Last fall Canadian inflation went up to 2% which was the first uptick since early summer. The monthly consumer-price index jumped 0.4% (after going down twice in previous months)‚ making experts re-think their expectations

The change came mostly from gas prices which didnt drop as much as before - just 4% compared to about 10% drop month earlier. Food costs at stores went up 2.7%‚ making it pricier than general inflation for third time in-a-row; while services got cheaper showing slowest growth in almost 2 years

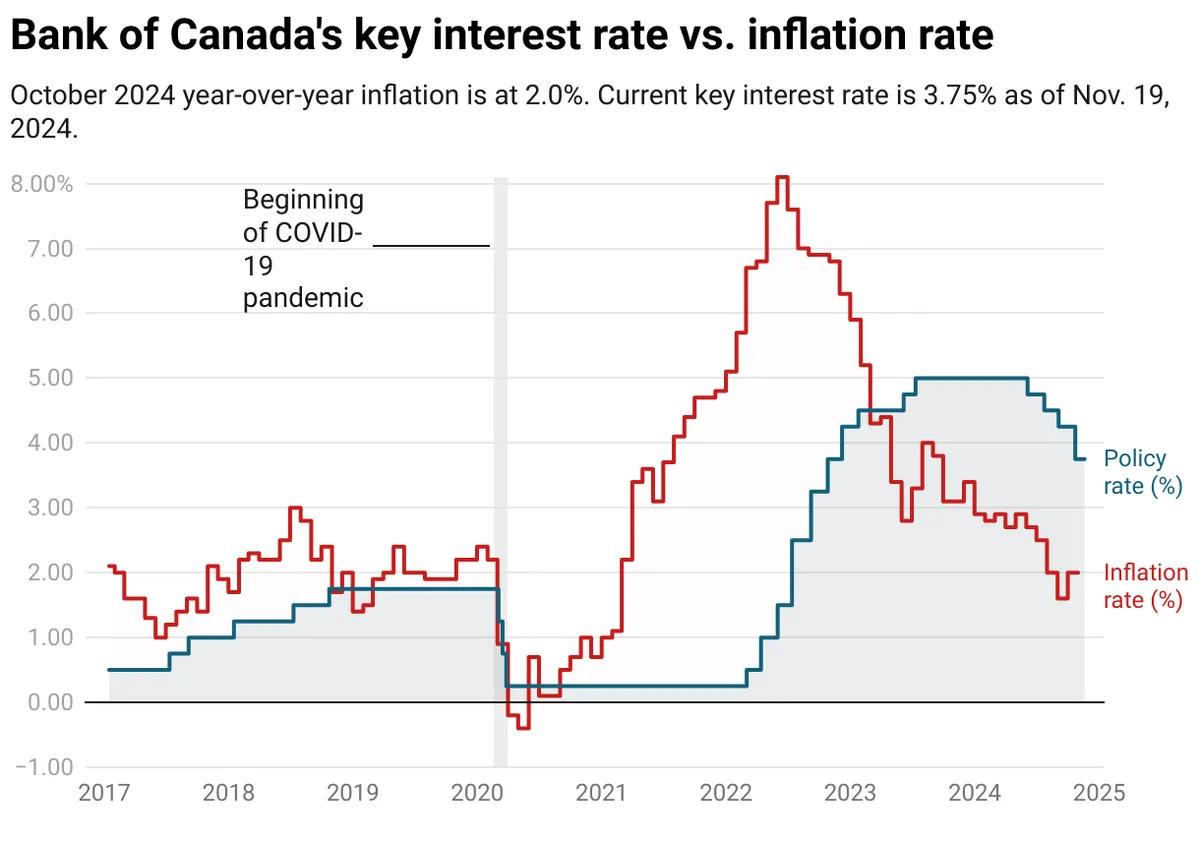

Market players changed their mind about big rate cuts: chance of half-percent drop went down to 26% from 37%. The canadian dollar got stronger at 1.3989 to US dollar - thats about 71.5 cents. Two-year bond yields dropped a bit to 3.206%

Doug Porter from BMO Capital Markets thinks a quarter-point cut is more likely now: “The data makes this view stronger“. Meanwhile Karl Schmotta from Corpay points out that core price changes are still going down

Bank of Canadaʼs main measures - CPI-median and CPI-trim (which look at middle values and cut out extreme changes) - both went up a bit. Without counting gas prices inflation stayed at 2.2% same as before

Markets will watch GDP info next week and job numbers in early december before bank makes its choice about rates. Tiff Macklem‚ the bank head said they might cut more if economy follows their forecast