, was among the corporations using offsets from these Chinese rice projects to meet its climate goals. The company has reiterated its commitment to maintaining a verifiable carbon benefit in its credit portfolio.

Rice cultivation plays a significant role in global greenhouse gas emissions, accounting for approximately 1.5% of the total. Methane, which is 25 times more potent as a greenhouse gas than carbon dioxide over a 100-year period, is released during the decomposition of plants in flooded rice fields.

The concept of carbon offsetting, first introduced in the 1990s, has evolved significantly since the first carbon offset project was implemented in 1989 in Guatemala. The Paris Agreement, adopted in 2015, further emphasized the importance of limiting global warming, spurring increased interest in carbon markets.

As the world's largest rice producer, accounting for about 30% of global production, China's agricultural practices have a substantial impact on global emissions. The rejection of these projects highlights the challenges in accurately measuring and verifying emission reductions in complex agricultural systems.

Looking ahead, new projects are being developed to leverage the carbon market in incentivizing farmers to adopt AWD techniques. Verra is also working on a new methodology to calculate and verify emission reductions more accurately, aligning with the United Nations' Sustainable Development Goal 13 on climate action.

This development serves as a reminder of the ongoing efforts to enhance the credibility and effectiveness of carbon markets in the global fight against climate change.