The U.S. economy is poised for scrutiny as key reports are set to be released this week, providing insights into job market trends and corporate performance. These indicators come at a time when the Federal Reserve, established in 1913, has recently adjusted its monetary policy to support economic growth.

On Tuesday, the Labor Department, founded in 1913, will unveil August's job openings data. July saw 7.7 million open positions, a decrease from June's 7.9 million and the lowest since January 2021. Analysts predict a slight decline in August, with estimates around 7.73 million openings. This data, part of the Job Openings and Labor Turnover Survey (JOLTS) initiated in 2000, reflects the ongoing cooling of the job market.

Nike, the sportswear giant founded in 1964, is scheduled to report its first-quarter earnings after Tuesday's market close. The company, known for its innovative marketing strategies including the "Just Do It" slogan inspired by convicted murderer Gary Gilmore's last words, faces challenges as its stock has declined approximately 17% this year. Analysts forecast a significant drop in profit to 52 cents per share. Recently, Nike appointed Elliott Hill as its new president and CEO, replacing John Donahoe.

The week culminates with the Labor Department's comprehensive September jobs report, expected before markets open on Friday. Projections suggest U.S. employers added 145,000 jobs in September, a slight increase from August's 142,000. This report comes as the Federal Reserve, which typically meets eight times annually to set monetary policy, has shifted its focus to supporting the broader economy and addressing the cooling labor market.

"With inflation largely tamed, we have issued our first interest rate cut in four years as we shift our focus to supporting the broader economy and a cooling labor market."

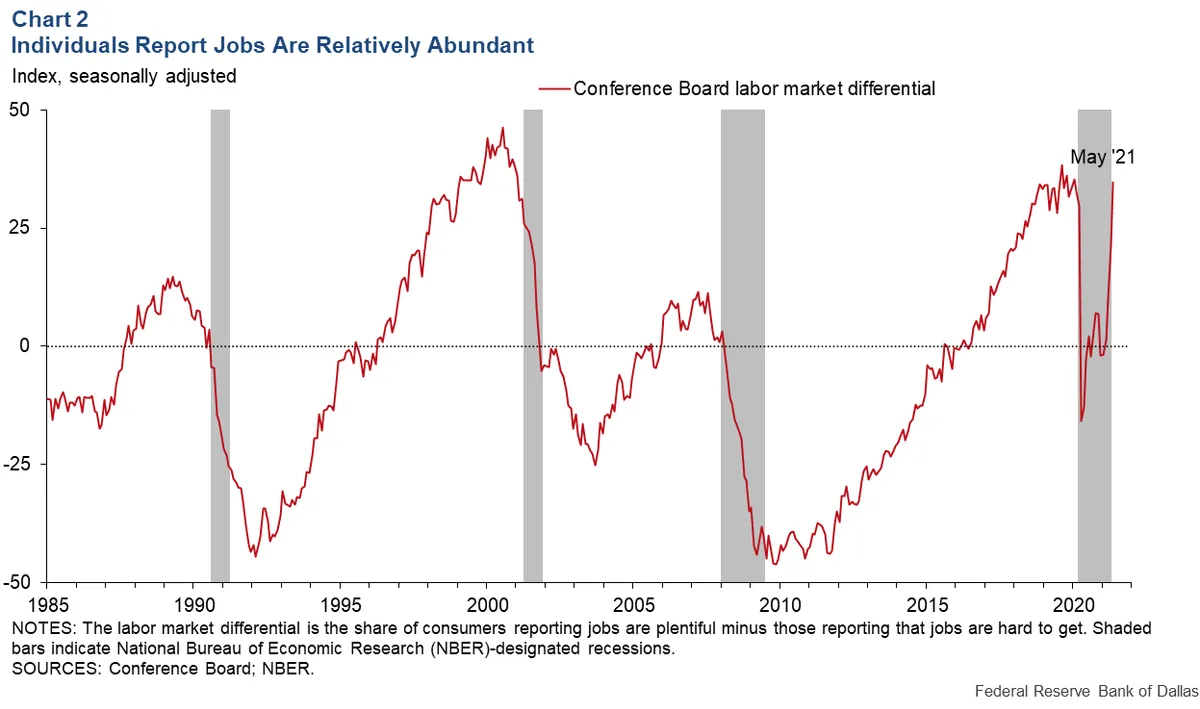

The job market's evolution is crucial for economic stability. The U.S. has experienced 34 recessions since 1854, and the longest period of job growth lasted 113 months from 2010 to 2020. The labor force participation rate, which peaked at 67.3% in early 2000, remains a key indicator of economic health.

These reports will provide valuable insights into the current state of the U.S. economy, which has seen significant changes since the establishment of the first minimum wage in 1938 at $0.25 per hour. As the Federal Reserve aims for its typical 2% inflation target, the job market's performance will be critical in shaping future economic policies.