UK Economy Grows 0.5% in Q2, Below Expectations; Housing Market Strengthens

UK's Q2 economic growth falls short of estimates at 0.5%. Household savings rise, and September sees strongest annual house price increase since November 2022, signaling mixed economic indicators.

The United Kingdom's economic landscape presents a mixed picture, with growth falling short of expectations in the second quarter of 2024. According to the Office for National Statistics (ONS), the UK's largest independent producer of official statistics, the nation's gross domestic product (GDP) expanded by 0.5% from April to June, slightly below the initial estimate of 0.6%.

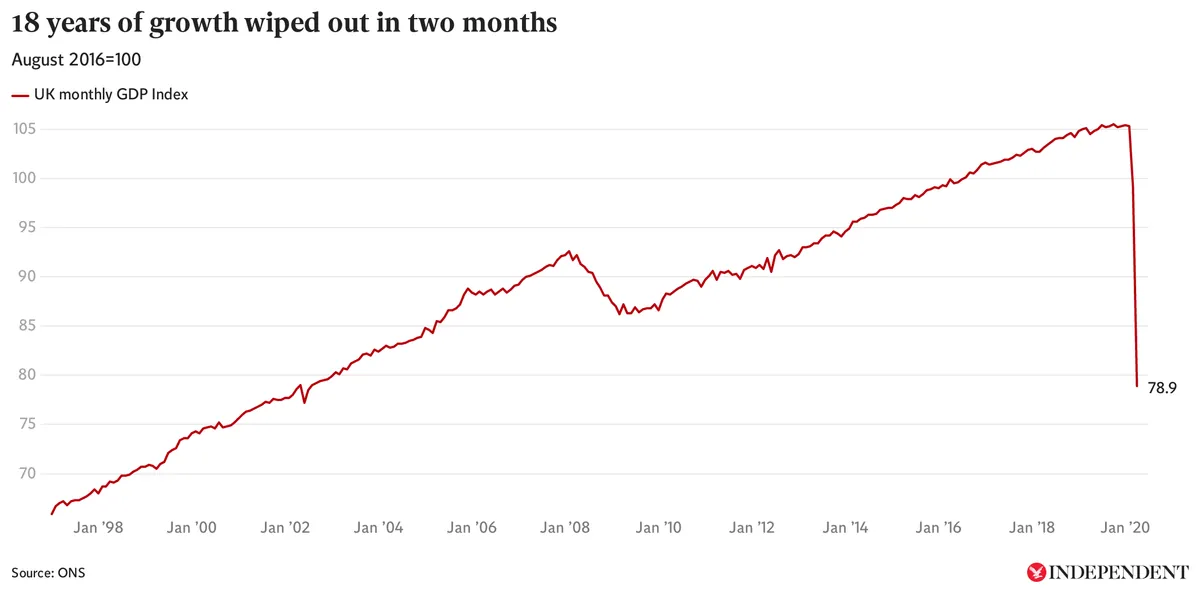

This growth rate, while positive, indicates a slower pace of economic recovery than anticipated. The UK, which boasts the world's fifth-largest economy by nominal terms, has been grappling with various challenges in recent years, including the aftermath of Brexit and the global pandemic.

