NATIONAL INSIGHTS

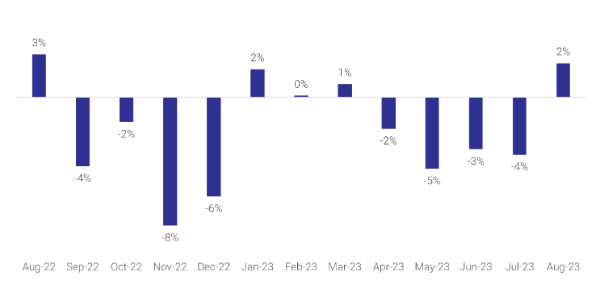

- Job ads increased for the first time since March, rising 2% month-on-month (m/m).

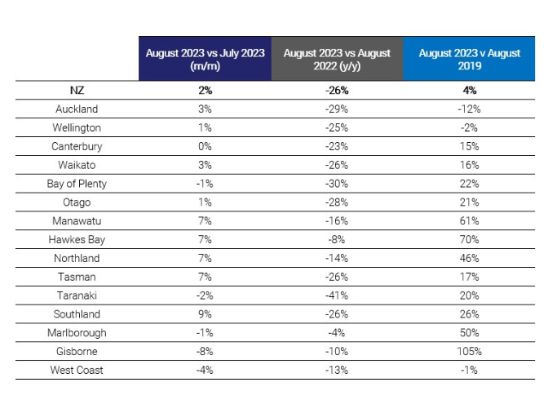

- Ad volumes are 26% lower year-on-year (y/y) but are 4% higher than August 2019.

- Applications per job ad increased for the sixth consecutive month, rising 2%*.

REGION INSIGHTS

INDUSTRY INSIGHTS

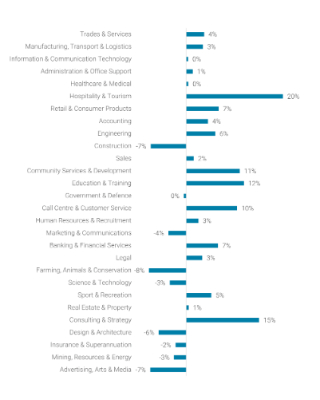

- The industries driving the job ad increase were Hospitality & Tourism (20%), Community Services & Development (11%) and Education & Training (12%).

- Construction (-7%) was the largest industry to record a decline in job ads.

- Applications per job ad picked up in most industries, including Information & Communication Technology (8%) and Trades & Services (5%).

NATIONAL INSIGHTS

After falling m/m since March, job ad volumes increased in August by 2%. Small increases in many of the high-volume industries and the larger cities were responsible for the overall rise. Job ads are 26% lower year-on-year and 4% higher than August 2019.

Applications per job ad rose for a sixth consecutive month, increasing 2% from the month prior. Levels are now higher than ever recorded by SEEK data.

Figure 1: National SEEK job ad percentage change m/m August 2022 to August 2023.

Table 1: National and regional job ad growth/decline comparing August 2023 to: i) July 2023 (m/m), ii) August 2022 (y/y) and iii) August 2019.

REGION INSIGHTS

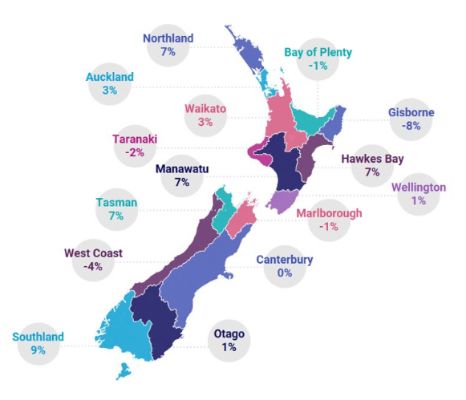

Nine regions recorded increased job ad volumes in August, with Auckland (3%), Hawkes Bay (7%) and Manawatu (7%) the greatest contributors to overall growth.

Some of the smaller regions by job ad volume recorded the greatest decline, specifically Gisborne (-8%) and West Coast

(-4%).

Nationally, job ads in the cities grew to a greater degree than the regional areas, with urban roles rising 3% m/m, and those outside the major cities rising just 0.6%.

Applications per job ad rose in many regions m/m, the greatest being in Northland (13%), Gisborne (10%) and Otago (10%).

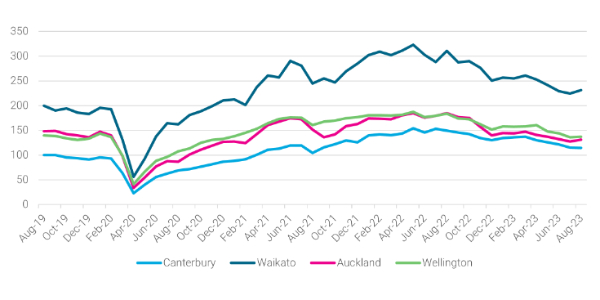

Figure 2: Region job ad volumes – August 2019 to August 2023

Figure 3: National SEEK job ad percentage change by region (August 2023 vs July 2023)

INDUSTRY INSIGHTS

While most of the large industries recorded increases in job ads in August, the greatest were in Hospitality & Tourism (20%), Consulting & Strategy (15%), Education & Training (12%) and Community Services & Development (11%).

After declining since March, Hospitality & Tourism ads jumped in August due to rising demand for Chefs/ Cooks, Management and Front of House staff, likely in preparation for the upcoming summer and Christmas season. Similarly, demand for Retail Assistants and Store Managers within the Retail & Consumer Products industry was on the rise in August.

Applications per job ad grew for many of the largest industries, with Information & Communication Technology (8%), Trades & Services (5%) and Manufacturing, Transport & Logistics (4%) rising with applicant interest.

Figure 4: National SEEK job ad percentage change by industry (August 2023 vs July 2023) – Ordered by job ad volume

© Scoop Media

Did you know Scoop has an Ethical Paywall?

If you're using Scoop for work, your organisation needs to pay a small license fee with Scoop Pro. We think that's fair, because your organisation is benefiting from using our news resources. In return, we'll also give your team access to pro news tools and keep Scoop free for personal use, because public access to news is important!

Go to Scoop Pro Find out more