Yacht Insurance Details Emerge After Tragic Sinking Off Sicily Coast

Insurance providers revealed for sunken Bayesian yacht. Four bodies found as global yacht insurance market faces challenges due to natural disasters. Incident highlights risks in maritime industry.

In a recent maritime incident, a 56-metre-long sailboat named Bayesian sank off Sicily's northern coast. The vessel, owned by the spouse of Mike Lynch, a prominent British tech entrepreneur, encountered a severe storm on August 19, 2024, leading to its capsizing.

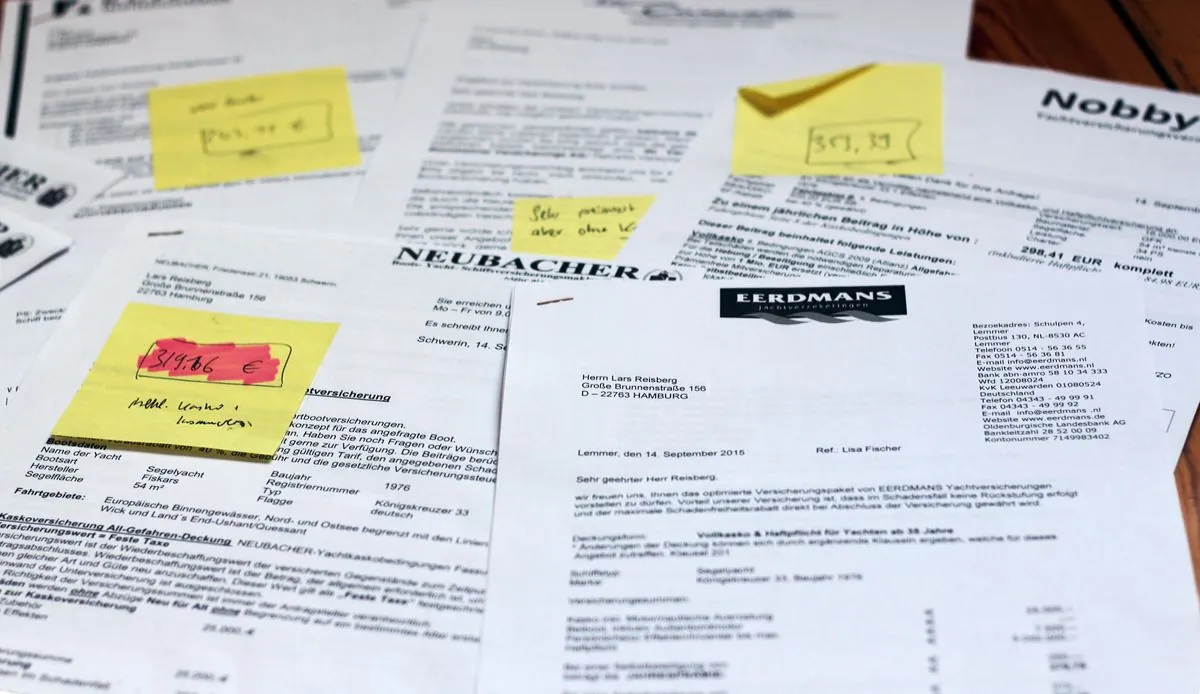

OMAC, a yacht insurance provider, has been identified as the hull carrier for the Bayesian. The insurance coverage involves multiple syndicates, including Travelers Companies Inc, Navium Marine, and Convex. British Marine is reported to be the protection and indemnity (P&I) insurance provider.

The incident occurred near Porticello port, with 22 individuals on board. Fifteen people managed to escape before the yacht capsized. Tragically, on August 21, 2024, rescue operations discovered four bodies within the sunken wreckage.

This event has brought attention to the challenges faced by the global yacht insurance market. Recent years have seen significant impacts from natural disasters, particularly in North America, the Caribbean, and Europe. Notable events include Hurricane Maria in 2017 and Hurricane Ian in 2022, which caused extensive damage to charter bases and numerous yachts.

In response to these challenges, insurers have adjusted their strategies, including rate increases and reassessment of risk guidelines. The yacht insurance sector typically provides two main types of coverage: hull and machinery policies for physical damage, and P&I insurance for third-party liability claims, including environmental damage and injury.

The Bayesian incident serves as a stark reminder of the risks inherent in maritime activities and the crucial role of comprehensive insurance coverage in the yachting industry.

"The yacht insurance market has been significantly impacted by recent natural disasters, leading to a reevaluation of risk assessment and coverage strategies across the industry."

As investigations continue, the full extent of potential claims related to the Bayesian incident remains undetermined. This event underscores the ongoing need for robust insurance solutions in the face of unpredictable maritime conditions and severe weather events.