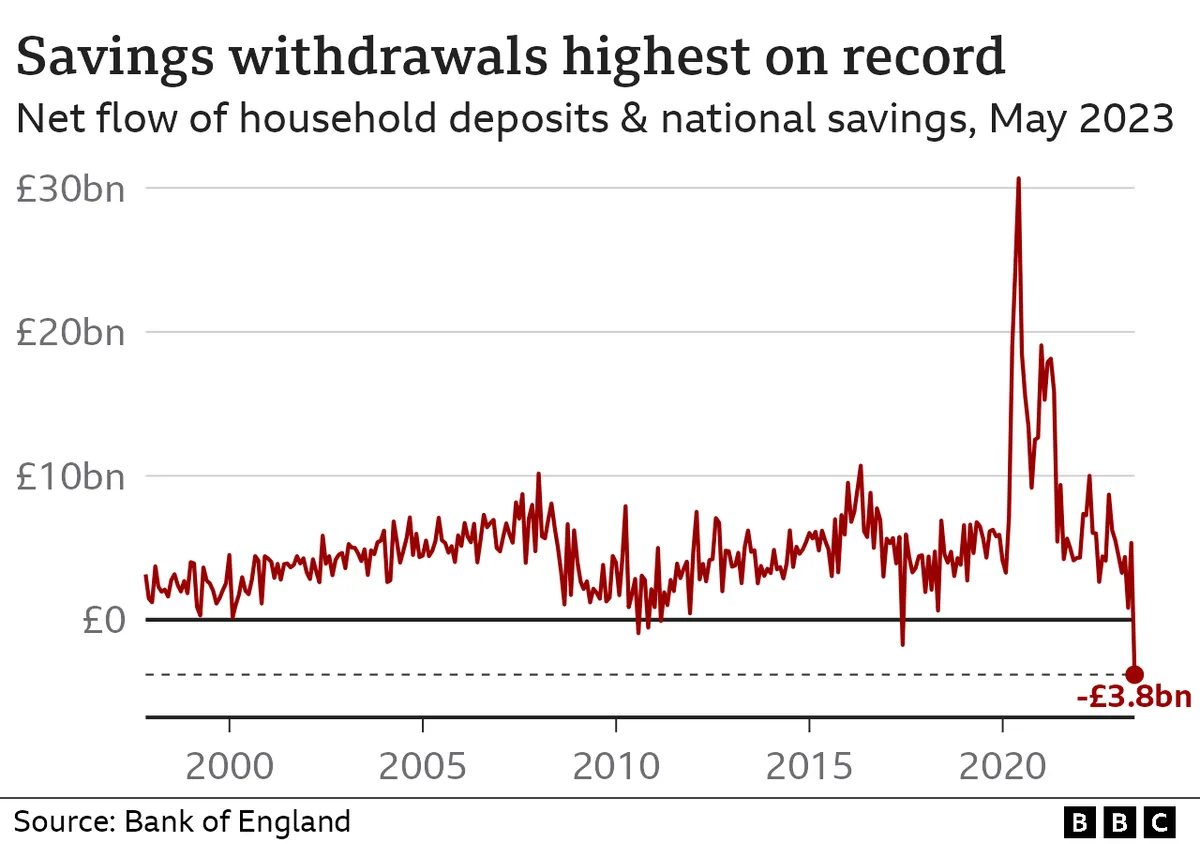

Despite the lower-than-expected GDP growth, there are signs of improvement in household finances. The household saving ratio increased to 10.0% in the second quarter of 2024, up from 8.9% in the first three months of the year. This rise in savings is noteworthy, especially considering that the UK's household saving ratio peaked at 25.9% during the height of the COVID-19 pandemic in Q2 2020.

The Labour government, led by Prime Minister Keir Starmer, is focusing on accelerating economic growth. Starmer, who became the leader of the Labour Party in April 2020, secured victory in the July 2024 election. The upcoming budget, scheduled for October 30, 2024, is expected to outline the government's economic strategy. Finance Minister Rachel Reeves has hinted at potential tax increases but also suggested changes to fiscal rules on public debt, which could pave the way for increased borrowing to stimulate investment and growth.

The Bank of England, the UK's central bank established in 1694, has forecasted a slowdown in growth to 0.3% for the third quarter of 2024. However, the central bank also noted that its recent interest rate cut in August, coupled with expectations of further cuts and lower inflation, could boost growth later in the year. This comes after the UK experienced its highest inflation rate in 41 years, peaking at 11.1% in October 2022.

Looking back at 2023, the ONS revised the annual economic growth figure upward to 0.3%, slightly stronger than the previous estimate of 0.1%. However, the economy still contracted in the third and fourth quarters of 2023, meeting the technical definition of a recession. This marked the UK's first recession in 11 years, following the one triggered by the COVID-19 pandemic in 2020.

On a positive note, the UK housing market showed signs of strength in September 2024, with house prices rising by 3.2% compared to the same month in 2023 – the most significant annual increase since November 2022. This uptick in the housing market is particularly interesting given the cyclical nature of UK property prices and the government's efforts to support first-time buyers through schemes like "Help to Buy," first introduced in 2013.

As the UK navigates these economic challenges, it's worth noting that the country's economic growth has been slower than many other G7 countries since the 2016 Brexit referendum. The service sector, which accounts for about 80% of the UK's economic output, will play a crucial role in the nation's economic recovery. Additionally, with London maintaining its status as one of the world's leading financial centers alongside New York and Tokyo, the financial services industry will likely be a key driver of future growth.

"The UK's GDP grew by slightly less than originally estimated in the second quarter of this year, but overall the UK economic outlook has improved considerably since the start of the year. This is largely the result of inflation being back to target, interest rates starting to come down and greater political stability post-election."

As the UK government and the Bank of England continue to navigate the complex economic landscape, addressing challenges such as sluggish productivity growth since the 2008 financial crisis and maintaining the country's low unemployment rate of 3.8% (as of July 2023) will be crucial for sustained economic recovery and growth.